#156: Brazilian social media users flock to Bluesky after X ban

Plus: New AI tool to track crypto tax cheats; Drex moves into Phase 2 as Central Bank unveils new use cases

Olá pessoal!

Welcome back to 🇧🇷Brazil Crypto Report for the week of September 2-6, 2024.

I hope you all had a pleasant Brazilian Independence Day on September 7, and that you had a chance to check out the first-ever NFL game played in Brazil last Friday. I haven’t paid as much attention to American football in recent years, but it’s still pound-for-pound the most exciting sport to watch from a sheer entertainment perspective. It’s very cool to see the league taking an interest in Brazil

This past week we saw Brazilians flock to X/Twitter alternatives like Bluesky after Alexandre de Moraes banned the platform in the country. We also saw a huge September 7 rally on Avenida Paulista demanding Moraes’ impeachment. Both sides are fighting fire with fire so we’ll be monitoring how this escalates.

🔍What’s in BCR this week?

Central Bank announces new Drex use cases

Receita Federal targeting crypto tax cheats with AI tool

Banco Itaú holds US$308 million of crypto under custody

Hashdex launches Solana ETF featuring staking rewards

Also, if you’re not signed up already you should definitely check out Ripio’s Modular Summit event in São Paulo on September 12. They’ll have speakers from Lightspark, Paxos, Circle and more. It’s shaping up to be a great event so make sure you stop by if you can!

Thanks for reading and have a great week!

-AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Kaleido is the most trusted digital assets and blockchain company by enterprises. Their product suite is the ultimate business blockchain cloud and is rated #1 for tokenization and #1 for blockchain-as-a-service. Kaleido is powered by open source, supports multiple protocols, connects to permissioned and public chains, and lets you utilize any smart contract. Tokenizing assets in a scalable and interoperable way has never been easier.

Built by veterans of IBM Blockchain and Consensys, the Kaleido platform combines turnkey functionality with enterprise-grade security and scalability to power your application — whether it be in banking and financial services, supply chain, media, government & public sector, or central bank digital currencies.

Request a custom demo of the platform today!

Central Bank announces Drex use cases

The Central Bank of Brazil in conjunction with the CVM announced 13 use cases that will be tested during the second phase of its Drex pilot.

The use cases chosen were among the 42 submitted by the 16 consortia that participated in the first round of the pilot. 11 of the use cases will fall under the remit of the Central Bank, while the other two will be under the jurisdiction of the CVM, Brazil’s securities regulator.

Recall that during the first phase of the pilot, consortia tested a single use case: transacting a tokenized government bond between two clients from different banks.

The institutions that had their use cases selected will build out proof of concepts within the Drex permissioned environment by mid-year 2025. The use cases will then be made available for all consortia to evaluate.

The Central Bank said in a statement that:

“in the second phase of testing, the infrastructure created for the pilot will start testing the implementation of financial services, made available through smart contracts created and managed by third parties participating in the platform"

The selected use cases are:

Assignment of receivables (ABC and Banco Inter)

Credit collateralized in CDB bank deposits (BB, Bradesco and Itaú)

Credit collateralized in government bonds (ABBC, ABC and MB)

Financing of international trade operations (Banco Inter) ,

Optimization of the foreign exchange market (XP-Visa and Nubank)

Liquidity pool for trading government bonds (ABC, Inter and MB)

Transactions with bank credit notes (ABBC)

Transactions with agribusiness assets (TecBan, MB and XP-Visa)

Transactions with assets in public networks (MB)

Transactions with automobiles (B3, BV and Santander)

Transactions with credits and decarbonization (Santander)

Transactions with debentures (B3, BTG and Santander)

Transactions with real estate (BB, Caixa and SFCoop)

👏 Notably, Mercado Bitcoin — the only crypto native company leading a Drex consortium — had four of its use case proposals accepted by the bank.

In a statement, Bradesco said that it plans to make its first loan operation using a tokenized bank deposit in the first half of 2025:

“The use of tokens will simplify and speed up the negotiation and settlement process in secured loan operations for individual and corporate clients, allowing the assets to be operated by the client themselves in products such as personal credit or working capital.”

The Central Bank also advised that a new application period for entities interested in participating in the Drex pilot will be opened up later this year.

Valor CriptoFacil Livecoins Portal do Bitcoin CoinDesk BlockNews BeinCrypto Exame

Brazilians flock to Bluesky after X ban

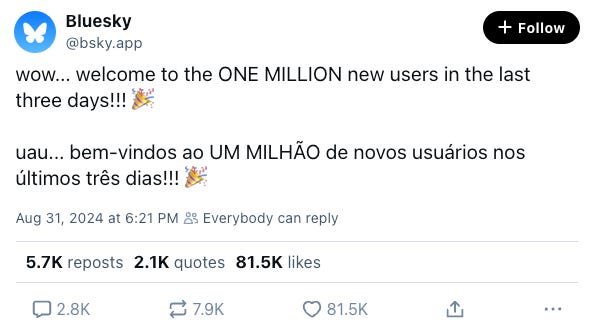

Bluesky, the X/Twitter clone co-founder by Jack Dorsey, saw an influx of Brazilian users after Alexandre de Morães banned X/Twitter in the country with threats of a R$50,000 PER DAY fine for people who use a VPN to circumvent the ban (though actually enforcing this at scale appears impossible)

Bluesky reported that it saw one million new users sign up in the three days after the ban came into effect.

On September 4, Bluesky said that it had onboarded 2.6 million users in recent days, with 85% of those being from Brazil. It also claimed that traffic from Brazil IP addresses was 15x higher than normal. It now has around 8 million total users worldwide.

InfoMoney reported that the platform is reportedly looking to solidify its legal status in Brazil to avoid X’s fate. While Bluesky is built on a decentralized protocol, its operators and users are still subject to relevant laws in their jurisdiction. It also has a content moderation team on-hand 24/7 to monitor for “misinformation”.

For what it’s worth, I signed up for Bluesky last week and wasn’t very impressed. The interface is a carbon copy of X/Twitter, and much of the dialogue feels very siloed. I do like the idea that you can customize the algorithm to better see content that you’re interested in, but overall it just feels like a worse version of pre-Elon Musk Twitter.

Also, even though it’s “decentralized”, Bluesky’s privacy policy reads pretty much the same as any you’d expect for a Web2 social network. Basically, they will collect user data and turn it over to third parties when they feel like it. In addition, Brazil’s Supreme Court has reportedly ordered the deletion of certain fake accounts from the platform, so we could be just lining up for the same fight all over again .

I will spend some more time on Bluesky this week before I come to a final verdict.

Other networks like Threads and bitcoin-friendly Nostr (which as apparently created by an anonymous Brazilian named “fiatjaf”) have also seen an uptake in interest locally. I haven’t experimented with either of these but will try to do so this week.

Cardano founder Charles Hoskinson is also jumping on the decentralized social network bandwagon, saying he will recruit Brazilians to help him build an alternative.

Portal do Bitcoin Livecoins CoinTelegraph Brasil CoinTelegraph Brasil

Receita Federal targets crypto tax cheats with AI tool

Brazil’s tax authority announced that it has developed a new tool that uses artificial intelligence and complex network analysis to crack down on the use of cryptocurrencies in tax evasion.

The tool focuses on identifying so-called notary companies that are created to issue tax documents without selling goods or services, and their operational beneficiaries. Much of the suspect digital currency flows are in the form of stablecoins.

The Receita Federal said in a statement that:

“the combination of different techniques has been relevant to identify suspicious transactions and signs of complex tax evasion and money laundering schemes using cryptocurrencies.”

In one such scheme, authorities identified a potential R$700 million ($125 million) moved by shell companies to purchase crypto. It also uncovered a R$350 million (US$62.5 million) operation involving drug and arms trafficking.

The agency published a brief demo of the platform below👇

Recall that the Receita Federal has been making a push this year to crack down on tax evasion with crypto via overseas exchanges.

Portal do Bitcoin CoinTelegraph Brasil Livecoins Valor Exame

Hashdex launches Solana ETF with staking rewards

The fund was developed in partnership with BTG Pactual, which provides market making services, and uses the Nasdaq Solana Reference Rate as an index.

The ETF will have an effective management fee of 0.7% that will be reduced to 0.1% until the end of September.

The product also incorporates Solana staking via an offshore structure in Bermuda. Staking profits are returned to the fund and used to increase overall returns and reduce or eliminate fees.

SOLH11 is Hashdex’s 7th ETF to launch on Brazil’s B3 exchange, and the 17th overall. Samir Kerbage, Hashdex chief investment officer, told Valor that the product is targeting institutions:

“We are mainly targeting institutional investors, because CVM Resolution 175 limited the exposure of funds to up to 10% if they are going to invest in cryptoassets directly, but allowed allocation of up to 100% for cryptoasset ETFs.”

Portal do Bitcoin CriptoFacil Livecoins Exame BeinCrypto CoinTelegraph Brasil

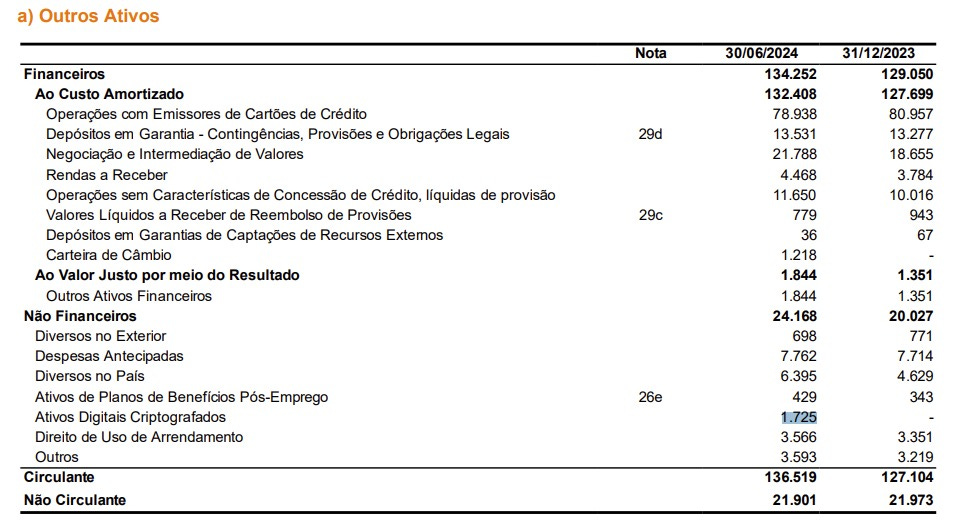

Banco Itaú holds US$308 million of crypto

Itaú, Latin America’s largest bank, revealed that it held R$1.725 billion (US$308 million) in bitcoin and ethereum in custody for clients as of June 30, 2024.

Recall that the Itaú launched its crypto product at the end of 2023.

CoinTelegraph Brasil Livecoins

🗞Brazil Crypto News Rundown

📈 Markets

Six out of nine investor profiles mapped out by B3 intend to hold cryptocurrencies in their portfolio, according to a new survey called “O Brasil que Investe” that surveyed 2,614 middle and upper-middle class Brazilians from across the country. (BeinCrypto)

Sao Paulo’s mayoral elections have generated R$380,000 in bets on Polymarket. (CoinTelegraph Brasil)

Real estate tokenization firm Dynasty Global purchased an eco-resort in Thailand using its DYN tokens. (BeinCrypto)

Crypto-friendly Zro Bank’s payments volumes are expected to increase 36% this year, with 70% of that total attributable to sports betting clients. President Edisio Pereira Neto told Valor:

“When we launched the digital bank, we gained 1 million customers in six months. But along with it came 1 million problems, bugs, complaints; we were not prepared for that volume. What we did was invest heavily in technology, in our own banking core. Then when Pix and bets became popular, we were prepared to deal with a very high volume. And since the systems are ours, we were able to modulate the APIs much more quickly to meet the needs of our customers

BeinCrypto interviewed several crypto market players about their thoughts on the appointment of Gabriel Galipolo as the next Central Bank president.

Which crypto exchanges are domestic and which are foreign? Ana Paula Rabello of Declarando Bitcoin has a new tool to help traders better understand. (Livecoins)

📲 Adoption

Tether is creating a global crypto research alliance and is looking to onboard Brazilians into the community. You can learn more here

Elo, one of Brazil’s largest payment tech companies, announced an RWA project for real estate in the Drex environment that would give Brazilians greater access to financing. (CoinTelegraph Brasil)

Solana announced its Solana Copa America initiative, which will distribute R$500,000 to startups in prize money and seed funding. (CoinTelegraph Brasil)

Businessman and Sao Paulo mayoral candidate Pablo Marcal flew to El Salvador to meet with president Nayib Bukele. (Criptonizando)

SmartPay launched a new tool that allows users to create personalized Pix keys to receive cryptocurrencies directly into their wallets. (CoinTelegraph Brasil) (BeinCrypto)

Brazil’s National Education and Research Network (RNP) will allocate R$23 million to initiatives using distributed ledger technology. (CoinTelegraph Brasil)

An article in Valor compared Drex to India’s e-rupee CBDC project, which has reached 5 million users in its phased rollout.

NFT.Brasil is hosting a three day bootcamp featuring educator and developer Solange Gueiros. (BeinCrypto)

Vinteum is promoting a free training program in Brazil for bitcoin developers. Bitcoin Dev Launchpad is a three month program to train developers how to create open source solutions in the bitcoin ecosystem. (CoinTelegraph Brasil) (Portal do Bitcoin)

ABCripto is partnering with Coimbra Business School in Portugal to promote blockchain education and events. (CoinTelegraph Brasil)

The Brazilian Observatory of Artificial Intelligence officially began its activities on September 3. The group is a non-profit responsible for implementing the decisions and projects of the Brazilian Internet Steering Committee, which has a focus on public policy initiatives around AI. (CoinTelegraph Brasil) (BeinCrypto)

🏛 Policy, Regulation and Enforcement

Brazil’s CVM rejected a proposed settlement with Bluebenx, which is accused of fraud and an irregular offering of cryptocurrency investments.

The organ rejected a proposal from André Massao Onomura and Renato Sanches Gonzales Junior of Bluebenx.

Recall that the CVM issued a stop order against Bluebenx in November 2022 after customers began reporting in August of that year that they could not withdraw their money. (Valor Investe) (Portal do Bitcoin) (BeinCrypto) (Livecoins)

Brazil’s Central Bank announced a new Center of Excellence for Data and Artificial Intelligence to promote the usage of new technologies in its new processes. (CoinTelegraph Brasil) (BeinCrypto)

ABCripto reached an agreement with the National Council of Justice to facilitate seizure of crypto assets and provide education. (CoinTelegraph Brasil) (Livecoins)

The Central Bank announced new rules for using Pix via cellular phone, such as a daily limit of R$200, designed to reduce fraud and scams. (CoinTelegraph Brasil)

Bitybank and Advice Compliance have announced a partnership to improve compliance and anti-money laundering procedures. (Livecoins)

The Rio de Janeiro Court of Justice resumed the evidentiary and trial hearing of “Pharaoh of Bitcoins” Glaidson Acacio dos Santos. One of the testimonies was from a journalist who was threatened by Glaidson after producing a report for Fantastico in 2021. (Portal do Bitcoin) (CoinTelegraph Brasil)

Enforcing tax rules on foreign crypto brokers remains a challenge, Receita Federal special secretary Robinson Sakiyama Barreirinhas said during a congressional committee hearing. (Livecoins)

Police in Paraiba seized bitcoin mining equipment that had been imported into the country without a proper invoice. (CriptoFacil)