#195: Brazil's Crypto Tax 💩 Show

Plus: Drex pilot will have 3rd phase, Central Bank announces

Olá pessoal!

Welcome back to Brazil Crypto Report for the week of June 9-13, 2025.

I had the chance to attend my first-ever Febraban Tech conference in Sao Paulo this past week with the Foxbit team. It was a great chance to see how the digital assets and tokenization are fitting into the Tradfi universe

Meanwhile, crypto was blindsided last week by a new tax proposal from the Ministry of Finance. This has the potential to be very problematic for the industry if it is ultimately implemented.

TLDR is that politicians and bureaucrats in Brasilia are starting to notice the financial flows associated with crypto assets and want their cut. Read on for details below.

🔎 What’s in BCR this week?

Roberto Campos Neto has harsh words for governments, fiat currencies

Crypto industry blindsided by new tax proposals

Drex pilot will have 3rd phase focused on tokenization and credit

Braza Group and Conduit launch stablecoins for FX partnership

Strategic Bitcoin Reserve bill advances in Congress

Thanks for reading and have a great week!

- AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Avenia is the programmable financial infrastructure for Latin America. Connect to local payment rails like PIX, SPEI and CBU — using stablecoins as settlement — and unlock real-time, cross-border payments without banks, FX desks, or SWIFT.

Whether you're building a wallet, a crypto card, or a global treasury solution, Avenia gives you the APIs and compliance-ready infrastructure to scale in LatAm. Move money between BRL, USD, MXN and more — fast, transparent, and fully on-chain.

🎙️New Podcast!

This week’s interview is with Lucas Nuzzi, who is a Brazilian-born data scientist and blockchain analytics guru. In November 2022, his on-chain research into the co-mingling of funds between FTX and Alameda Research provided a full picture of the extent of the fraud inside Sam Bankman Fried’s empire.

He tells the story of how he was able to confirm that FTX had been lending customer deposit funds to Alameda in the form of an “infinite line of credit” dating back to the launch of the companies in 2019.

🙌 Friendly reminder that you can listen to BCR on your favorite podcast platform YouTube | Spotify | Apple Podcasts

Crypto industry blindsided by new tax proposals

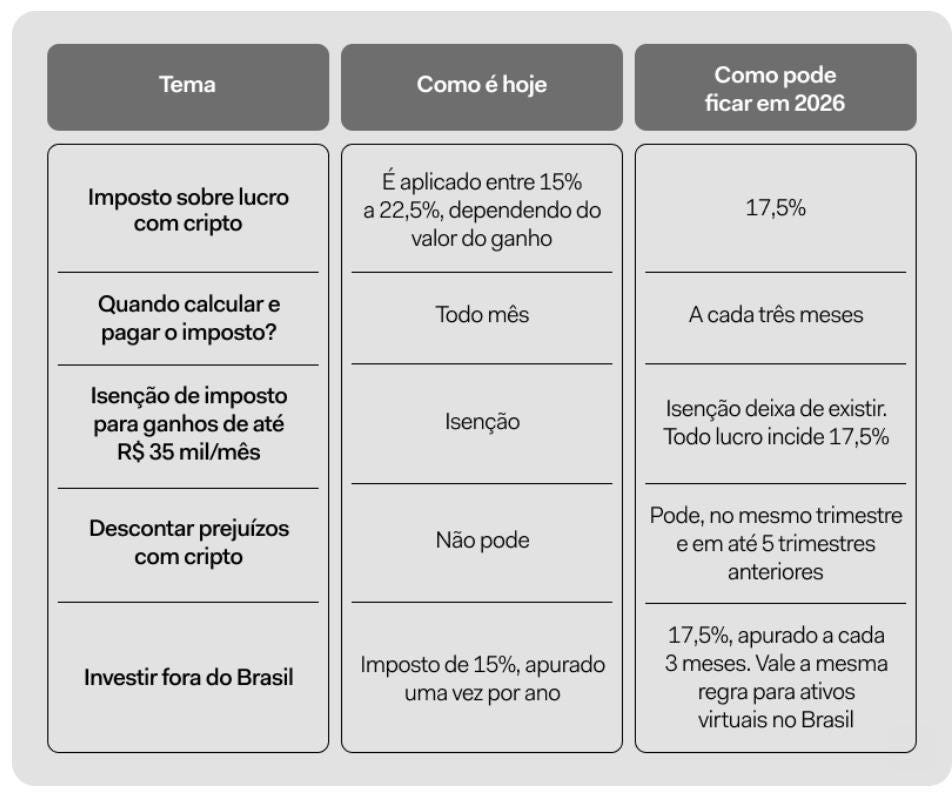

The industry was taken by surprise this week after Brazil’s Finance Ministry released a provisional measure overhauling crypto income tax rules.

The new rules seek to compensate for the loss of revenues from the rollback of certain parts of a new IOF tax rules earlier this month

The measure seeks standardize crypto capital gains tax rates between domestic and offshore exchanges at 17.5% (offshore exchanges currently incur less than domestic).

Most importantly, the current monthly exemption of R$35,000 would be done away with, meaning every crypto trade that involves an increase or decrease in value be a taxable event. Currently, if a user trades less than R$35,000 in volume in a month, any gains incurred are exempt from capital gains taxes.

Another feature of the provisional measure is a withholding rule that would require exchanges to withhold 17.5% of a customer’s yield that is generated through staking, lending or other activities. Such a rule ultimately treats national and international platform users unequally.

Bernardo Srur, CEO of ABCripto, told Valor that the proposal would be extremely negative and could even kill the national crypto market altogether, arguing that it will harm small investors in addition to putting local industry at a disadvantage.

“It is taking away from those who have less money, who trade less than R$35,000, while reducing the tax rate to 17.5% for large investors, who paid 22.5%. The average Brazilian crypto investment is low, under R$1,000. These are the people who will be harmed.”

“The provisional measure is, in fact, a step backwards, completely and completely out of line with the current process. It could destroy the national cryptocurrency market.”

Srur also pointed out another unfairness to retail investors: the new tax would not impact investors who have exposure to crypto ETFs.

Additionally, the 17.5% tax applies across the board to all types of crypto assets, whether it be bitcoin, an NFT or any other type of token. However, for tokens representing other types of financial instruments, the tax treatment related to the underlying asset will be applied.

Yet another tax increase, this time in the CSLL - known as Social Contribution on Net Income - is being proposed and would potentially impact VASPs. The tax is currently between 9%-15% and is paid by fintechs that are not classified as financial institutions. It would increase to 20% under the new proposal.

Industry spokespersons argue that the result of these new taxes would be a flight to more decentralized and “grey area” platforms to trade and custody crypto assets.

Guilherme Peloso Araujo of Carvalho Borges Araujo Advogados said in a statement that the proposal is:

“yet another clear proof of the chronic disregard for legal certainty in Brazil; furthermore, the change in the recent taxation regime abroad shows that the reliability of the changes proposed by the current Brazilian government is low.”

Thiago Barbosa Wanderley of Salles Nogueira Advogados said that the new quarterly reporting requirements create a massive burden for investors:

“If it becomes law, MP 1303/15 has the potential to absolutely crush the crypto market. In addition to the fact that the calculation of profits and losses is quite difficult to reconcile with data from several exchanges, requiring individuals to carry out this calculation quarterly is unimaginable.”

Rocelo Lopes, CEO of SmartPay said that the proposal prevents local industry from competing with larger, better financed international brokers that operate in more stable markets.

“With a disproportionate tax burden, investors will look for platforms abroad, outside the reach of national regulations — and this is dangerous for the user and terrible for the development of the local industry. Brazil has already lost many technological opportunities. We cannot repeat this mistake with the crypto economy.”

Representatives from crypto industry players and trade groups rallied in Brasilia this week with the Free Market Parliamentary Front, a group of deputies who support free market solutions.

It’s important to note that the changes outlined in this provisional measure MUST be approved by Congress within 120 days. If approved within that period, the new rules will go into effect at the beginning of 2026.

Srur of ABCripto concluded that there is optimism that the rules will not be approved by Congress:

“Of course, the market expects that the provisional measure may be overturned, but we are working on the best-case scenario, which is one of pacification. We see a very turbulent time.”

Indeed, Deputy Gustavo Gayer submitted a decree to annul the provisional measure, claiming that document exceeds powers granted to the executive branch and violates fundamental principles of the Brazilian tax system. The decree states:

“The imposition of taxes on crypto assets and the creation of new tax obligations without due legislative discussion, without a broad technical debate and without the participation of the affected parties, compromises the predictability and transparency of the tax system.”

Folha de S. Paulo reports that congressional leaders have indicated that the measure will not be approved unless other conditions are met by the Lula government.

👀 I will be publishing an in-depth podcast interview with crypto tax law expert Daniel de Paiva Gomes on this subject early next week so stay tuned

Valor Exame Portal do Bitcoin InfoMoney Valor Investe Portal do Bitcoin Valor Livecoins

Drex pilot will have 3rd phase focused on tokenization and credit

Brazil’s Central Bank revealed that it will launch a third phase of the Drex pilot project focusing on the creation of tokenized collateral solutions that can help increase access to credit at lower rates.

Rogerio Lucca, executive secretary of the bank, said at Febraban Tech that specifics of the phase will be announced later this year once the second phase concludes.

“The customer must have ease of use and a sense of security to ensure that the national financial system develops services and solves problems such as high indebtedness in poor quality credit.”

He explained that the idea is for customers to consent giving greater visibility to financial institutions regarding the assets they own, like CDBs, real estate and vehicles. This would enable banks to better assess the customer’s risk profile and offer more competitive credit products.

Lucca emphasized that this initiative is a part of broader efforts within the bank to reduce the cost of credit, pointing out that five of the 13 use cases being tested in the second phase of the Drex pilot deal with tokenized assets as credit collateral.

Bank president Gabriel Galipolo emphasized during his Febraban Tech address that Drex is not, in fact, a CBDC in the traditional sense of the term, but rather an infrastructure play focused on bringing efficiency to credit and access to financial products using blockchain. He said:

“The more we advance in reducing the perception of risk of those who are granting credit, the better for the economy.”

Valor Valor CriptoFacil Livecoins BeinCrypto

Braza Group and Conduit launch stablecoins for FX partnership

The partnership aims to allow Conduit customers to make transfers from BRL to USD while settling on blockchain via stablecoins.

When a customer uses the platform to make a payment in dollars from Brazil, Braza will issue a BBRL stablecoin (pegged to BRL) which can then be exchanged for as USD-backed stablecoin.

In this case, the fiat BRL currency does not actually leave the country; rather, they remain in Braza’s reserves. Conduit co-founder Andre Masse told Valor:

“You send dollars to Ripple, for example, which mints [issues new tokens on the blockchain] RLUSD, it converts them to BBRL in minutes and the money remains in the country.”

Braza Group CEO Marcelo Sacomori predicted that in five years’ time there will be no such thing as exchanges that do not involve stablecoins in some form:

“I can't find any disadvantages in crypto. You have true ownership of an asset.”

Strategic bitcoin reserve bill advances in Congress

A strategic bitcoin reserve bill received a favorable opinion from Deputy Luiz Gastao, rapporteur for the Economic Development Committee. He said:

“despite its recognized volatility, Bitcoin may represent a strategic opportunity for the Union's assets, including in terms of the composition of international reserves.”

The next step is that the bill, authored by Deputy Eros Biondini, will be voted on by the full committee and then several other committees before advancing to a full plenary vote.

Portal do Bitcoin CriptoFacil BlockNews CoinTelegraph Brasil

Campos Neto has harsh words for governments, fiat currencies

Speaking during a “Presidential Conversations” episode, promoted by Brazil’s Central Bank, former bank president Roberto Campos Neto had sharp words for how governments and central banks around the world have failed to be accountable to their constituents.

“Governments, over the last few years, have treated currencies badly, globally speaking. There has been a lot of debt issuance and very little accountability to those who hold the currency, to the citizen. Governments have sought easy ways out, of various types, which in the end have cost the currencies their credibility.”

This lack of accountability, when taken in the context of the rise of crypto, isn’t surprising in his view:

“This movement towards digital currencies is no coincidence.”

He referred to bitcoin as “digital gold” and articulated that he sees central banks adopting cryptocurrencies eventually, and that what is happening in the US currently is an indicator of this trend.

“Policies that bring stablecoins closer to prepaid cards or more robust ways of monetizing digital assets will be part of banks’ strategy in the future,”

CoinTelegraph Brasil Livecoins

🗞Brazil Crypto News Rundown

📈 Markets

Meliuz announced that it had raised US$32.4 million to acquire bitcoin. (CoinDesk) (BlockTrends)

Matera is partnering with Circle to use USDC on its Digital Twin platform, which is responsible for managing balances and statements in real time for bank and fintech end users. The integration will make it possible to transfer between BRL and USDC using the bank’s interface for use in payments and investments abroad. CEO Carlos Netto told Valor:

“In the context of this initiative, Digital Twin will be expanded to also manage balances in USDC, allowing the simultaneous viewing of balances in reais and USDC in the banks' digital interfaces.” (CriptoFacil) (BlockNews) (BeinCrypto) (CoinTelegraph Brasil)

Solana and ether futures will debut on the B3 exchange on Monday, June 16. Additionally, the exchange said it plans to launch crypto options products in the 4th quarter of this year. Felipe Goncalves, B3’s product superintendent, explained:

“We are considering whether we will launch only bitcoin options or bitcoin, ether and solana. They will be options on ETFs [exchange-traded funds] and on futures.” (Valor)

QR Capital co-founder Joao Paulo Mayall is leaving the company amid a planned transition. The holding company controls QR Asset Management, Vortx QR Tokenizadora and content platform BlockTrends. He told Livecoins

“The exit reflects the maturation of the crypto sector and its integration into the financial market. QR Capital is prepared for a new cycle of growth.”

📲 Adoption

Serasa Experian has created a Hyperledger Besu-based blockchain wallet for authentication use in e-commerce and financial services. Marcelo Queiroz, authentication and fraud prevention executive at Serasa explained that blockchain simultaneously provides the security, interoperability and guarantee of traceability for the solution. He told Valor:

“How do I know if the credential was used or not? If it was authorized or not? All of this is registered in the blockchain” (CoinTelegraph Brasil)

Nubank told customers that it will not increase fees charged on crypto transactions after readjusting them in light of the recent IOF tax changes. The fees will return to what they were before the IOF increase. The company said in an email to users:

“We decided to absorb this cost in order to offer you the best possible experience, and we have reduced the fees to the values they had before the IOF increase.” (Portal do Bitcoin)

Brazil ranks third globally in terms of number of users of Avalanche’s new card product, which was launched in February and allows users to pay in USDC, USDT and AVAX. Leandro Davo, an Argentine lawyer who leads Avalanche’s Latam ecosystem efforts, told Portal do Bitcoin:

“Brazil is very well positioned in terms of adoption. The number of users of our card was extremely positive and surpassed Argentina, which was a surprise.” (Portal do Bitcoin)

Dinamo Networks launched a new hardware security module with post-quantum encryption to protect traditional and digital financial applications. (Exame)

Nuclea announced that it will launch a tokenized receivables in the third quarter of this year. (BeinCrypto)

Trexx officially launched its Trexx Club platform aimed at digital engagement between fans and e-sports teams via a partnership with Imperial E-Sports. (BlockNews)

Pix 2.0 will feature four new features, including automatic payments, greater security, contactless payments, and guarantess for Pix funds to be used as collateral. (CoinTelegraph Brasil)

The first atomic transaction on the Drex network was conducted on Polkadot using the Moonbeam network. (CoinTelegraph Brasil)

🏛 Policy, Regulation and Enforcement

A new bill would require cryptocurrency miners to obtain a “Digital Miner Authorization License” within 90 days after starting activities. It would also require professional crypto traders to obtain a “Cryptocurrency Speculation Authorization License” — which would require a higher education degree and a clean criminal record. (Portal do Bitcoin) (Livecoins)

Military Police in Parana seized R$250,000 in bitcoin mining machines in Santa Tereza do Oeste in a suspected smuggling operation. (Portal do Bitcoin) (Livecoins)

Federal Police launched Operation Luxus in Parana against a crypto pyramid scheme that stole R$50 million from 400 investors. (Portal do Bitcoin) (CriptoFacil)