#173: Receita Federal ramps up Pix surveillance

Plus: new crypto tax rules coming in March; crypto contributes to record capital outflows in 2024

Olá pessoal!

Welcome to Brazil Crypto Report for the week of January 6-10, 2025.

I hope everyone is having a great start to the new year. Flagging quickly that I’ll be in Davos, Switzerland for the World Economic Forum meetings the week of January 20. If you’ll be on the ground and interested in say hi please shoot me a note on Linkedin or Telegram at @AaronStanley

🔎 What’s in this week’s BCR?

Brazil’s tax authority is ramping up monitoring of Pix transactions, raising financial surveillance and privacy concerns

B2V founder says Brazil’s tradfi community is lagging behind on crypto

Receita Federal to crypto tax declaration rules by March

Bitcoin contributes to record negative capital outflows in 2024

Lula Administration lashes out at Meta for removing censorship controls

Thanks for reading and have a great week!

- AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Powered by hydroelectric energy from the ITAIPU Dam, Morphware provides high-performance compute to run, train, and build your AI apps and agents.

One of the greatest expenses when it comes to building AI applications is the compute. Morphware provides a gateway to accessible compute for AI development.

Using abundant clean energy from Paraguay, NVIDIA’s highest performing GPU servers, and bitcoin mining infrastructure Morphware offers some of the most competitive prices for compute in the industry.

Follow on X @Morphwareai and join the Telegram to be a part of the community

🎙New Podcast!

For our first episode this year I’m joined by Hathor Network co-founders Marcelo Brogliato ad Yan Martins to talk about their exciting plans for 2025.

As Hathor approaches its 5-year mainnet anniversary, the project stands out for its novel hybrid DAG-blockchain architecture and its focus on real-world asset tokenization and other features. For this coming year, they will be rolling out “nanocontracts” (Python-based smart contracts), Metamask Snap integrations, anti-MEV mechanisms, an EVM bridge deployment and “blueprints” that allow open source developers to monetize their code contributions.

Following the recording, Hathor announced last week that it is enabling the tokenization of R$1 billion in court order, a judicial debt asset in Maranhao, in partnership with Mannah and Acura. (Full article in CoinTelegraph Brasil)

🎧 You can find Brazil Crypto Report content wherever you listen to podcasts: Spotify | Apple Podcasts | Amazon | Anchor | YouTube

Receita Federal to track Pix transfers from crypto exchanges

A new regulation established by Brazil’s tax authority (starting January 1) now requires crypto exchanges and other financial institutions to report their customers monthly Pix transactions that surpass R$5,000 (US$818).

The rule is part of a broader push to monitor Pix transactions in the country. Transfers exceeding R$5,000 for individuals and R$15,000 for legal entities must be reported to the agency by credit card operators and payment institutions. The agency insists that is not taxing these transfers directly, but rather monitoring them for compliance.

An important point is that it is not just transactions that exceed R$5,000 that will be monitored, but any account that receives or sends more than R$5,000 cumulatively during a monthly period.

Robinson Barreirinhas, special secretary of the Receita Federal, said:

“We will cross-reference this data with a series of other data so that we can focus our energy on that minority of taxpayers who present some inconsistency.”

These rules will have the most impact on informal workers, traders, and freelancers. André Felix Ricotta de Oliveira of Felix Ricotta Advocacia, told CoinTelegraph Brasil:

“For those who receive more than R$5,000 per month, from now on, there is no longer any exemption. These people will have to file an Income Tax return, and the Tax Authorities will cross-check the financial transaction information with the declarations.”

“The Federal Revenue Service will start monitoring a larger volume of financial transactions and this could lead to a significant increase in inspections. Therefore, it is essential that taxpayers comply with the new legislation and declare all their sources of income transparently.”

The agency said that it already has data on bitcoin and crypto transactions carried out by Brazilian citizens abroad, and it will begin to collect taxes on these starting in 2026.

Libertarian economist Fernando Ulrich argued that the move to monitor Pix transactions creates a state surveillance and control mechanism over the financial activity of all Brazilian citizens:

“If a product is free, it is because you are the product. This is exactly what happens with Pix, which is a practical and free service for individuals…In return, they become vulnerable to all types of monitoring and restrictions by the Central Bank and the government.”

“Of course, this is yet another measure to monitor everything that is happening and to be able to collect even more. This, for me, is one of the biggest problems and is the hallmark of the current administration, the great diligence they have to collect, to monitor, to inspect, to tax citizens more, while there is almost no effort to limit public expenditure and spending, that is, the waste of citizens' money.”

CoinTelegraph Brasil BeinCrypto

B2V: Faria Lima lags behind on crypto

Brazil’s traditional finance community is still far behind when it comes to understanding and adopting crypto, B2V Crypto co-founder Axel Blikstad argued in an interview with Valor.

He said that the recent bitcoin run-up to US$100,000 caught many on Faria Lima by surprise:

“Faria Lima is very frustrated because this market keeps rising. It’s amazing how no one has the asset. They are extremely uncomfortable. But the denial won’t last forever; one day this penny will drop.”

Blikstad also predicted in the interview that bitcoin will top out between US$150,000 and US$200,000 in 2025.

“US$175,000 is a midpoint without the approval of strategic reserves in the US.”

Receita Federal to crypto tax declaration rules by March

Normative Instruction 1.888, first implemented in mid-2019, regulates how crypto exchanges report customer activity to the the Receita Federal, Brazil’s tax authority.

This rule is being revised and will be updated by the end of March, the agency stated. In addition, the Receita communicated that it:

“will contemplate the consolidation of self-regulation opportunities, initially. And the execution of coercive actions, when necessary, at a later stage”

The end result will be DeCripto, a new framework that encompasses new types of crypto assets that did not exist in 2019. It is also expected to fold in crypto tax information exchange rules adopted by the OECD.

"In addition, DeCripto will capture information on the transfer of crypto assets from abroad to Brazil, and vice versa, of crypto assets referenced to assets, of the transfer of crypto assets to a decentralized finance platform and of the fractionation of NFTs."

The agency received 24 responses from the industry in response to a recent public consultation about a proposal to overhaul its existing rules. The comments from the public were received by email and not disclosed publicly.

The Receita also hosted a meeting with domestic and international companies last August to discuss crypto taxation and monitoring.

Blocknews Exame Portal do Bitcoin CriptoFacil Livecoins

Bitcoin contributes to record negative capital outflows in 2024

Brazil recorded negative capital outflows of US$87.2 billion for the year 2024. It’s the worst figure since the Central Bank began disclosing this information in 2008.

The result contributed to a deficit of US$18 billion in foreign exchange outflows. Bitcoin and cryptocurrencies were responsible for at least 20% of the country’s dollar outflows through financial channels.

The strength of the US dollar and Brazil’s deteriorating fiscal situation have prompted the outflows, despite attempts to increase interest rates. The benchmark Selic rate is now at 12.25% with more hikes promised this year.

Nicola Tingas, chief economist at AcreFi, told Folha de S. Paulo:

"The relative pressure in relation to the dollar has been worsening due to the external scenario, US interest rates, which are still at a very high historical level, and the joint perception that the US risk is better than the Brazilian one."

Cryptocurrencies and stablecoins offer an easy way to dollarize assets, which is the main reason why the Central Bank is looking to restrict their ability to be transferred outside of licensed brokerages.

Lula Administration lashes out at Meta for removing censorship controls

Meta CEO Mark Zuckerberg announced last week changes to content moderation policies on the company’s platforms, like Instagram, Facebook — aligning with the free speech ethos embraced by Elon Musk and Donald Trump.

The company will abandon the use of independent fact checkers and internal filters to prevent spreading of “harmful” content, and it will adopt a Community Notes type system similar to X.

In his announcement Zuckerberg indirectly referred to actions taken by the Lula government and Alexandre de Moraes against regime opponents, stating that in Latin America there are "“secret courts that can order companies to take down content silently.”

The Lula Administration did not react kindly to the news. Finance Minister Fernando Haddad said:

“Today we had an announcement from an important global communications organization, saying that it will remove fake news filters from its controls, adhering somewhat to the mentality that freedom of expression includes slander, lies, defamation, and everything else, something that concerns us.”

“We saw what happened in 2018 with Brazilian democracy in relation to fake news, we saw what happened after the 2022 election and the preparations not only for a coup d'état in Brazil, but for the murder of people.”

🗞Brazil Crypto News Rundown

📈 Markets

Avin Asset will launch a local multimarket to invest in a new fund called the Tarmac Income Fund that will execute crypto arbitrage strategies abroad. (Valor)

Coinbase’s managing director for the Americas Fabio Plein laid out his positive outlook for 2025, arguing that Brazil’s constructive regulatory developments and encouraging developments in the US are a strong setup for the year ahead. (Valor Investe)

Mercado Bitcoin begins 2025 as the 3rd largest private credit tokenizer in the world, with US$171 million in assets and US$88 million of that being active operations. The data comes from RWA.xyz. (BeinCrypto) (CoinTelegraph Brasil)

Brazilians invested a total of US$234 million in cryptocurrency funds in 2024, according to CoinShares. (CoinTelegraph Brasil)

Thales Freitas, Crypto.com’s new general manager for Brazil, is optimistic about crypto’s convergence with traditional finance in the country in 2025, drawing on the exchange’s success last year.

“Last year we traded US$1.3 trillion. That was the volume we did on Crypto.com globally, and in December alone it was US$324 billion. So all this movement of ETFs from the United States also helps. In Brazil, in real pairs, US$150 million are traded per day on all exchanges in Brazil. Crypto.com trades US$10 billion per day globally, so it's a very large magnitude.” (Exame)

📲 Adoption

Blocknews celebrated its five year anniversary covering crypto in Brazil on January 6 👏

Argentine tourists visiting Brazil are spending 15-20% less on their transactions by using crypto platforms with Pix integrations. (Livecoins)

Bybit has launched a physical debit card for customers in Brazil. The Mastercard-branded product provides cashback of up to 2%. (CriptoFacil)

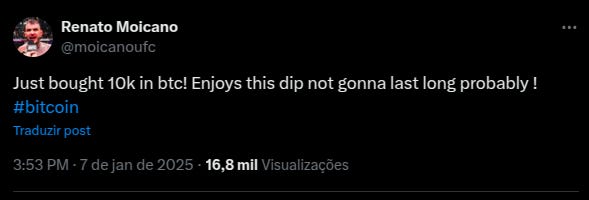

Brazilian MMA fighter Renato Moicano bought US$10k worth of bitcoin on last week’s dip. (Portal do Bitcoin)

Andre Portilho, head of digital assets at BTG Pactual, said that the bank sees blockchain as the “new infrastructure of the financial market”

“We continue to have this very strong vision, especially now, with things converging: regulation, institutional adoption, the United States moving forward, technology developing, Drex... So, things are at an inflection point.” (Exame)

An anonymous X profile claims to have tracked down the wallet of legendary Brazilian bitcoiner Daniel Fraga. Fraga’s whereabouts have been unknown since 2017. (CoinTelegraph Brasil)

🏛 Policy, Regulation and Enforcement

Brazil’s Treasury Department is now monitoring customers from 66 betting sites authorized to operate in the country starting January 1. Players must migrate from the old betting sites to new versions of the regulated platforms that end with the “bet.br” domain. In total, more than R$2 billion (US$327 million) in licensing fees was received by the government. (CoinTelegraph Brasil)

Two bills that would bring legal clarity to the Drex project are expected to progress in the Senate in February. (CoinTelegraph Brasil)

Gabriel Galipolo has assumed the role of President of Brazil’s Central Bank. In addition to him, other key appointees Nilton David, Gilneu Vivan and Izabela Correa will assume important roles with regards to cryptocurrency regulation and Drex implementation. (Blocknews)

A Brazilian investor has petitioned a US court for help in summoning Gisele Bundchen over her role promoting investments in FTX. The investor is seeking compensation of R$390 million, the amount he lost on the defunct exchange, but is having trouble locating the supermodel. (BeinCrypto) (Portal do Bitcoin)

The Receita Federal and Treasury Ministry established a working group to monitor online betting sites. (CoinTelegraph Brasil)

Former Febraban director Fabio Moraes has joined ABCripto as its research and education director. (CoinTelegraph Brasil)

A city councilman in Belo Horizonte has proposed a bill that would require the city accept cryptocurrencies for tax payments. (CoinTelegraph Brasil)