🇧🇷 Brazil Crypto Report #24: NuBank Goes Public; Crypto Regulation Bill Advances in Congress

👋 Olá pessoal and welcome to 🇧🇷 Brazil Crypto Report for the week of December 6-10, 2021. I’d like to kick off with a big shout out to the Eth:Rio community. The event will be taking place March 14-17 - you can join the Telegram group here.

It was a big week as Brazilian fintech unicorn Nubank went public on the New York Stock Exchange on December 9 under the “NU” ticker symbol. Founded in 2013 with a no-fee credit card offering, the firm quickly earned the backing of blue chippers like Warren Buffett’s Berkshire Hathaway, Ribbit Capital, Tencent Holdings and Sequoia Capital. It is now Latam’s most valuable listed bank with 48 million customers across Brazil, Colombia and Mexico and a $41bn valuation, according to Reuters. The week prior to the IPO, Nubank slashed its valuation by 20% after facing uncertain demand from investors.

Photo credit: CNBC/NYSE

Brazil’s Câmara dos Deputados (House of Representatives) approved a bill that would regulate the Brazilian cryptocurrency market by appointing a supervisory body to oversee operation of crypto exchanges and brokerages. It ramps up penalties on those who use crypto for fraud and money laundering.

In other fun news, a Senate committee accidentally invited an alleged bitcoin ponzi scheme operator to testify about the need for transparency and regulation of crypto markets. More on this in the policy and regulation section below.

Also, while not specific to Brazil, I wanted to highlight an important development out of Colombia. Gemini - the US exchange founded by the Winklevoss twins - has launched crypto trading through a partnership with Bancolombia, the country’s largest bank. The exchange also hired in November a new corporate development and strategy specialist based in São Paulo and focused on the Latam region. This ties nicely into one of the metathemes of this publication, which is the growing arms race among exchanges and service providers looking to establish and solidify their presence in the region before the next bull market kicks off.

Até mais,

Aaron

🙏 Special thanks to Celo Community Fund for supporting Brazil Crypto Report!

If you’re new here, the meta-thesis for this publication is that Brazil - with a population of 214 million and a US$1.8tn economy - is the most overlooked crypto market in the world. The objective is to highlight the important news and provide useful context for the English-speaking audience.

👩💻Brazil Crypto Hiring Spotlight

Hathor Labs, developer of the Hathor Network blockchain, announced the hiring of Rodrigo Rosa as COO. Rosa has 20 years of experience with Walt Disney Brasil, Toyota and SAP Ariba. Rosa commented:

“Like all professionals in the field, I see that blockchain solutions are no longer just the future, but also the present. Hathor has a great purpose as an easily applicable blockchain in B2B projects, and bringing companies and their businesses to our network will be a great challenge.” (CoinTelegraph Brasil)

🗞Brazil Crypto News Rundown 🗞

📈 Markets

MCO2, the cryptocurrency of Brazilian carbon credit tokenization platform MOSS, surged 85% after being listed on Coinbase Pro. MOSS becomes the first Latam token project to list on Coinbase, the premier exchange in the US. (CoinTelegraph Brasil) (Valor Investe)

BTG Pactual, Latam’s largest investment bank, has launched a new multimarket fund with exposure to ETH. The BTG Pactual Reference Ethereum 20, as it’s called, has 20% exposure to ETH and 80% to fixed income. It carries a 0.5% administration fee and requires a minimum investment of R$100 (US$18). (The Block) (Valor Investe)

Mercado Bitcoin listed three new tokens for trading - Avalanche (AVAX), Algorand (ALGO) and Internet Computer (ICP) (CoinTelegraph Brasil)

Zro Bank, Brazil’s first multicurrency bank, earned an award for its solution allowing users to send and receive reals and bitcoin via Telegram. (CoinTelegraph Brasil) (BlockNews)

Photo credit: BlockNews

Parfin, a fintech that offers crypto asset trading, management and custody services raised R$34m (US$6m) in a new investment round. The round, an extension of the round commenced in March 2021, was led by Valor Capital Group with Alexia Ventures participating. (CoinTelegraph Brasil)

Gustavo Albanesi, a veteran of Bear Stearns and Credit Suisse, raised R$2.2m (US$387k) to launch a new digital currency exchange called Uniera. The platform looks to offer crypto investment options that cater to various investor profiles, with a minimum investment of R$100. It will trade bitcoin and ethereum, as well as Uniera Token, Dollar Yield and SOV Token. Each of these three tokens represents a basket of digital assets in line with various investor risk profiles. Grant Thornton will be responsible for auditing the tokens. (Valor Investe) (BlockNews)

Crypto assets are the most attractive space for investing in Latin America even if some tokens are overvalued, said Paulo Passoni - head of Softbank’s Latin America Fund - adding that roughly 10% of the US$5bn managed by the company is in crypto. He said during a webinar hosted by the Eurasia Group:

“Of course there is some excess, of course not all tokens are worth what the market is saying…I believe it's the most relevant thing happening in the world right now." (InfoMoney)

Bitcoin trading volumes on Brazilian exchanges were down 24% in November from the previous month, according to a report by CointraderMonitor. More than 26,000 bitcoins changed hands during the month, with nearly 35% of that volume coming on Binance. That figure was down from roughly 35,500 bitcoins exchanged in October. (CoinTimes)

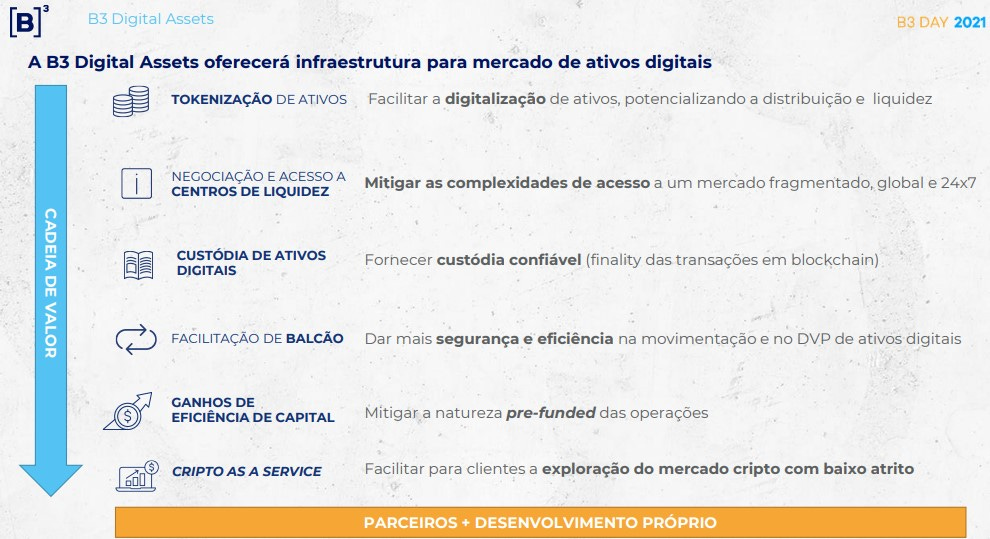

B3 Exchange, Brazil’s primary stock exchange, intends to provide crypto trading infrastructure in 2022 as part of its strategic roadmap, according to remarks made by CEO Gilson Finkelsztain at “B3 Day”. He noted that the strategy is not to serve as a crypto exchange, but to “enter this market to offer services to those who trade crypto.” This could include launching a crypto ETF, asset tokenization and custody services and over the counter trading and liquidity provision. (Valor Investe) (Portal do Bitcoin) (CoinDesk)

Binance has listed two new metaverse trading pairs link - SAND/BRL and GALA/BRL (Livecoins)

Coinbase enabled fiat-to-crypto trading for residents of Brazil (and other countries). Brazilians can now buy, convert or send USDC on the platform, but will not be able to sell or withdraw that currency. (Livecoins)

🚀Adoption

“Quanto custa 1 bitcoin” (how much is 1 bitcoin) made Google’s list of most popular searches in 2021 for Brazil. (CoinTelegraph Brasil) (InfoMoney)

Trustt Digital has become what’s believed to be the first tokenized corporation in Brazil. The Curitiba-based company, which specializes in business structuring and asset digitization, uses blockchain tech to tokenize and register shares. The process, which normally takes about a week through traditional methods, was completed in less than 24 hours, according to CEO Michel Vitale:

“For companies, accountants and the legal sector, this change represents an evolution of 100 years. The registration process that needed to be done manually can happen digitally and instantly.” (CoinTelegraph Brasil)

50% of Brazilian cryptocurrency holders began investing in either 2020 or 2021, according to a new investor profile report by Hashdex, Getúlio Vargas Foundation and University Blockchain Research initiative. 38% began to invest in the years 2017-2019, while just 12% started before 2016. The report asserts that crypto investors are primarily young, risk-tolerant, self-taught and pessimistic about the future of the Brazilian economy. (CoinTelegraph Brasil)

Stonex is partnering with Tifereth Brasil to create a token backed by rare diamonds valued at US$180k, with the goal of expanding access to the gemstone market. TIFF token will have 180k units and be issued on Binance Smart Chain. (CoinTelegraph Brasil)

Brazilian public sector entities have until December 31 to adopt a data sharing system using blockchain technology per new guidance from the Receita Federal. (CoinTelegraph Brasil) (Livecoins)

Crypto media website CoinTimes has launched an education platform called Cointimes Club to help users better understand crypto investing principles.

🪙 Digital Real

Brazilian consumers could be using a Digital Real by as early as 2023, according to new guidance put forth by the Banco Central. Testing is scheduled to begin in 2022, when various solutions proposed by financial system participants will be incubated in the BC’s Lift Lab. Companies have from January 10 - February 11, 2022 to submit use-case proposals, with selected projects being announced in March. Testing will gradually shift to segments of the broader population in 2023 - similar to how China is rolling out its digital yuan.

The Lift Lab was founded in 2018 as a partnership between the BC and Fenasbac - a trade group representing BC service providers - as a way to fast-track innovation projects. This special Digital Real focused cohort of Lift Lab will seek to develop solutions for offline payment, currency exchange and liquidity provision for digital asset transactions. Rodrogoh Henriques, a specialist at Fenasbac, commented, emphasizing that the Digital Real represents just one form of money issued by the BC and therefore will represent just a portion of the monetary base:

"The actions require a more robust infrastructure, which members of the financial system already have, but any project is welcome… An individual may have specified electronic money in their account, which is what we already have in the bank today, and the currency. The difference is that some transactions can only be made possible through virtual money, such as programmed use." (Folha de S. Paulo)

🎮 NFTs and Gaming

BAYZ, the Brazilian NFT gaming guild, closed a US$4m seed investment (R$22.5m) round led by Yield Guild Games with participation from Delphi Digital, BITKRAFT, Valor Capital and others. BAYZ works with publishers, creators and gamers to create community around NFT games like Axie Infinity, The Sandbox and Ember Sword. (CoinTelegraph Brasil) (CoinTimes)

São Paulo-based digital design studio Black Madre has been chosen to produce NFT artwork for the Philadelphia 76ers, a US NBA club. Black Madre has previously worked with Nike, Guaraná and Nubank but has shifted its focus to NFTs in recent months. (CoinTelegraph Brasil) (Portal do Bitcoin)

The Paulista Football Federation will launch fan tokens and NFTs for its 2022 championship tournament, known as the Paulistão. Mauricio Galiotte, president of Palmeiras, said in a statement:

"This is another great partnership that we established for Palmeiras, which will further increase the engagement of the fans in Brazil and in the world." (CoinTelegraph Brasil) (InfoMoney)

Fan tokens globally now have an estimated market cap of US$417m, up US$157m since June, according to data from FanMarketCap. (CoinTelegraph Brasil)

Fresh off its victory in the Copa Libertadores, Palmeiras football club announced plans to launch its $VERDAO fan token on the Socios platform using the Chiliz blockchain. Other major Sao Paulo clubs Corinthians and SPFC issued fan tokens earlier this fall. The launch date and price will be released soon. (CoinTelegraph Brasil)

🏛 Policy, Regulation and Law Enforcement

Brazil Chamber of Deputies passed a much-anticipated crypto regulation bill last Wednesday evening, sending it to the Senate for consideration. The bill is scheduled to receive a vote in the Senate Committee on Economic Affairs on December 15th. The bill, known as PL 2303/15 and sponsored by Deputy Aureo Ribeiro, and would create a regulatory structure for registering and supervising crypto exchanges in the country. Most notably, it would appoint a single regulator to oversee these activities. This regulator was originally proposed to be the Banco Central, but the Executive Branch would select the supervising entity under the revised language. The bill would also stiffen penalties on criminals who operate cryptocurrency pyramid schemes or engage in money laundering, with a penalty of four to eight years imprisonment.

The bill was approved at the committee level in the Camara in August but had yet to receive a floor vote until now. (Portal do Bitcoin) (Valor Investe)

Representatives from crypto exchanges Binance, Bitso and Mercado Bitcoin were invited to testify in the Senate on crypto regulation in the country. Representatives from the CVM (Brazil’s securities regulator), the Banco Central, BTG Pactual and Febraran - a banking industry trade association - have also received invitations. (CoinTelegraph Brasil)

An alleged pyramid scheme operator was inadvertently invited to testify as a “blockchain expert” in front of a Senate committee hearing on cryptocurrencies. Antonio Neto Ais is cited in at least 20 complaints by local authorities in Paraiba and is identified as one of the ringleaders of the D9 Club ponzi scheme. His company Braiscompany is accused of running a bitcoin pyramid scheme that promised 15% per month to investors, lying about its registration status and was kicked off of the show “Startup Battle” - a Shark Tank type show on Record News.

In his Senate testimony, Ais spoke of the importance of transparency and regulation in the crypto market. “I put my company, Braiscompany, at your disposal to help make the regulation of this market,” he concluded.

An investigation by (Portal do Bitcoin) discovered that Ais had received a summons to testify from Senator Maria Eliza from Rondonia. Her office stated that Ais had been “nominated” by the owner of Braiscompany, but would not specify who made the nomination. In a later questioning, an advisor from the senator’s office said he did not remember who proposed Ais. A Portal do Bitcoin report commented:

“On Thursday morning, Antonio Neto Ais took the microphone of the CAE session for 10 minutes to discuss the regulation of cryptocurrencies. His presence in Congress promptly surprised those who follow the crypto market.”

Import taxes on cryptocurrency mining hardware could be removed under a new proposal in the Brazilian Congress, which calls for a complete exemption provided that the mining activity is carried out using renewable energy sources. Such a move could transform the country into a “mining Mecca” according to Ray Nasser of Arthur Mining. While just under half of Brazil’s energy comes from renewable sources, cost per kilowatt-hour averages out at around US$0.12 - which leans on the expensive side for bitcoin mining operation. (CoinTelegraph Brasil)

Assets valued at R$1.44m (US$256k) seized in the arrest of “Bitcoin King” Claudio Oliveira, operator of the Grupo Banco Bitcoin pyramid scheme, last summer will be auctioned off in Curitiba this week. The prize assets for sale include Oliveira’s luxury vehicles, such as a Porsche Panamera, three BMWs and a Honda HR-V. A Lamborghini worth R$800k that was also seized is not among the items for auction. (CoinTelegraph Brasil)

“Pharaoh of Bitcoins” Glaidson Acacio dos Santos released an open letter on YouTube claiming to have a “broken heart” because his company GAS Consultoria had its accounts blocked and is unable to repay clients and investors. Accused of running GAS as a cryptocurrency pyramid scheme, the plea from Glaidson comes after three separate requests for habeas corpus were denied. He was arrested in Barra da Tijuca in Rio de Janeiro on August 25 in possession of R$150m in cryptocurrencies, marking Brazil’s largest-ever digital asset seizure. (CoinTelegraph Brasil) (Livecoins)