#160: Blackrock promotes bitcoin on Faria Lima

Plus: 30% of Brazil's financial outflows are crypto and gambling; Campos Neto says Drex will continue under new BC leadership

Olá pessoal!

Greetings from Salt Lake City, Utah and welcome back to 🇧🇷Brazil Crypto Report for the week of September 30 - October 4, 2024!

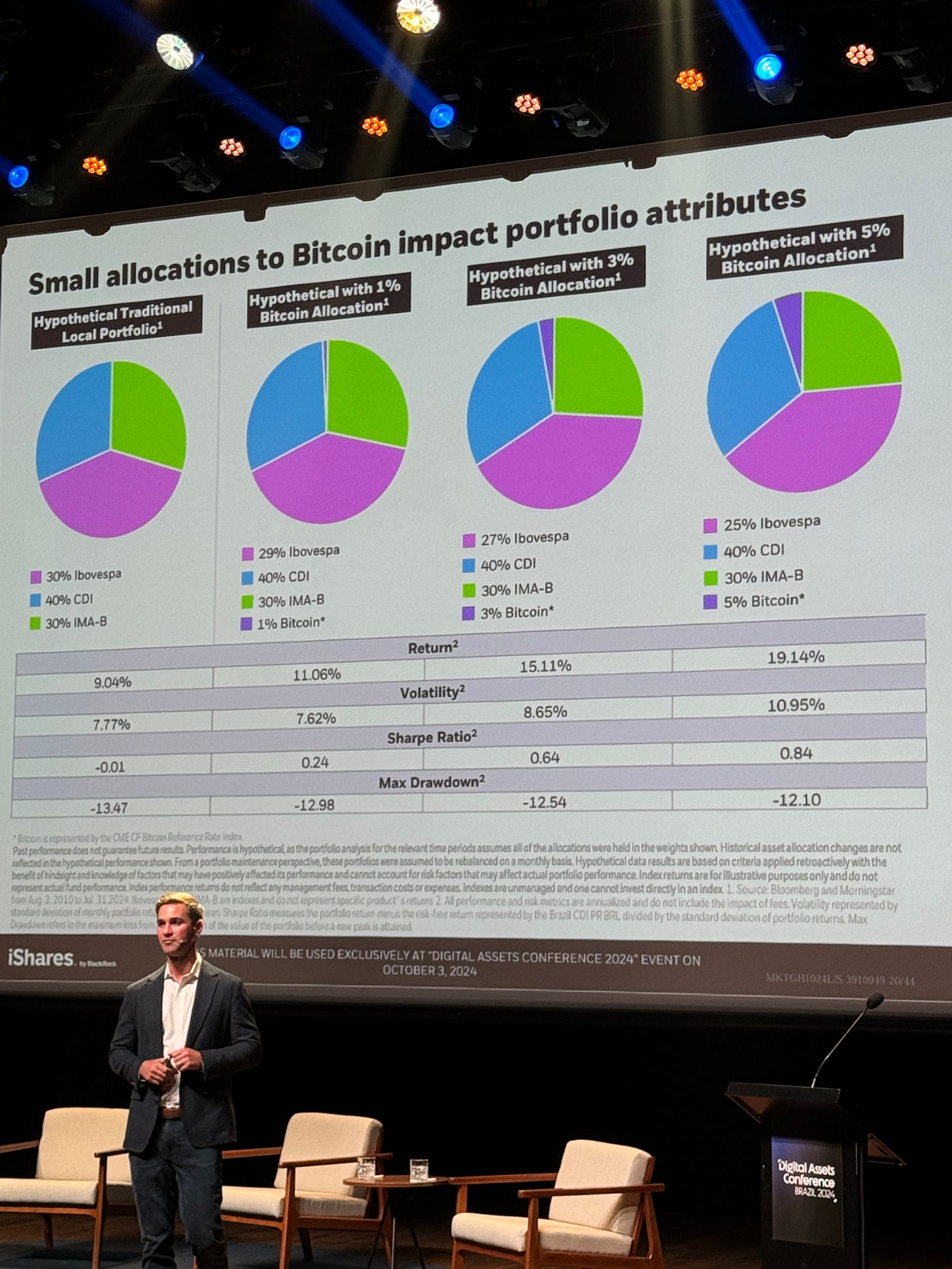

Blackrock was in town last week to promote its bitcoin ETF products to Brazilian investors at a conference organized by Mercado Bitcoin. The event also featured talks from CME, Deribit, CVM, and Roberto Campos Neto. If you missed the event, you can catch the replay on YouTube here.

🔎 What else is in this week’s BCR?

Crypto and gambling are 30% of Brazil’s financial outflows

Campos Neto: Drex will continue under new BC leadership

Nubank again cuts crypto trading fees

Thanks for reading and have a great week!

-AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Kaleido is the most trusted digital assets and blockchain company by enterprises. Their product suite is the ultimate business blockchain cloud and is rated #1 for tokenization and #1 for blockchain-as-a-service. Kaleido is powered by open source, supports multiple protocols, connects to permissioned and public chains, and lets you utilize any smart contract. Tokenizing assets in a scalable and interoperable way has never been easier.

Built by veterans of IBM Blockchain and Consensys, the Kaleido platform combines turnkey functionality with enterprise-grade security and scalability to power your application — whether it be in banking and financial services, supply chain, media, government & public sector, or central bank digital currencies.

Request a custom demo of the platform today!

🎙New podcast!

This week I talk to Matthias Broner of ZKsync and Argentine crypto lawyer Mili Santamaria about the Crecimiento movement, which kicked off in August with a month-long pop-up city in Buenos Aires.

We talk about how Crecimiento aims to turn Argentina into a global hub for crypto startups and innovation in the coming years, and preview the next pop up city event which will take place in December.

🎧 You can find Brazil Crypto Report content wherever you listen to podcasts: Spotify | Apple Podcasts | Amazon | Anchor | YouTube

Crypto and gambling are 30% of Brazil’s capital outflows

Brazil has seen US$48 billion in capital outflows through August this year, with US$14.7 billion — roughly 30% of that volume — attributable to outflows from cryptocurrency and online gambling platforms.

There are growing concerns that capital outflows from Brazil via cryptocurrency and online gambling sites will have material impact on the country’s balance of payments and exchange rate against the US dollar.

This is problematic because right now there is no corresponding source of capital inflows to offset this activity.

Iana Ferrão, an economist at BTG Pactual, told Valor:

“Although there is low external vulnerability, there is no strong net flow coming into the country…If you look at the balance of payments as a whole and take cryptoassets into account, you will see a lower net result. But the market is used to looking only at the current account deficit and how it is financed by Direct Investment in the Country”

“We know that some online betting companies, bets, and some platforms that make international transfers [for use of cards when traveling] are using cryptoassets to make payments because the transaction is faster and cheaper.”

Pedro Guimarães, head of products at Ouribank, reckoned that the volume of cryptocurrencies in the financial account is too large to be attributable to simply investors speculating or accessing dollar stablecoins. He told Valor:

"I think it could be related to other things, such as the growth of the betting market, or other companies that operate in the country but are headquartered abroad.”

These trends could be tamed in the near future by impending regulation — first the betting platforms, and then crypto platforms.

List of authorized betting platforms is released

The Finance Ministry released a list of 205 sports betting sites, operated by 93 companies, that are authorized to continue operating in the country. The betting houses requested authorization by September 30th and met the legal requirements to remain in operation.

The other 600+ online betting sites (!!) that are still operating but not regulated in Brazil could start being shut down as soon as this week by Anatel — the agency responsible for regulating the cites. Finance Minister Fernando Haddad said:

“Just as X went offline, these companies should also go offline, due to lack of compliance with the legislation approved by the National Congress…If you have money in a betting house, ask for a refund now”.

CoinTelegraph Brasil Portal do Bitcoin BlockTrends

Campos Neto: Drex will continue under new BC leadership

In a speech at the Mercado Bitcoin Digital Assets Conference in Sao Paulo, outgoing Central Bank president Roberto Campos Neto said that the Drex project will continue irrespective of who’s leading the institution:

“The four main blocks of the project are getting closer, and the Central Bank will continue with this work, regardless of who is leading the institution.

For the first time, there is a clear perception within the Central Bank of how relevant this project is, not only from a technical point of view, but also in the real impact on people's lives."

The views of Gabriel Galipolo, who has been nominated to be the next leader of the bank, towards Drex are not yet entirely clear. Campos Neto’s term expires at the end of this year.

Don’t prohibit banks from accessing crypto

Campos Neto also said in his talk that the authority is not in favor of limiting commercial banks’ access to crypto assets, particularly stablecoins:

“Prohibiting banks from having access to virtual assets does not reduce the risk, it increases it.

“We are a Central Bank that is not in favor of banning or opposing digital assets. On the contrary, we believe that they should be part of the financial base.”

He added that stablecoin usage is among the most interesting trends that the bank is currently watching — a sector on which the authority is expected to issue regulation in the coming year:

“The one that is growing the most is dollar-denominated stablecoins, which arise from the desire to have a dollar account very cheaply.”

Campos Neto also emphasized that the possibility of combining privacy with tokenized transactions via Drex “can transform the world of banking,” and that the 21st century will be a period of multi-asset, regulated global tokenized networks:

“We have carried out public securities transactions with DvP [delivery versus payment] and pseudo-anonymity. We are moving forward with new assets and services, such as card receivables and collateralized assets.”

Speaking at a separate event in the US, he said that Pix has successfully scaled to 240 million transactions per day, and that it costs roughly US$10 million per year to run the system.

Nubank again cuts crypto trading fees

The digital bank announced a new cut in transaction fees after shutting down trading for its Nucoin loyalty token.

Most customers will now be able to access a 0.6% fee per transaction, the bank said, though it did not provide specifics on how users could unlock that rate. The bank charges different rates for customers depending on the volume trading by the individual user over a pre-defined period of time.

The new fee structure is a 62% cut from where fees were one year ago.

Will the real Nucoin please stand up?

Meanwhile, BeinCrypto followed up on its investigation into whether or not Nucoin, Nubank’s loyalty token, ever existed. The bank claimed initially that because the token was issued on a private Polygon Layer 3 blockchain, it isn’t visible to outside observers.

Developers interviewed by BeinCrypto critiqued Nubank's position, arguing that a private blockchain undermines claims of decentralization, and that the concept is misleading for investors. They also expressed concern over the lack of new validators and noted that the private blockchain's existence should not justify selling a blockchain product to investors. The absence of public transaction data further fueled skepticism.

Valor Nubank CriptoFacil Portal do Bitcoin CoinTelegraph Brasil BeinCrypto

Ripple Payments launches in Brazil via Mercado Bitcoin

Mercado Bitcoin will be the first entity in Brazil to adopt Ripple’s new high speed payment solution, which is aimed at speeding up international transactions.

Formerly known as RippleNet, Ripple Payments provides a blockchain-based rail for sending faster and cheaper international transfers. It operates on the XRP Ledger and offers liquidity and settlement, but doesn’t require users to own or use cryptocurrencies.

Silvio Pegado, Managing Director LatAm at Ripple, said:

“Ripple Payments offers unique capabilities that are important to crypto businesses, enabling them to streamline operations, optimize liquidity and ultimately improve margins through real-time payment settlement.”

Jordan Abud, head of banking at Mercado Bitcoin, said the solution will simplify the transfer process:

“The idea of the product is to provide a simplified transfer through the experience of Ripple, our international partner specialized in international payments.”

Portal do Bitcoin CoinTelegraph Brasil CoinDesk Exame

Drex pilot opens to new private sector participants this week

Fabio Araujo, Drex coordinator at the Central Bank of Brazil, said that a call for new private sector participants will be announced this coming week. The registration window will be open for at least four weeks. Araujo explained:

“The expansion comes as the second phase of the Drex pilot kicks off. The phase will focus on testing a broader range of use cases within the CBDC platform…At this stage, we can cover a much larger number of use cases, as we are maturing governance.”

Speaking at the Digital Assets Forum hosted by BlockNews and Cantarino Brasileiro, Araujo revealed some of Drex’s broader ambitions. Namely, that Drex aspires to be the central environment of the Brazilian financial system, with other digital solutions like Open Finance and Pix living on top of it. He said, via CoinTelegraph Brasil:

"Drex's long-term goal is to be the Brazilian financial system, where all negotiations will take place. It is something that takes time, that will not happen overnight, and that depends on the advancement of technology"

“I hope that Drex will one day replace the STR [Reserve Transfer System]…All transactions would be made within this environment. As this technology advances, all business would be done within it…I hope it takes time, because migrating the internet to blockchain is costly.”

Araujo also added that the bank continues to work on privacy solutions, but that the continued search may delay the project again. End-user testing is expected to begin in late 2025 or early 2026, he added.

Meanwhile, there is growing concerns that the main challenge facing Drex implementation may not be technogical, but rather regulatory in nature.

Renata Petrovic, head of innovation at Bradesco, highlighted that use cases like settling real estate and automobile transactions on decentralized networks will require significant changes to existing laws and regulations:

“Is the representation in the form of a token legitimate for the registration that is at Detran [Brazil’s DMV]?”

Larissa Moreira of Itau Digital Assets said that understanding how and when regulatory agencies should be injected into these processes to find solutions will be critical:

“The provocation and mindset should be: what kind of efficiency and review of roles can we do? What benefits are we going to discuss in changing the scenario to take to the regulator and identify what needs to be changed so that we can move towards the productive environment of Drex innovation?”

Liqi joins Drex pilot

Asset tokenizer Liqi has been admitted to the Drex pilot and will support Itaú in tests with Banco do Brasil, Bradesco and Nuclea.

Liqi will tokenize an operation in which bank deposit certificates (CDBs) from the banks will be given as collateral for loans. CEO Daniel Coquieri said:

"By using blockchain and smart contracts, people and companies will be able, for example, to use their investments to take out loans in different institutions, providing access to credit and better opportunities for everyone. The consortium will have the chance to test several of the advantages attributed to Drex"

Valor CoinTelegraph Brasil Exame Valor Valor

🗞Brazil Crypto News Rundown

📈 Markets

Visa will create a platform for Brazilian banks to create their own cryptocurrencies on Ethereum. The Visa Tokenized Asset tool will allow for the creation of tokenized currencies backed by fiat. Eduardo Abreu, executive director for new business at Visa, said:

"The platform is already available in a test environment, with APIs, and already has an international partnership with BBVA. Now, we are bringing this innovation to Brazil. We are also approaching companies that tokenize digital assets, as we understand that the future of payments, especially with cards, is directly linked to this new digital economy.” (Exame) (CoinTelegraph Brasil)

Crypto exchange Coins.xyz is expanding its presence in Brazil ahead of anticipated VASP regulation. The company is led by former Binance CFO Wei Zhou. (CoinTelegraph Brasil)

Renata Petrovic, head of innovation at Bradesco, said that the bank having a play in the crypto market is mandatory given enthusiasm for the product among young people:

“Being outside this market is not an option. There is no turning back.” (BeinCrypto)

KuCoin will expand its presence in Brazil and Latin America in the coming year following impressive user growth over the last 18 months, managing director Alicia Kao told Exame:

"Last year, we witnessed enormous support from Latin American users. We saw a 34% increase in newly registered users in the region in 2023, and this was followed by another 31% growth in the first half of 2024".

Exchange Ripio has appointed Matías Dajcz as its new chief revenue officer. (CoinTelegraph Brasil)

Notcoin, Kucoin Token, SUI, Bitget token and JasmyCoin were the most traded coins this week on Mercado Bitcoin. (BeinCrypto)

Nomad head of research and content Paula Zogbi discussed the digital bank’s thesis toward bitcoin, crypto ETFs and RWAs. (CoinTelegraph Brasil)

Asset manager Hashdex filed an S-1 amendment for its proposed Nasdaq Crypto Index ETF in the US. (CoinTelegraph Brasil)

Hashdex CIO Samir Kerbage argues that loosening monetary policies around the world and the potential election of a crypto-friendly president in the US are the major catalysts for potential bullish price action in Q4. (CoinTelegraph Brasil)

Febraban president Isaac Sidney is calling for a prohibition on the use of Pix payments as an onramp to online casinos. Febraban is pushing for the creation of a task force that could result in Pix deposits for gambling sites being suspended.

“While there is no regulation authorizing all online betting companies, there must be a brake. This brake involves some emergency measures. We have advocated that instant payment methods, such as Pix, can be temporarily suspended for placing bets.” (Livecoins) (CoinTelegraph Brasil)

📲 Adoption

The ban on X/Twitter usage in Brazil has made it more difficult for researchers, influencers, fundraisers and enthusiasts to access crypto industry information. (CoinTelegraph)

Boali, Brazil’s largest healthy food franchise chain, is now accepting Lightning Network via a partnership with Foxbit. (CoinTelegraph Brasil)

24% of X users in Brazil said they don’t plan to return to the network once it is unblocked, according to a survey by Broadminded, the research arm of Sherlock Communications. (CoinTelegraph Brasil)

The advancement of artificial intelligence in Brazil needs to be reconciled with the country’s General Data Protection Law, argued expert Gabrielle Ribon:

“The LGPD imposes strict restrictions and obligations regarding the use and storage of personal data, regardless of the size of the company.” (CoinTelegraph Brasil)

A Brazilian bitcoiner miner solo mined a bitcoin block, receiving a reward of R$1 million in bitcoin. The miner used a mining hosting service offered by Level Miner, using a 67 Bitmain Antminer S19K Pro 120TH and five Bitmain Antminer T21 190Th machines. (Portal do Bitcoin) (BeinCrypto)

🏛 Policy, Regulation and Enforcement

Brazil’s CVM will discuss its regulatory agenda for tokenization this week at an event hosted by Febraban and Nuclea. (CoinTelegraph Brasil) (Livecoins)

Representatives from the Receita Federal, Brazil’s tax authority, presented to 38 countries its dashboard tool for monitoring for tax evasion, tax avoidance and other crimes using cryptocurrencies. The agency stated:

"With the crypto module, tax auditors have visually identified notary companies (created basically to issue tax documents, without selling goods or providing services, with the objective of tax evasion or undue compensation of taxes) and the operational beneficiaries, analyzing the flow of different types of virtual currencies" (CoinTelegraph Brasil) (Livecoins) (CriptoFacil)

The Receita Federal is studying how to tax RWA tokens such as receivables and fixed income. (CoinTelegraph Brasil)

Starting in October 2024, companies that receive contributions from foreign investors in cryptocurrencies must report these assets in foreign direct investment registry. (CoinTelegraph Brasil)

ABCripto and Acrefi — the National Association of Credit, Financing and Investment Institutions — are partnering on anti-money laundering and terrorist financing initiatives. (Valor) (CoinTelegraph Brasil)

Fernando Martines of Portal do Bitcoin and Joao Pedro Malar of Exame were able to obtain some answers about the Sao Paulo mayoral candidates views towards crypto and blockchain

The Central Bank reported a leak of 53,000 Pix keys from payments fintech Qesh Passwords. (CoinTelegraph Brasil) (Portal do Bitcoin)

Proposed legislation in Congress seeks to discontinue to printing of physical money within five years, while another a competing bill aims to ensure that cash will continue to exist. (Livecoins)

Federal Police in Sao Paulo launched Operation iFraud investigating the illegal importation of smartphones using crypto. The scheme involves a former janitor turned YouTube influencer. (Livecoins) (CriptoFacil) (CoinTelegraph Brasil)

Civil Police in Parana indicted a man operating a crypto pyramid investment scheme that resulted in R$400,000 in losses. (Portal do Bitcoin)

Federal Deputy Júlia Zanatta has presented a bill to block the development of Drex/Digital real, arguing that it represents “state control”. (CoinTelegraph Brasil)

A fake Globo interview with Fernando Haddad discussing cryptocurrencies is circulating via Whatsapp. (Livecoins)

Civil Police in the Federal District launched Operation Phantom Machine targeting three people for falsely reporting a crime relating to stolen bitcoin mining equipment. (Portal do Bitcoin)