#157: Nubank shutters Nucoin trading

Plus: Brazil in 10th place on Chainalysis Global Adoption Index; Ripio announces new onchain credit card

Olá pessoal!

Welcome back to 🇧🇷Brazil Crypto Report for the week of September 9-13, 2024. I hope everyone had a great weekend. I know a bunch of you are in Singapore for Token2049 (major FOMO) so I look forward to hearing from you all about it.

🔍What’s in BCR this week?

Nubank discontinues trading of its Nucoin loyalty token

Brazil checks in at 10th place on 2024 Chainalysis Global Crypto Adoption Index

Ripio announces a new “onchain” credit card product

Neymar’s Bored Ape NFTs are down 90%

Central Bank to release 2nd public consultation on crypto regulations in October

Thanks for reading and have a great week!

-AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Kaleido is the most trusted digital assets and blockchain company by enterprises. Their product suite is the ultimate business blockchain cloud and is rated #1 for tokenization and #1 for blockchain-as-a-service. Kaleido is powered by open source, supports multiple protocols, connects to permissioned and public chains, and lets you utilize any smart contract. Tokenizing assets in a scalable and interoperable way has never been easier.

Built by veterans of IBM Blockchain and Consensys, the Kaleido platform combines turnkey functionality with enterprise-grade security and scalability to power your application — whether it be in banking and financial services, supply chain, media, government & public sector, or central bank digital currencies.

Request a custom demo of the platform today!

🎙New podcast!

This week I talk to Theodoro Fleury who is chief investment officer at QR Asset. We talk about QR Asset’s new Solana ETF, which is now trading on Brazil’s B3 exchange and was the first of its kind in the world.

🎧 You can find Brazil Crypto Report content wherever you listen to podcasts: Spotify | Apple Podcasts | Amazon | Anchor | YouTube

Nubank discontinues Nucoin trading

The digital bank is winding down its Nucoin experiment, announcing that it will no longer allow the purchase and sale of the Polygon-based loyalty token. Trading was suspended immediately to avoid volatility, and will be formally discountinued by the end of the month.

Recall that Nucoin, which was introduced as a groundbreaking experiment in customer loyalty, could be both bought and sold on the open market as well as earned as a reward for card spending. However, the coin could only be traded on Nubank’s app and could not be withdrawn to an external wallet.

Trading for the token was also frozen about a year ago during a period of extreme volatility that saw value rise 2000%.

The Nucoin program will continue to exist as a loyalty mechanism, whereby consumers can redeem them for various types of benefits on the platform. Nubank expects to roll out new benefits for the program by year’s end.

Customers who have at least R$100 in Nucoin will be able to redeem the tokens for other cryptocurrencies until December 9. Otherwise, the Nucoins will be available for future rewards program benefits. Nubank will also distribute prizes to some of the 16 million customers who currently hold Nucoin.

Nubank said that the decision to recalibrate the Nucoin program based on customer feedback:

“The company found that the benefits offered within the Nubank ecosystem are among the rewards most valued by people. Therefore, Nubank chose to reformulate the front of the rewards program, so that the offer can evolve and expand in a way that is even more adherent to people's demand.”

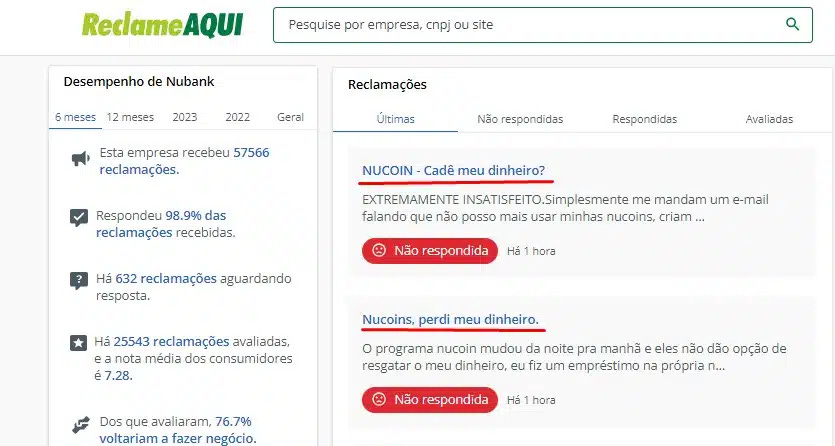

Several Nubank users took to Reclame Aqui to discuss their frustration. One client says he purchased thousands of Nucoins with cash on the open market, as opposed to earning them as cashback via debit card. Another was upset because he bought Nucoin because it’s a cryptocurrency, not because he wanted Nubank benefits. Others took to Bluesky to complain that they had been “simply scammed” by Nubank.

Isac Costa, a professor at Insper, agreed that the decision to halt trading was unexpected and strange. He told Exame:

“The decision is indeed surprising, considering that those who acquired the token did so not primarily for the benefits, but for the possibility of appreciation, as owners".

Costa added that the ability to terminate trading is probably covered in the terms of use, Nubank could still face potential lawsuits.

“It is possible to attempt some type of compensation action if there is a loss compared to the redemption value and the market value of the token at the time of the decision. Otherwise, it would be as if it were the redemption of a Nubank bond in which the redemption conditions were previously established in the issuance instrument.”

Valor CriptoFacil Portal do Bitcoin BlockNews InfoMoney Exame Livecoins

Brazil Drops to 10th on Chainalysis Crypto Adoption Index

Brazil fell from 9th place to 10th in the 2024 Global Adoption Index, produced every year by blockchain analytics company Chainalysis.

Brazil was the highest ranking country from the Latin America region. Venezuela, Mexico and Argentina placed 13th, 14th and 15th, respectively.

The results were released as a teaser ahead of its annual Geography of Cryptocurrency Report, which will come in the ensuing months.

Valor Portal do Bitcoin CoinTelegraph Brasil

Ripio announces onchain credit card

The Argentine crypto exchange is rolling out a new crypto card product that allows holders to use funds invested in a DeFi liquidity pool as collateral.

Card holders will be able to pay for products and services, but the funds will not be debited directly from the user’s cryptocurrency balance. Rather, they will be applied against a limit equivalent to roughly 30% of the user’s liquidity pool holdings.

CEO Sebastian Serrano told Valor:

“The amount will come out of the liquidity pool and you will have a debt with the pool, you will not need to sell your cryptocurrencies automatically.”

The card is in a testing period with a wait list that is open to the public.

The idea is that such a product can be a simple bridge into the world of DeFi for users, removing the need to perform complex operations and multiple transactions. Serrano explained:

“Currently, there are many crypto assets that are sitting in wallets because users see them as investments for the future. Our system provides flexibility by allowing these assets to be used as collateral, so users can keep their assets and, at the same time, finance the purchase of goods and services.”

The announcement was made at its Modular Summit conference last week in São Paulo

Portal do Bitcoin CoinTelegraph Brasil

Neymar’s Bored Ape NFTs Down 90%

Football star Neymar purchased three Bored Apes during the height of the NFT boom in 2022, paying more than R$6 million (US$1.2 million) for the collection. The market value for the NFTs now is around R$500,000, resulting in a million-dollar loss on the investment

🗞Brazil Crypto News Rundown

📈 Markets

Mercado Livre announced a new cashback program to give its customers digital dollars via the Melí dollar stablecoin. (Portal do Bitcoin)

InfoMoney profiled Foxbit founder João Canhada’s journey in crypto, touching on his decision to be 100% exposed to crypto assets, the tragic death of his co-founder in 2019 and weathering several bear markets.

Central Bank director of regulation Otavio Damaso gave a keynote address at an event hosted by ABFintechs, where he identified tokenization as a principle feature of the bank’s financial innovation agenda moving ahead:

“After years of discussion about tokenization, I can say that there is a consensus: tokenization has the potential to transform the national financial system.” (Portal do Bitcoin)

Guilherme Nazar, VP of Latam at Binance, argued that the Brazilian market’s combination of quality regulators, investors and participants is a foundation for the crypto market to prosper.

"I think it's a very positive combination, I can't say unique, that would be reckless, compared to other markets where I may not have this level of visibility, but it is undoubtedly a very positive combination. It's no wonder you see dozens of participants, you see companies, players from the traditional market also wanting to participate, which shows how thriving and attractive this industry is in Brazil.”

Nazar also commented on the recent settlement with the CVM, which resolved an administrative process investigating illegal derivatives offerings. He explained that Binance has been in frequent conversations with the CVM since 2020 on the subject and has sought to make necessary adjustments when needed:

“The term of commitment highlights this view that Binance has taken all necessary actions, we have already done everything that was necessary, and we have always sought to adapt to the rules and current local legislation that impacts us." (Exame)

73% of Brazilian fintechs were founded less than five years ago, according to a new report by ABFintechs. (Exame)

Fuse Capital has invested in Mexican startup Etherfuse, a debt tokenization protocol that is looking to expand in Latin America. (BlockNews)

Mercado Bitcoin is partnering with OpenAI to incorporate artificial intelligence into its customer service system. (BeinCrypto) (Livecoins)

📲 Adoption

Daniel Mangabeira has joined Circle as VP for Strategy and Public Policy for Brazil and Latin America. He previously spent nearly 3 years at Binance. (BlockNews)

Consortia participating in the second phase of the Central Bank’s Drex pilot will be able to test whichever privacy solution they choose, or even multiple solutions, project coordinator Fabio Araujo said during a panel at NFT.Brasil. The solutions available for testing include Zether, Parfin’s Rayls, EY’s Starlight and ZKP Nova. (Valor)

During the panel, Araujo re-iterated that Drex is more than “simply a currency” and argued that it will have the same impact on the local financial system as Pix by democratizing access to different investments. (Exame)

The Brazilian financial system has established itself as one of the most innovative in the world, a panel at Ripio’s Modular Summit argued. The digitization of financial processes and the momentum around Drex has laid a unique foundation for crypto to grow. Guto Antunes, head of digital assets at Itaú, said:

“I was in a meeting with Itaú Personnalité clients who had never bought crypto, but I asked who knew Drex and everyone raised their hands. So this will help us a lot to evolve in the crypto sector in Brazil.” (Exame)

Bitso has named Barbara Espir as its new Brazil country manager. She was hired initially in 2019 as Bitso’s first employee in Brazil, and most recently held the position of VP of legal. Thales Freitas, who previously held the role, is departing the company. Bitso said in a statement:

“Espir takes on the position at a time of growth for the company in the country and expansion of B2B business, through the Bitso Business segment that provides payment infrastructure to international companies that want to operate in the Brazilian market in a regulated manner and with a connection to Pix.” (Valor) (Portal do Bitcoin) (CoinTelegraph Brasil)

Brazilians have taken a heightened interest in VPN services after access to X/Twitter was blocked in the country. (Portal do Bitcoin)

Portal do Bitcoin and Decrypt profile BlueSky, the decentralized Twitter alternative that has seen a surge in new Brazilian users this month.

The Brazilian Volleyball Confederation has issued 100,000 NFT digital cards in project with Chiliz. (BeinCrypto) (CoinTelegraph Brasil)

Enegix Global intends to use natural gas to mine bitcoin at a new 25 megawatt site in Brazil, with ambitions to expand to 80MW. CEO Yerbolsyn Sarsenov said in a statement:

“Brazil has ideal conditions to also attract the digital mining industry. With clean energy sources, such as isolated natural gas and hydroelectric plants, the country favors the promotion of sustainability in the sector while also presenting favorable conditions for operational costs and electricity generation”. (BeinCrypto) (CoinTelegraph Brasil)

Singer Luan Santana is launching his own utility token to “transform” his relationship with fans. (Exame)

Instagram has been reportedly banning the accounts of crypto influencers in Brazil. (Livecoins)

Brazilian banks and financial institutions are increasingly turning to AI tools for credit analysis and personalization. (CoinTelegraph Brasil)

NFT.Brasil is exploring a name change for future editions, organizer and skateboarder Bob Burnquist explained to Exame:

"The name NFT Brasil continues to be valid in the art experience, but we are keeping an eye on the evolution to take the next step and deconfusion. We need to adjust the name, but we can't do that overnight. At the moment, we understand that the art experience still justifies keeping the name, reflecting this artistic and cultural part. But the event talks about everything, and now we have to have this vision of transition.”

🏛 Policy, Regulation and Enforcement

The Central Bank is expected to release its 2nd public consultation on cryptocurrency regulation in October. (Portal do Bitcoin)

The Receita Federal is preparing a package of three actions focused cryptocurrency transactions carried out via international exchanges. (CoinTelegraph Brasil)

Representatives from the CVM, Receita Federal, Febraban, Ministry of Justice, and the University of Sao Paulo Law School met recently to discuss current challenges with regards to cryptocurrencies and anti-money laundering. The seminar was organized by Pierpaolo Cruz Bottini, coordinator of USP research group focused on the topic. (Valor)

Federal Police launched Operation Niflheim last week to dismantle three criminal groups suspected of laundering money and sending funds abroad to the US, Hong Kong, China and UAE using cryptocurrencies. The groups are suspected to have moved more than R$148 billion (US$27 billion) worth of crypto assets since 2019, with most of the funds originating from Rio Grande do Sul. (Valor) (CriptoFacil) (Portal do Bitcoin) (BeinCrypto) (CoinTelegraph Brasil) (Livecoins)

15 bitcoin mining ASICs were stolen from a Brazilian man in Ciudad del Este, Paraguay following a violent confrontation between the thieves and local police. (CriptoFacil)

Banks and fintechs in Brazil are required to provide data on Pix and card transactions to tax authorities, per a new ruling from the Supremo Tribunal Federal. (CoinTelegraph Brasil)