🇧🇷 Brazil Crypto Report #15: Coinbase 👀 Brazil

The growing arms race among crypto exchanges looking to expand in Brazil has been a frequent theme of this newsletter.

Mercado Bitcoin, Bitso, Ripio, NovaDax, Foxbit and other local players are looking to grow and solidify their respective positions in the market. Big international exchanges like Binance and Huobi are also competing for a slice of the pie.

Now, Coinbase appears to be readying a big move into the Brazilian market. It currently has five Brazil-specific job openings on its careers page, including a business development manager for payments and several front- and back-end engineering positions. A Brazil-based director of product role was also listed until recently before being taken down (it’s unclear if the position was filled or removed).

Expect to see more of this. Coinbase has quietly been on a Brazil hiring spree over the last few months. A Linkedin scan shows at least 10 new Brazil-based software engineer hires over the summer, with 8 of those coming since August. Coinbase also grabbed a new head of Brazil marketing with a background at Disney and Unilever earlier this summer. Two new Brazil-based tech recruiters also joined the company this month.

The implications of this are quite massive. Coinbase is the largest crypto exchange in the US and is unquestionably the industry’s blue chip company after going public in April. While the Brazil exchange space is getting crowded, Coinbase is well-positioned to make significant penetration against any competition. It has incredible brand recognition in the space, significant political chops and a virtually bottomless pool of capital to tap into as it looks to scale.

Notably, Coinbase’s growing interest in Brazil comes as its arch-rival Binance - still the largest exchange by volume that services the country - has found itself under growing regulatory scrutiny in Brazil (and basically everywhere else).

Legislation that would force exchanges like Binance to register with federal regulators before beginning operations in the country is working its way through the Brazilian Congress. It’s also been discovered that operators of local cryptocurrency scams and pyramid schemes have been using Binance to launder money out of the country.

Binance’s Brazil country manager abruptly resigned in July after six months on the job, and he has yet to be replaced.

Coinbase appears to be laying the groundwork for a Brazil splash while its main rival is temporarily without a bearing. At the same time, anyone who’s been in crypto long enough knows that betting against Binance is a bad idea.

Meanwhile, the local and regional exchanges themselves are no slouches. They are investing feverishly into their products and customer acquisition efforts. It’s going to be exciting to watch how all of this plays out in the coming months.

Welcome to 🇧🇷 Brazil Crypto Report #15 for the week of Oct 4-8, 2021. As always, thanks for reading.

-AWS

🎉 Obrigado to Our Partner Non-Fungible Brasil

Non-Fungible Brasil is an official NFT partner of popular Brazilian cultural icons Flow Podcast (3.4m subscribers) and Venus Podcast (425k subscribers).

The team recently launched its Eu Ajudo o Pantanal NFT series with an eye for promoting and preserving the Pantanal - the world’s largest tropical wetland located in southwestern Brazil. The photography for this project is absolutely beautiful and showcases the region’s biological diversity. All NFT sale proceeds will go to SOS Pantanal, a non-profit devoted to preserving one of the world’s environmental treasures.

Be sure to visit the Eu Ajudo o Pantanal marketplace on OpenSea before scrolling further!

👩💻Brazil Crypto Hiring Spotlight

Hashdex looks to hire 45 people across its offices in Sao Paulo, Rio de Janeiro and New York. The crypto asset manager is looking for software engineers and institutional sales specialists, as well as research, marketing and communications professionals. The firm plans to grow its headcount in Brazil by roughly 30, CEO Marcelo Sampeio told Bloomberg. Co-founder Bruno Caratori will also be relocating from Silicon Valley to New York to help build the operation.

Ripio announced the hire of Henrique Teixeira as its new Brazil country manager. He previously served as Brazil country manager for Ripple, and prior to that spent time at HSBC, SWIFT, Deutsche Bank and American Express.

For Portuguese readers, CoinTelegraph Brasil has a handy run-down of different Brazil crypto related jobs here.

🗞Brazil Crypto News Rundown 🗞

📈 Markets

Brazil’s five crypto ETFs had a combined total of 159,000 individual investors holding positions in them at the end of August. In the same month, these ETFs saw R$1.6bn (US$290m) worth of trading, while the funds reached a combined AUM of R$2.48bn (US$450m). (Valor Investe)

Brazilian singer Frank Aguiar now has his own fan token on the exchange ApolloEx. Token holders can receive VIP access to concerts, discounts on products and merchandise, autographed items and exclusive video calls. Anderson Souza, president of ApolloEx, explained:

“Other people, football clubs and even companies around the world are issuing digital currencies and Frank Aguiar is the first Brazilian artist to launch a product in this segment. We launched a bath of 50,000 tokens, which sold out in a few days.” (Valor Investe)

Traders Club has made a US$15m investment in 2TM, the holding company that owns Mercado Bitcoin and several other related entities, giving it a roughly 0.7% stake given the exchange’s US$2.1bn valuation. Traders Club is a Robinhood-like product aimed at democratizing investing. Traders Club users will have the ability to purchase cryptocurrencies via the Mercado Bitcoin platform. (CNN Brasil)

Vitreo launches Brazil’s first two funds devoted to investing in NFTs. The first fund, available to accredited investors only, will invest in six NFT series in the realm of ‘play to earn’ gaming - a segment which has been popularized this summer by Axie Infinity. The second fund, available to retail investors, will be more diversified with a mix of 20% NFTs and 80% exposure to crypto ETFs. (Money Times)

Ripio will launch an OTC desk for Brazilian customers in the coming weeks. (CoinTelegraph Brasil)

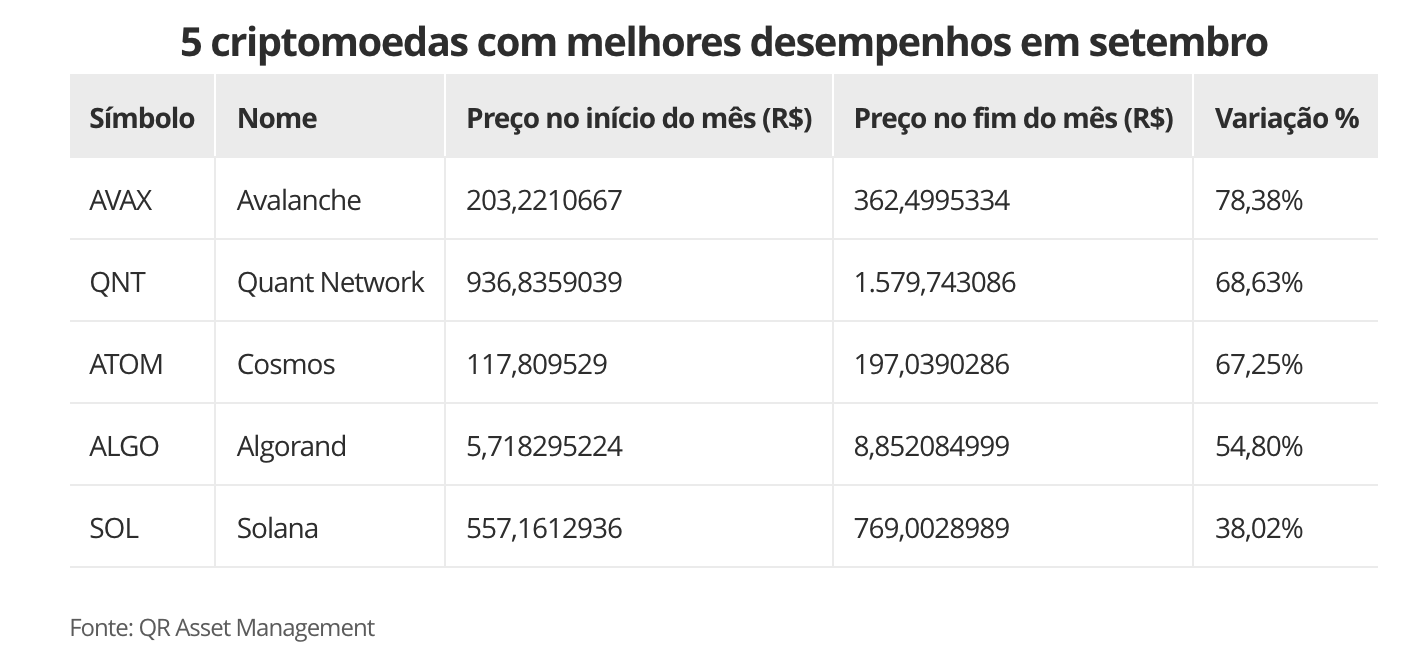

AVAX, QNT, ATOM, ALGO and SOL were the best performing cryptocurrencies against the Brazilian real for the month of September, according to research from QR Capital.

🚀Adoption

São Paulo Football Club becomes the fourth Brazilian football team to launch a ‘fan token’ on the Socios platform. The entities inked a five-year partnership, and the Socios logo will be featured on SPFC’s jerseys. Terms of the token sale were not disclosed, but typically these raises have been split 50/50 between the Socios and the club. (Exame)

Mercado Bitcoin is launching a television marketing campaign on the TV Globo network with popular comedian Rafael Infante. (Portal do Bitcoin)

Banco Itaú, one of the country’s largest banks, is said to be partnering with Mercado Bitcoin to tokenize receivables for trading on the MB Digital Assets platform. The arrangement is said to be a “test” to see what new products and solutions can be developed with these new technologies. (CoinTelegraph Brasil)

Investments in cryptoassets is “very relevant” and will be an “important discussion in the coming months,” said Bruno Serra, a director at the Brazilian Central Bank, at an event hosted by BTG Pactual. He said that total inflows into crypto are approaching US$12bn for the year, rivaling the annual amount invested by Brazilians into the US stock market. Serra also noted that he was surprised by the uptick in crypto investments given the real’s decline against the dollar over the past year. (Reuters)

Inflation in the 12 months through September officially reached 10.25%. (Reuters)

Bitcoin has proven to be the only major investable asset in the Brazilian market to post higher-than-inflation returns over the last 12 months, both on a real and nominal basis. (CoinTimes)

The real now has the lowest purchasing power since being introduced in 1994, down 85%. Fernando Ulrich, a popular Brazilian bitcoiner, highlighted on Twitter:

Mercado Bitcoin listed ADA on October 7 in response to overwhelming customer demand. The minimum purchase order is R$50 (US$9). (Portal do Bitcoin)

Cryptocurrencies are “the devil’s money and should go to hell,” says Brazilian economist José Carlos de Assis. (CoinTelegraph Brasil)

Can Jericoacoara be Brazil’s version of Bitcoin Beach? Brazilian singer Fernando Motolese is hoping to turn the tourist destination into a bitcoin hotspot in the same manner as El Zonte in El Salvador, showcasing the tech to local merchants and residents. (Livecoins)

Brazilian waste treatment firm Orizon is selling carbon credits via blockchain-based tokens. (CoinTelegraph Brasil)

The Getúlio Vargas Foundation’s São Paulo School of Economics is partnering with Ripple Labs to host a “Datathon challange” focused on cryptocurrencies. (CoinTelegraph Brasil)

🏛 Policy, Regulation and Law Enforcement

Banco Central President Roberto Campos Neto highlighted the rise of decentralized finance and the need to observe the DeFi space more closely at a “Regulating Big Tech” virtual event hosted by the Bank for International Settlements.

On the subject of CBDCs, he emphasized that there are many “things to resolve to assure that digital money does not disrupt the balances of banks.” (CoinTimes) (Valor Investe) (Reuters)

“Faraó dos Bitcoins” Glaidson Acácio dos Santos, owner of the GAS Consoltoria, will remain in custody after the Brazilian Supreme Court denied a Habeas Corpus petition from his attorney. He is accused of running an organized crime syndicate that laundered money and operated pyramid schemes using cryptocurrency. He and other leaders of the ring were arrested in August by Federal Police in what’s been dubbed Operation Kryptos. R$150m worth of cryptocurrencies were seized, in what was the largest such bust ever in Brazil. (Livecoins)

Glaidson and 16 others implicated in GAS Consultoria are now formally defendants in the case, having been charged with crimes against the financial system. (G1)

Receita Federal do Brasil, the Brazilian tax authority has released new documentation instructing consumers and businesses on how to declare gains and losses from crypto trading. As of May 2021, consumers had already declared R$30m (US$5.4m) in cryptocurrency trades. (Livecoins)

The Comissão de Valores Mobiliários and the B3 exchange are launching a campaign to protect consumers against scams and fraudes. The effort comes amid a growing prevalence of pyramid schemes involving cryptocurrencies and aims to help consumers better understand the common identifiers of fraudulent schemes. (Livecoins)

The federal government has sent a formal request to the Brazilian Congress to pass a law requiring cryptocurrency exchanges to be formally registered with a federal regulator before commencing operations in the country. The request comes in light of a proliferation of crypto pyramid schemes and unregistered operators, such as GAS Consultoria. (CoinTelegraph Brasil)

If you’re new here, the meta-thesis for this publication is that Brazil - with a population of 214 million and a US$1.8tn economy - is the most overlooked crypto market in the world. The objective is to highlight the important news and provide useful context for the estrangeiro (foreigner) English-speaking audience.

If that’s something you’re interested in, then hit subscribe if you haven’t done so already read on👇 Please share with others who might find it interesting!

Ate mais,

Aaron