#184: More Brazilians hold crypto than stocks, Datafolha confirms

Plus: CVM overturns Mercado Bitcoin stop order; Nubank adds four new tokens

Olá pessoal!

Greetings from Buenos Aires and welcome back to 🇧🇷Brazil Crypto Report for the week of March 24-28, 2025.

It was great seeing everyone at the Merge Buenos Aires conference last week. The event was definitely one of the best crypto conferences in the region to date, and word on the street is that it will be in Brazil next year 👀

On a side note, I was very tempted to buy a last minute ticket to the Brazil vs Argentina match on Tuesday, but in hindsight I’m glad I didn’t 💀

Later in the week, my wife and I stopped by the Aleph Crecimiento Hub for the closing ceremony to their March Pop-Up City! I love the vision of Crecimiento to turn Argentina into the world’s first crypto nation!

We also paid a visit to the world famous Michelangelo Tango Show - an absolutely incredible experience!

Enough with the ChatGPT Ghibli images and onto this week’s news!

🔎 What’s in BCR this week?

More Brazilians hold crypto than stocks, Datafolha survey finds

CVM walks back stop order against Mercado Bitcoin

Lula representative says bitcoin strategic reserve is of “public interest”

Nubank adds 4 new cryptocurrencies

World suspends new registrations in Brazil after government denies appeal

Thanks for reading and have a great week!

- AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Binance is the largest platform for trading of digital assets. With over 250 million users around the world, the exchange offers over 350 trading pairs, best-in-class products and services for investors, and advanced tools for institutions players.

Binance currently holds over US$ 160 billion in user assets under custody and reached a cumulative historical trading volume of $100 trillion in 2024, showcasing the trust placed in it by users worldwide.

With user-focus at the core of its DNA, Binance continuously invests to increase usability, bring new features and deepen security.

Liquidity matters. Security is non-negotiable. Join Binance Now

🎙New Podcast!

This week’s episode is a little bit different. João Pedro Malar, host of Exame’s Future of Money podcast was kind enough to invite me on his show to share about my experience as a gringo in Brazil’s crypto community, and my why I decided to build out an English language newsletter and podcast devoted to Brazil’s crypto economy.

This interview is in Portuguese. I hope you enjoy!

🎧 You can find Brazil Crypto Report content wherever you listen to podcasts: Spotify | Apple Podcasts | Amazon | Anchor | YouTube

More Brazilians hold crypto than stocks, Datafolha survey finds

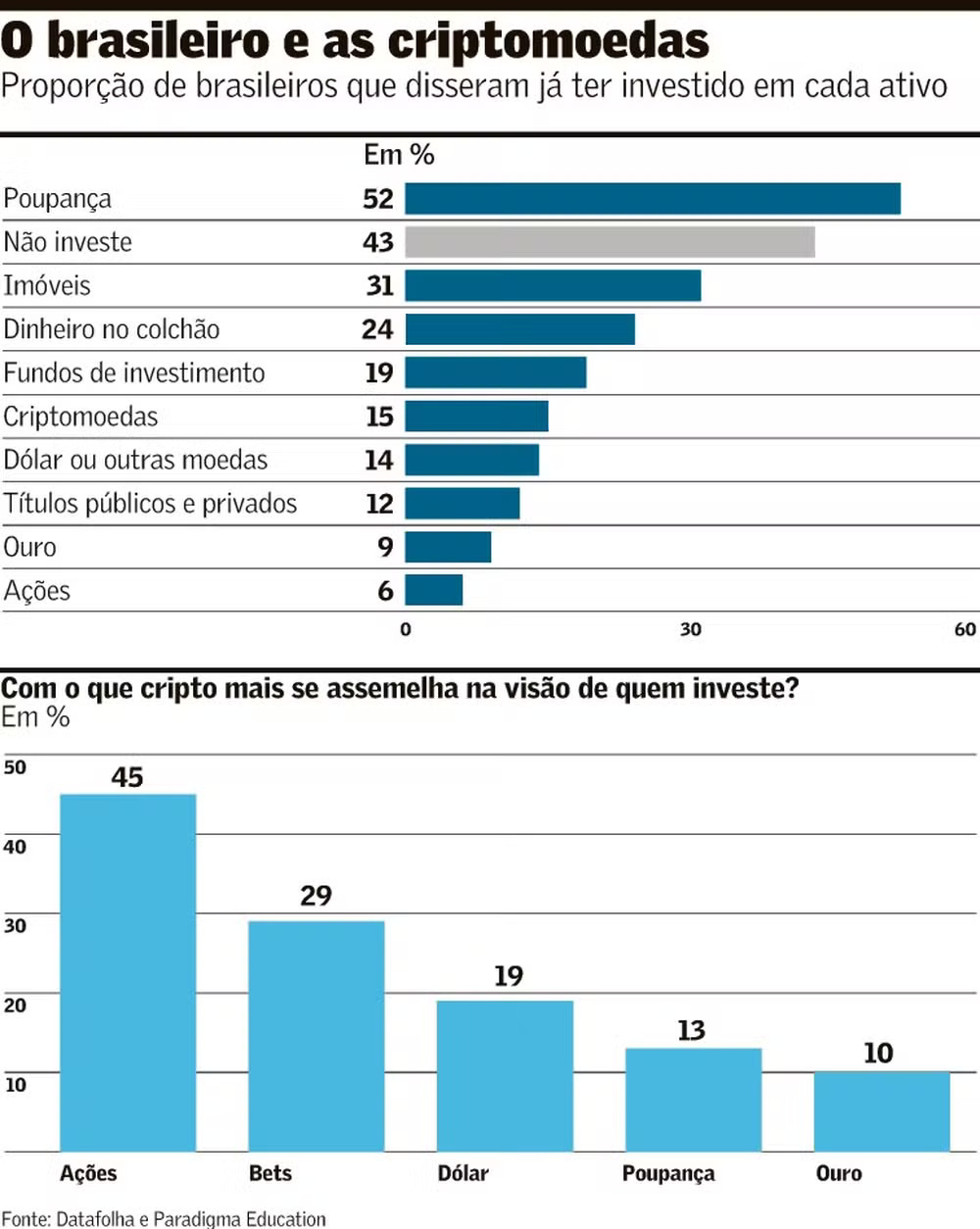

More Brazilians are currently investing in cryptocurrencies than in stocks, government bonds or US dollars, according to a new survey from Datafolha and Paradigma Education that was commissioned by Hashdex and Coinbase.

The survey found that 43% of Brazilians do not invest at all. But among those who do invest, the most popular products are savings accounts (52%), real estate (31%), physical cash (24%), investment funds (19%) and cryptocurrencies (15%).

Respondents were less inclined to invest in foreign currencies (14%), public and private bonds (12%), gold (9%) and stocks (6%). This data indicates that there are 2.5 times more crypto investors than investors in stocks.

Based on the sample size of 2,007 individuals, roughly 24 million people throughout the country have invested in crypto. 15 million have invested through banks, 6 million with exchanges, funds or ETFs, and 3 million through self-custody platforms.

The survey provided some interesting points about investors’ familiarity with specific crypto projects. 54% said that they had heard of bitcoin, and two-thirds of that group said that bitcoin was the only cryptocurrency they had heard of. The next most recognized coins were ether (9.2%), Drex (6%) and Dogecoin (4.4%).

Fabio Plein, regional director for the Americas at Coinbase, said that further efforts are required to better educate people about the nature of crypto investments:

“Although crypto is already one of the five most popular investments in Brazil, many still associate it only with savings accounts, overlooking other services [that generate returns] like staking.”

Paula Zogbi, head of analysis at Nomad, said that Brazilians’ overexposure to bitcoin’s volatility could be cause for concern. She told Valor:

“One of the most striking findings is that more Brazilians hold crypto than dollars. That’s a preference for exposure to an extremely volatile asset, often driven by news cycles, without a hedge in strong currency.”

Exame BlockNews BeinCrypto CoinTelegraph Brasil Livecoins BlockTrends

CVM walks back stop order against Mercado Bitcoin

The CVM, Brazil’s securities regulator, voted unanimously to overturn a decision ordering Mercado Bitcoin to suspend trading of 11 tokens backed by investment contracts that it had deemed to be securities.

The decision was made following an appeal by MB, which was reportedly taken by surprise over the initial stop order ruling as the exchange was in discussions with the regulator about which of the impacted assets might be securities.

Namely, the affected tokens were issued before April 2023, when the CVM published an interpretation letter encouraging token issuers to pursue crowdfunding under CVM Resolution 88 — published in 2022 — if they wish to publicly offer tokenized securities.

Valor reports that MB had been in communication with the CVM about why it believed the tokens were not securities, but never received a definitive response from the regulator.

MB said in a statement:

“We appealed the decision because we are convinced that we followed all the rules and commitments with the regulator and the best practices of transparency and diligence in the development and offering of these assets. We remain committed to the evolution of the market, the protection of investors and the work with regulators, as we have done for 12 years.”

The company added that the affected token offers will remain closed to the public and on the secondary market:

"Most of them have been inactive since 2022-2023 and there was no relevant volume of investors or trades. Even so, all the conditions related to the related to these 11 tokens will continue to be strictly complied with, without harm to investors."

In a Linkedin post, CEO Reinaldo Rabelo explained how MB has tried to build constructive dialogue with the CVM since 2019

“When we were notified of a stop order on the tokenization of receivables, we knew it was our duty to rebuild the bridge that had been lost in this connection between innovation and compliance with regulatory requirements.”

João Nascimento, partner at CSMV Advogados, told Valor that the incident highlights the complexities and gray areas of Brazil’s tokenization market.

“This complexity justifies ongoing dialogue between the market and the regulator to achieve greater regulatory clarity.”

Marcos Sader, a partner at I2A Advogados, said that requiring crypto exchanges and token issuers to register as securities brokers creates a lot of overhead, and that this may prompt these entities to seek another type of classification:

“There are additional costs with registration, intermediaries and compliance, in addition to reducing margins and increasing the need for care in the preparation and disclosure of information.”

Exame Portal do Bitcoin CriptoFacil BlockNews BeinCrypto CoinTelegraph Brasil

Lula representative says bitcoin strategic reserve is of “public interest”

Pedro Giocondo Guerra, chief of staff to VP Geraldo Alckmin, spoke about the bitcoin reserve topic during the inauguration of Federal Deputy Julio Lopes as the new president of the Parliamentary Front for Competitive Brazil.

In the first such remarks made by a representative of Brazil’s executive branch, he said that:

“Debating rigorously the creation of a sovereign reserve of Bitcoin value is in the public interest and will be crucial to our prosperity. After all, Bitcoin is digital gold, the gold of the internet. It is a technology that allows us to quickly transfer wealth from one end of the planet to the other and store the fruits of our labor efficiently and safely.”

Exame Portal do Bitcoin CoinTelegraph Brasil Livecoins

World suspends new registrations in Brazil after government denies appeal

Brazil’s National Data Protection Agency (ANPD) denied an appeal from Tools for Humanity, the company behind World, that sought to reverse the regulator’s stop order on paying out the WLD token to individuals who registered their identity with the platform using their biometric data.

In its denial of the appeal, the agency wrote:

“the solutions presented by the regulated company do not meet the ANPD's determination, since the financial consideration for the collection of sensitive personal data is still characterized".

"the change in the legal hypothesis of consent in the present case is not admissible, since the requirements for genuine circumstantial changes that would justify such an exceptionality are not met".

ANPD established a R$50,000 daily fine if the registration activity is resumed, due to:

"imminent risk of serious and difficult or impossible damage to the fundamental rights of the affected data subjects".

Exame CriptoFacil BlockNews CoinTelegraph Brasil Livecoins

Nubank adds 4 new cryptocurrencies

Nubank announced that it was adding four new cryptos to its digital asset offering. Cardano (ADA), Near Protocol (NEAR, Cosmos (ATOM) and Algorand (ALGO) will now be available through the fintech app.

The digital bank now offers 20 cryptocurrencies via its platform.

Thomaz Fortes, Nubank’s executive director of crypto, said in a statement:

“We want to offer a complete and safe experience for those who want to invest in crypto assets. Our goal is to meet customer demand for relevant and innovative tokens.”

CriptoFacil CoinTelegraph Brasil Livecoins BeinCrypto

🗞Brazil Crypto News Rundown

📈 Markets

Parfin has obtained the licenses necessary to operate as a virtual asset service provider in both Portugal and Argentina and is offering its crypto brokerage, custody and settlement platform to local companies and institutions in each region. CEO Marcos Viriato told Valor:

“Our focus has been very much on international payment infrastructure with stablecoins. The use of stablecoins to hedge against exchange rates in Argentina is still very strong, it is a very dollarized economy.”

BRLA Digital, issuer of the BRLA stablecoin, has established legal entities in both Argentina and the United States in anticipation of growing usage of stablecoins in cross-border payments. BRLA currently provides infrastructure for Pix payments by Brazilians in Argentina and vice versa. Co-founder Leandro Noel said:

“We have seen a lot of growth in flows between subsidiaries and headquarters. These are cases of treasury management: repatriation or financing of local operations. This is something we see growing.”

Brazil’s Central Bank intends to monitor cryptocurrency transactions that happen outside the purview of regulated exchanges - ie via self-hosted wallets or decentralized exchanges, it stated in its fiscal year 2024 report. The report states that the “BC is organizing the collection of new information on crypto assets, including transactions settled without exchange contracts.” (Portal do Bitcoin) (CoinTelegraph Brasil)

Liqi launched six new RWA tokens that promise returns above 18% per year. (CoinTelegraph Brasil)

📲 Adoption

Pedro Cerize, chairman of Porto Seguro’s board of directors, has resigned after losing a bet on X against Mises Capital. Last year, he bet that the Ibovespa would appreciate in value more than bitcoin in the two years to come. Bitcoin has increased 55% since the bet was made, while the Ibovespa is down 7.6%, resulting in trolling and online discussions that prompted Cerize to resign. (Valor)

Min Lin, chief business officer at Bitget, talked to Money Times about the exchange’s expanding presence in Latin America.

“There is enormous potential due to the size of the market. That is why, when we seek business growth, we like to focus on developing countries.”

Ripio says that real estate tokenization will be a key trend to watch in 2025 in Brazil and Latin America. (CoinTelegraph Brasil)

Stablecoin usage in Brazil now exceeds US$18 billion and is larger than the traditional tourism exchange market, Bitybank CFO Ibiaçu Caetano claimed on a webinar hosted by BlockNews. 3% of the volume is for arbitrage, 8% for investment and 89% for payments, he said.

"Basically, there are two major use cases for virtual assets: payments and investments. And you can see that investment, although relevant, does not represent as large a volume as payments. After all, it is through payments that the global economy operates. Therefore, stablecoins have much greater potential as a practical use case than investment itself.” (CoinTelegraph Brasil)

The town of Santo Antônio do Pinhal in Sao Paulo’s interior is seeking to become Brazil’s next bitcoin city. With 7,000 residents, it has 79 commercial establishments that accept bitcoin. (CoinTelegraph Brasil)

Former Central Bank president Roberto Campos Neto said he believes digital banks like Nubank will severely disrupt traditional banks. Speaking at an XP Private Bank event in Miami, he said:

“My biggest prediction is that traditional banks will be deeply shaken by digital platform banks. It is a process that is already happening and that will accelerate in the next two years.” (CoinTelegraph Brasil)

BlockTrends profiled the six individuals it believes to be the largest holders of bitcoin in Brazil

🏛 Policy, Regulation and Enforcement

Brazil’s Senate will hold a public hearing on legislation that would require crypto exchanges to segregate assets and mandate foreign exchanges to have a CNPJ before entering Brazil. (Exame) (CoinTelegraph Brasil)

More than half of Brazilians were the targets of attempted financial scams in 2024. (CoinTelegraph Brasil)

The Receita Federal, Brazil’s tax authority, insisted that it will never invade user privacy and ask for the hash or public wallet of anyone’s cryptocurrency wallet. During a webinar promoted by BlockNews, a representative stated:

"We will never, ever, ask for transaction hashes or public wallet addresses from any user.” (CoinTelegraph Brasil)

The Public Prosecutor’s Office of Sao Paulo accused a civil police officer and two businessmen of money laundering for the PCC (one of Brazil’s largest organized crime groups) using fintech platforms 2GO Bank and InvBank using cryptocurrencies. (Portal do Bitcoin)

Federal Police launched Operation Protected Content to dismantle a piracy website that accepted cryptocurrency payments for ads. (CoinTelegraph Brasil) (Livecoins)

Livecoins detailed some tax reporting changes that will impact crypto investors in Brazil

ABCripto has launched a new system that allows exchanges, tokenizers, and service providers to be 100% up to date with new tax reporting requirements from the Receita Federal. Tiago Severo, VP of Legal Affairs and Self-Regulation at ABCripto, said:

“The Program was structured within the scope of ABCripto's self-regulation pillar, with the objective that any market player, whether associated or not, can have a soft landing regarding the adequacy of new standards issued by the RFB.” (CoinTelegraph Brasil)

Senator Soraya Thronicke, rapporteur for the Senate special committee on online betting platforms, is calling for the creation of rules that would limit and reduce the amount of time that users can spend on gambling websites. (CoinTelegraph Brasil)

Federal Police launched Operation Libertatis 2 against a criminal group accused of using crypto for money laundering. Police arrested 21 individuals and seizing R$350 million in assets. (Livecoins) (BeinCrypto)