#190: B3 to launch ETH and SOL futures trading

Plus: Meliuz inches closer to becoming Brazil's MicroStrategy

Olá pessoal!

Welcome back to Brazil Crypto Report for the week of May 5-9, 2025.

It’s been nice to see a rally in crypto markets the last few days, and it was a very pleasant surprise to see Ethereum coming out of its five year slumber. Let’s hope that we’re setting up for a sustained upward push in the coming weeks. I’m personally a little skeptical after what we’ve seen since the Trump inauguration, but will great

Quick heads up that I’m going to be announcing a rebrand of BCR in the next week or two, so please be on the lookout for that!

🙌 Brazil Crypto Report now has a special Telegram group for readers! Feel free to jump in via this link and say hi.

🔎 What’s in BCR this week?

Central Bank unlikely to budge on stablecoin transfer prohibitions

B3 exchange to launch Ethereum and Solana futures

Government asks exchanges to freeze cryptos linked to INSS scandal

World inks sponsorship deal with Copa Sudamericana

Meliuz inches closer to formalizing bitcoin pivot

Thanks for reading and have a great week!

- AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

🎙New Podcast!

This week I soft-launched a new podcast series called Bits & Borders which is devoted to exploring frontier tech in frontier markets.

For our first episode, I talk to Infinita CEO Niklas Anzinger to learn about the innovations in governance happening at the Prospera Special Economic Zone on Roatan Island in Hondurance.

We talk about how poor governance and regulations have created “stranded technologies” and economic value that could be unlocked if given a better operating environment.

This is one of the most exciting experiments happening anywhere in the world right now in the realm of tech, innovation and governance. Definitely worth a listen!

🎧 You can find Brazil Crypto Report content wherever you listen to podcasts: Spotify | Apple Podcasts | Amazon | Anchor | YouTube

Central Bank unlikely to budge on stablecoin transfer prohibitions

The regulator is unlikely to reverse the controversial rules on stablecoin transfers it proposed late last year, according to lawyers close to the process.

Notably, the most controversial rule is a ban on transferring stablecoins from VASPs to self-custodied wallets. Another rule prevents Brazilian users from sending stablecoins to people outside the country.

This rule will have a significant impact on crypto exchanges operating in Brazil, argued Erik Oioli of VBSO Advogados. He told CoinTelegraph Brasil:

"For large exchanges, which already have a robust structure, the impact will be smaller. However, small brokerages and individual operators will face a higher barrier to entry.”

He emphasized that the bank’s ambition is to maintain control over foreign exchange transactions, crypto and otherwise. Hence the desire “to regulate the use of stablecoins so that they are not used as a way to send funds abroad informally."

The market pushed back heavily against this rule in Public Consultation #111, which concluded at the end of February, but these efforts are unlikely to influence the final rule, Aioli explained:

"The Central Bank will not give in on this point. Anyone who wants to remain in the market will need to accept this new reality. Brazil has always had a history of adapting to strict rules, and I believe that this time will be no different."

As discussed in BCR previously, other exchange operators in the country are sounding the alarm bells also.

Guilherme Sacamone, country manager for OKX in Brasil, told Exame that the proposed rules could create an “unsustainable” operating environment for crypto companies in Brazil.

"We need to have a regulatory framework that protects, but does not isolate, Brazilians.”

He argued that the self-custody ban:

“would generate a complete disruption in the cryptocurrency market in Brazil and could make it unsustainable for crypto companies to maintain operations in the country. That is why we are being so active in this regard. It is great to work with the Central Bank, and regulation requires careful approach, otherwise we can become isolated".

B3 exchange to launch Ethereum and Solana futures

Starting June 16, traders on Brazil’s main stock exchange will be able to trade Ethereum and Solana futures contracts, following approval from the CVM - Brazil’s securities regulator.

Both contracts will be quoted in US dollars and referenced by the Nasdaq Ether Reference Price Index and the Nasdaq Solana Reference Price Index, respectively.

The regulator also approved the exchange to reduce the size of its bitcoin futures contract offering, which was first launched last year, from 0.1 bitcoin to 0.01 bitcoin. Reducing the size of the contract has the effect of allowing more people to trade the asset, increase the liquidity of the product and reduce trading costs.

Marcos Skistymas, B3’s product director, said in a statement:

“B3 makes new cryptocurrency derivatives instruments available to meet the growing demand for products linked to crypto assets, bringing more innovation and sophistication to our products, in addition to offering more alternatives to investors familiar with blockchain technology against the price variation of digital assets, in a regulated and secure manner.

In related news, the B3 reported revenue of R$47 million from bitcoin futures trading during Q1, up 16.5% year-over-year. Trading volumes for the product were up 18% over the prior year period.

Valor Portal do Bitcoin BeinCrypto CoinTelegraph Brasil

Government asks exchanges to freeze cryptos linked to INSS scandal

A huge scandal involving the theft of billions of dollars worth of pension benefit payments retirees is rocking Brazil, and it appears that some of the actors involved used cryptocurrency to hide and launder stolen assets.

Jorge Messias, minister of the Attorney General’s office in Brasilia, said during a press conference:

“There is strong evidence that this criminal organization is using cryptocurrencies to divert assets from the fraud perpetrated against retirees and pensioners.”

He explained that his office will be contacting crypto brokerages to help locate, freeze and seize assets tied to the scandal:

“There is a strategy to conceal assets outside Brazil, as we have heard in intelligence reports. We are adopting a request to issue an official letter to cryptocurrency brokers with the aim of locating and seizing existing values.”

World inks sponsorship deal with Copa Sudamericana

World, co-founded by Sam Altman, will make its famous Orb iris scanners available during more than 50 Copa Sudamerica tournament matches as part of a sponsorship deal with Conmebol (South American Football Confederation).

The strategy is to verify the identity of fans who agree to register in exchange for certain benefits and exclusive experiences.

However, fans will not be paid out with the WLD cryptocurrency, as this has become the source of a legal dispute with the Brazilian governmen.

The sponsorship deal is valid for this year’s tournament and the 2026 edition as well.

Campos Neto to join Nubank as Vice Chairman

Former Central Bank president Roberto Campos Neto will join Nu Holdings, effective July 1, as Vice Chairman and Global Head of Public Policy.

Nu Holdings is the parent company of Nubank.

The announcement comes as Nubank looks to expand its digital banking product to new markets in the region.

CEO David Velez said that Campos Neto “has been one of the world's leading thinkers on how to use technology to advance local financial systems through systems such as PIX and Open Finance” and that he will be a “valuable strategic leader for the continued growth of our portfolio and operations in Latin America and future geographies”.

BlockNews BlockTrends BeinCrypto CoinTelegraph Brasil

Haddad: Drex will not create new taxes or surveillance

In response to questions from a federal deputy, Finance Minister Fernando Haddad explained that Drex will not create new taxes or change way that the government monitors the tax obligations and financial transactions of citizens and companies.

The letter, prepared by a tax auditor within the agency, explained:

“Just as there is no taxable event for the use of cash, there is also no taxable event specifically related to payment through Drex.”

“the use of Drex does not change the scope of the actions carried out by the Special Secretariat of the Federal Revenue of Brazil (RFB) to verify compliance with tax obligations.”

Portal do Bitcoin Exame CoinTelegraph Brasil Livecoins

Meliuz inches closer to formalizing bitcoin strategy

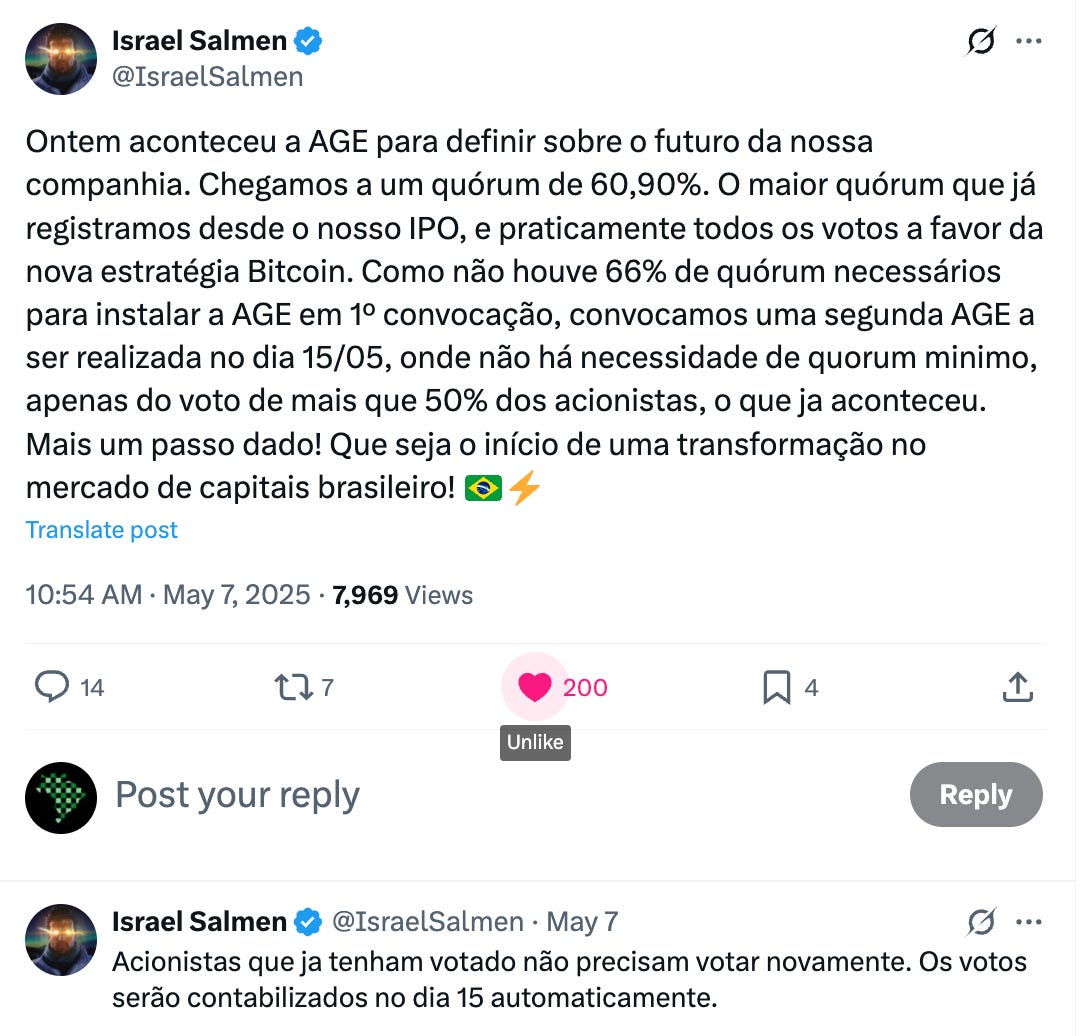

The e-commerce company held a special shareholder meeting last week to vote on a proposal to pivot Meliuz’s mission to bitcoin accumulation — which would effectively make the company Brazil’s version of MicroStrategy (now known as just “Strategy").

The proposal received 60.9% of the vote, the highest vote recorded since the company went public. However, since the minimum quorum required for approval was 66%, the company will call a second shareholder meeting on May 15 to approve the proposal with a 50% majority vote.

This means that a week from now, Meliuz will almost certainly be the Brazilian MicroStrategy. Meliuz shares are up more than 120% since announcing its intent to be a bitcoin company.

BeinCrypto BlockTrends CoinTelegraph Brasil Livecoins

🗞Brazil Crypto News Rundown

📈 Markets

The XRP cryptocurrency has struggled in price since the world’s first XRP ETF was launched on the B3 exchange last month. (BeinCrypto)

Bybit announced Israel Buzaym as its new Brazil country manager. (CoinTelegraph Brasil)

Brazilian DeFi platform PicNic and GnosisPay launched a Visa debit card product complete with self-custody, competitive transfer rates and cashback of up to 5%. (CoinTelegraph Brasil)

📲 Adoption

Caixa Economica Federal signed a contract with GoLedger, which specializes in Hyperledger blockchain solutions, to create a blockchain innovation laboratory. (CoinTelegraph Brasil) (Portal do Bitcoin)

Brazil’s Central Bank announced new rules related to automatic Pix payments. (CoinTelegraph Brasil)

Alex Netto represented Blockful at the Stanford Blockchain Governance Summit discussing the company’s governance security solution. (CoinTelegraph Brasil)

A city council vote on whether to make the city of Belo Horizonte a symbolic “Bitcoin "Capital” passed its initial plenary but not before escalating into heated insults and partisan bickering. (CoinTelegraph Brasil) (Livecoins) (BlockNews)

🏛 Policy, Regulation and Enforcement

The CVM issued a warning to the market forex and crypto brokerage activity being carried out by CFI Financial, an entity previously promoted by Formula 1 driver Lewis Hamilton. The entities have been banned from offering securities trading to Brazilian investors. (Portal do Bitcoin) (Livecoins) (BeinCrypto)