#170: Coinbase surges in Brazil App Store rankings

Plus: Transfero acquires Fuse Capital; Metamask launches crypto debit card in Brazil

Olá pessoal!

Welcome back to 🇧🇷Brazil Crypto Report for the week of December 9-13.

I hope everyone had a great weekend. I spent mine diving into the AI agent craze and taking positions in some of these coins. Hard to tell if these are going to be a real thing or just the next iteration of memecoins, but I’m here for the journey!

👋 If you’re new here, BCR is a newsletter and podcast platform that provides actionable intelligence for investors, operators and builders with an interest in the Brazil and Latin America digital asset ecosystem

🔎 What’s in this week’s BCR?

More than 130,000 Brazilians have scanned their eyes for Worldcoins

Brazilians’ interest in altcoins ramps up, October data shows

Consensys releases Metamask debit card in Brazil

Transfero acquires Fuse Capital

Binance partners with PicPay for offramping

Coinbase is most Brazil’s most downloaded crypto app

Valor Capital: Brazil set to be world’s first tokenized economy

Thanks for reading and have a great week!

-AWS

Questions? Comments? Suggestions? Feel free to shoot me a note at @AaronStanley on Telegram or on Linkedin

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

LIT Collective is the ultimate creative and design studio for Web3 companies.

Based in Brazil and serving the globe, they’ve helped more than 100 brands with user-centric branding, UX/UI design, motion, Webflow development and other creative needs.

Check out their website, follow them on X/Twitter and Instagram, and book a free consultation to learn about how LIT Collective can help you with your creative needs.

Powered by hydroelectric energy from the ITAIPU Dam, Morphware provides high-performance compute to run, train, and build your AI apps and agents.

One of the greatest expenses when it comes to building AI applications is the compute. Morphware provides a gateway to accessible compute for AI development.

Using abundant clean energy from Paraguay, NVIDIA’s highest performing GPU servers, and bitcoin mining infrastructure Morphware offers some of the most competitive prices for compute in the industry.

Follow on X @Morphwareai and join the Telegram to be a part of the community

🎙New podcast

This week I talk to Wei Zhou, who is the former CFO of Binance and currently the CEO of Coins. Coins is an exchange that started in the Philippines in 2014 and found great success in processing crypto remittance transactions and in facilitating the crypto gaming boom of 2021.

Wei talks about how he acquired the exchange in 2022 and is expanding its operations to emerging markets around the world like Brazil

🎧 You can find Brazil Crypto Report content wherever you listen to podcasts: Spotify | Apple Podcasts | Amazon | Anchor | YouTube

More than 130,000 Brazilians have scanned their eyes for Worldcoins

More than 131,000 individuals have officially scanned their irises in exchange for 250 WLD tokens since the World project hard launched last month.

An additional 2681 users in Brazil registered for the service in 2023 when the project operated briefly. Further, 540,000 Brazilians have already downloaded the World app, meaning that they can now verify themselves physically with an iris scan

Individuals stare into the famous Worldcoin Orb, which takes a high-resolution image of the person’s face that converts their unique iris into a text code. The purpose is to prove a “proof of humanity” identification system based on the individual’s unique iris.

In exchange for registering for the service, individuals receive 25 WLD tokens — currently around R$500.

Brazilians’ interest in altcoins ramps up, October data shows

Transactions with altcoins like Ethereum and Solana increased during October at a faster rate than bitcoin, according to Receita Federal data .

The tax authority reported 2.4 million bitcoin transactions in October with a volume of R$3.8 billion. The total transaction volume was nearly double that of October 2023, while the total volume tripled over that period.

Ethereum trading volume grew four-fold during the period from R$243 million to R$1 billion, while Solana volume increased 10x from R$57 million to R$500 million for the period.

Vinicius Bazan of Underblock told Valor that the trends reinforce Brazilians’ interest in decentralized finance and speculative applications:

“The user experience on the Solana network is very good and, although we do not have clear data from Brazil specifically, there is a strong growth in transactions and interactions with memecoins created and traded within the blockchain.”

US dollar-pegged stablecoins continue to represent the lion’s share of crypto trading volume in Brazil — roughly 70% of the total reported to the Receita Federal. Though USDT, the dominant stablecoin in Brazil, moved R$14.7 billion during the month of October, down 20% from the prior year period.

Consensys releases Metamask debit card in Brazil

Consensys released a debit card product that allows users to make purchases directly from their Metamask wallet using USDC, USDT and wrapped ether on the Linea L2 network.

The product is live in Brazil, US, UK, Mexico and Colombia. It differs from other crypto card products in that it doesn’t require the transfer of crypto funds to a centralized exchange or bank to convert them into fiat currency — eliminating a major point of friction.

Consensys also released a survey of the Brazilian market showing that 43% of citizens who are familiar with crypto have already invested in the asset class.

96% of respondents surveyed said that they have heard of crypto, while 47% reckoned that crypto rails would be an improvement over the existing financial system. 43% of respondents in the country’s Northeast region said they already own cryptocurrencies — highest in the country.

28% of the 1,051 surveyed said that they feel excluded from the traditional financial system and 13% argued that the financial system should be more inclusive.

The main barrier to entry among respondents (41%) was the perception that there are still too many scams in the market and that investing in crypto is “too expensive”.

Daniel Lynch, senior director at Consensys, reckoned that banks in Brazil are paying more attention to “underbanked” populations following the success of Pix.

“It’s a trend we see in Latin America. A wealthy person can have a private bank account with several currencies and access to money markets. The underbanked have at most a checking account or savings account.”

Regarding the debit card product, Lynch told BCR:

"We couldn't be more proud to be bringing the world's first self custodial debit card to Brazil. No top-ups, no prepaying - spend directlty from your EOA and the rich DeFi universe it's connected to.”

”Its time people had full access to a fully self custodial banking experience with saving, spending, lending, credit and rewards - a YouBank."

He added that Consensys will continue to view Brazil as a key region for adoption:

“For me, it is the country of the future and one of MetaMask's priority markets.”

Valor Portal do Bitcoin Exame BlockNews BeinCrypto CoinTelegraph Brasil

Transfero acquires Fuse Capital

Digital assets and infrastructure platform Transfero announced the acquisition of Fuse Capital — a VC firm and asset manager focused on blockchain tech and tokenization.

The objective of the merger is to push new fronts in developing DeFi solutions and financial products in the Drex ecosystem. Terms of the deal were not disclosed.

Fuse Capital will continue to operate independently from other companies in the Transfero group. The deal allows Transfero to expand its asset management capacity and positions it as a bigger player in Brazilian financial markets.

Claudio Just, CEO of Transfero Ventures, said:

"With Fuse Capital, we are prepared to launch new services in DeFi, driving not only the integration with Drex, but also bringing innovative financial solutions that will benefit companies and consumers globally.”

Fuse Capital co-founder Dan Yamamura added:

"This strategic union with Transfero will allow us to accelerate the creation of a more integrated financial ecosystem, based on blockchain and DeFi. With the arrival of Drex, we see a unique opportunity to revolutionize the digital financial market, not only in Brazil, but globally."

Valor Portal do Bitcoin BlockNews BeinCrypto

Binance partners with PicPay for offramping

The partnership allows customers with accounts at both companies to send reals from their PicPay wallet direct to their Binance wallet, providing users with alternative way to fund their Binance account.

Binance said in a statement:

“With the new partnership, Binance is increasing the alternatives for deposits on the exchange, which include transfers via Pix and TED and credit and debit cards.”

Guilherme Nazar, Binance’s VP of Latam, said:

“Partnerships like this allow investors to have another alternative for efficient and intuitive access to the cryptocurrency ecosystem, reduce friction for new entrants and consolidate Binance's position in the national market. For cryptocurrencies to play an even greater role in people's lives, it is important that transactions happen easily.”

BlockNews BeinCrypto CoinTelegraph Brasil Livecoins CriptoFacil

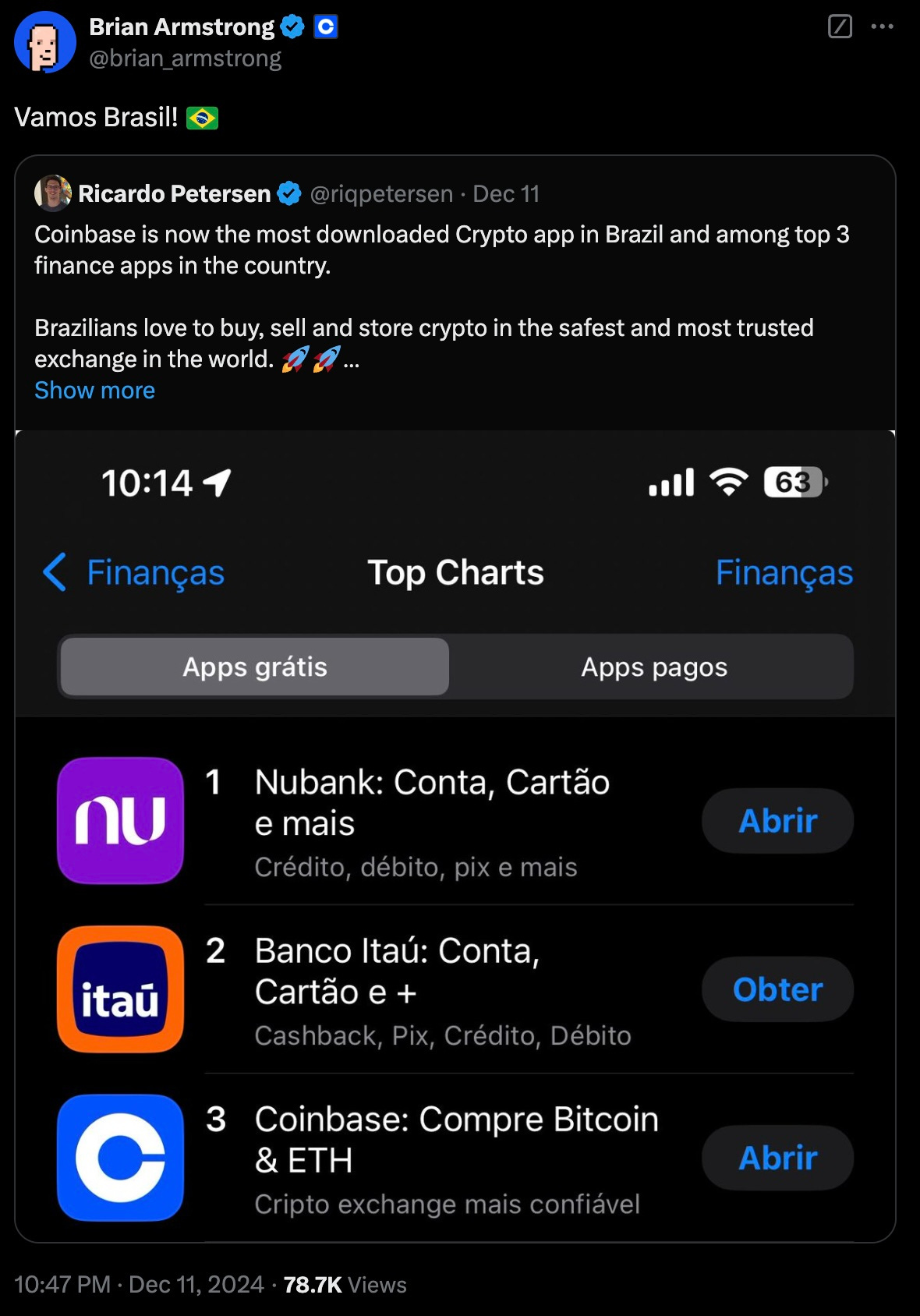

Coinbase is most Brazil’s most downloaded crypto app

Coinbase surged to become Brazil’s most downloaded crypto app and the third-most downloaded finance app. The success resulted in a shoutout from CEO Brian Armstrong on X/Twitter

Coinbase also inked economist Charles Wicz, one of the top 10 financial ambassadors in the country, as an ambassador and rolled out its Pense Cripto, Pense Coinbase campaign that gives R$20 to new users in the country.

BeinCrypto CriptoFacil Livecoins CoinTelegraph Brasil

Valor Capital: Brazil set to be world’s first tokenized economy

In an interview with CoinTelegraph Brasil, Valor Capital Group managing partner Michael Nicklas argued that Brazil will be a world leader in asset tokenization, particularly with the emergence of the Drex project — which he argues gives Brazil a strategic advantage.

"Brazil has the potential to be a global model of efficiency and financial innovation…Brazil is set to be the first country to tokenize its economy, becoming the first fully tokenized global economy.”

🗞Brazil Crypto News Rundown

📈 Markets

Stablecoins figure to play a much bigger role in Brazil’s financial system as they emerge as an alternative to the SWIFT settlement network globally, Valor reports.

Brazil has another bitcoin ETF, COIN11, trading on the B3 exchange. Renato Nobile of Buena Vista Capital — manager of the fund, told Valor:

“ETFs like these democratize access to markets considered complex, such as cryptocurrencies and American small-caps, and allow individual investors to explore global trends.”

The Verde multimarket fund, led by Luis Stuhlberger, appreciated 3.29% in November with gains from its positions in dollars, stocks and crypto assets. (Valor)

Securitization company Opea has created a digital asset platform in partnership with Growth Tech. The platform allows the tokenization of information and resource flow of structured credit operation — from origination to assignment of the receivable to assignment to a fund or sale through crowdfunding platforms. The official launch will come in early 2025. Hugo Pierre, CEO of Growth Tech, told Valor:

"The tokenization of contracts is the first step towards a truly digital capital market. By tokenizing flows and automating processes, we create the foundations for the tokenization of assets, ensuring a safe transition aligned with regulations.”

Hathor has enabled the tokenization of R$1 billion in court-ordered debts from the state of Maranhao, in partnership with blockchain firm Mannah and asset manager Acura. The deal is said to be the largest-ever tokenization of a real-world asset in Brazil and Latin America. (BeinCrypto)

Vixio Regulatory Intelligence is forecasting that gross revenue from online betting games in Brazil will be more than US$2.9 billion in 2025, immediately establishing the country as a top 10 global market. Revenues should reach US$6.3 billion by 2028 — enough to make Brazil the second largest market in the world. (SBC News)

Ribus received approval from the the CVM to tokenize and fractionalize real estate. (CoinTelegraph Brasil)

📲 Adoption

Fintech CloudWalk has migrated its operations to its own blockchain network called Stratus, with plans to expand the project globally. CTO Thiago Scalone told Exame:

“One of our missions is to create a global intergalactic payments network, and that's why we believe so much in blockchain. Stratus is the first step towards this, something that anyone can download, and we want to bring other players to the network.”

A new survey from Bitso shows that online searches for terms related to crypto grew 124% over the last two years in Brazil. (Exame) (BeinCrypto)

Anbima released a technical guide for issuing tokenized assets. (CoinTelegraph Brasil) (CriptoFacil)

Mercado Bitcoin and BityBank won the Reclame Aqui 2024 award for providing good customer service and helping them resolve complaints quickly. (CoinTelegraph Brasil)

The state of Minas Gerais has already issued more than 2 million National Identity Card IDs using blockchain validation. (CoinTelegraph Brasil)

Financial influencer Nathalie Arcuri apologized for her criticisms of bitcoin from 2016. (Livecoins)

Jack Mallers’ Strike platform enabled deposits and withdrawals in Brazil via USDT on Tron. (Livecoins)

Banco Bradesco hosted an “ideathon” to test decentralized digital identity use cases and looks to implement the technology using blockchain in 2025. Such a credential will greatly facilitate Drex use cases, the bank said:

“We have this vision for the use cases we are working on at Drex: tokenized CDB as collateral for loans and the life cycle of debentures. The use of verifiable credentials can help us solve business problems, in addition to facilitating onboarding at other financial and payment institutions and updating registration.” (Valor) (CriptoFacil)

A fake Valor article has been circulating saying that Banco do Brasil is suing popular television personality Luciano Huck for talking about cryptocurrency investments. (Valor)

Brazil’s Ministry of Defense has labeled blockchain technology a “strategic product”, meaning that any company providing this service to the agency must meet certain authorization requirements. (Exame) (BlockNews)

BEE4, the over-the-counter market for tokenized shares of small and mid-sized companies, is partnering with Dinamo Networks for the generation, storage and management of cryptographic keys for nodes in its network. (BlockNews)

Foxbit announced a special promotion on Toncoin staking on Foxbit Earn that offers 50% APY. J. Victor Mendes, business director at TON Foundation, said in a statement:

"Foxbit was my gateway to the cryptocurrency universe in 2017 and, today, I am extremely pleased to collaborate with this partnership that will accelerate TON's growth in Brazil.” (CoinTelegraph Brasil)

🏛 Policy, Regulation and Enforcement

Marlon Klein, founder of ContaRico — an investment company that has been the subject of complaints from investors saying they are unable to withdraw their funds — said that he has been scammed and is a victim of companies that are withholding R$1.5 million of his funds. (BlockNews) (BeinCrypto)

Real estate tokenization firm NetSpaces said it has no relationship with ContaRico despite its name appearing in ContaRico’s proposal for Phase 2 of the Drex project. CEO Andreas Blazoudakis told BlockNews that his company’s name was used without authorization:

"This is very serious. We have no relationship with this in any way and we couldn't, because I don't even know if they can make this product.”

Brazil’s Central Bank is “in the spotlight” and will need to decide whether bitcoin is a currency, says the Brazilian Exchange Association. (CoinTelegraph Brasil)

An AI regulation law was approved by Brazil’s Senate in a symbolic vote on December 10. The law goes to the Chamber of Deputies where it faces resistance from the Big Tech lobby. (CoinTelegraph Brasil)

Suspected pyramid scheme BeeFund announced its return, indicating that it will try to make depositors whole and re-enable withdrawals from the platform. Wagner Oliveira, one of the promoters of the fund, has reappeared in the community’s Telegram channel a promoting food donation drive. (Portal do Bitcoin)

Tokenization is among the CVM’s priorities for 2025, according to its 2025 Regulatory Agenda published last week. (Portal do Bitcoin)

Changes to a tax reform bill approved by Brazil’s Senate were celebrated by the crypto industry. The initial version of the bill would have made all digital asset transactions more expensive by taxing all cryptocurrencies as commodities. The current tax burden on the crypto sector in Brazil stands between 14-17%; the initial bill would have increased this to 25-27% — thereby creating a divergence between national and international brokers. (Exame) (CoinTelegraph Brasil)

The Central Bank’s VASP regulation proposal could be impacted if Brazil’s Congress approves a bill requiring asset segregation for crypto companies. (BlockNews)

Senator Jorge Seif requested a session with the Senate’s board of directors to discuss privacy, regulation and state control over cryptocurrencies in Brazil. He said that he will vote against any proposal to increase the tax burden on cryptos:

“There is concern in the market, especially with regard to the higher taxation by the federal government against cryptocurrencies…I will be against it and will fight for the Brazilian State to promote autonomy for innovation.” (CoinTelegraph Brasil)

ABCripto launched a Virtual Asset Specialist Certificate for professionals looking to work in the industry. (CoinTelegraph Brasil) (CriptoFacil)