#202: Surprise! Drex Ditches Blockchain at Blockchain Rio

Plus: Brazil's Congress to hold hearing on Bitcoin Strategic Reserve legislation

Olá pessoal!

Welcome back to Brazil Crypto Report for the week of August 4-8, 2025.

It was great seeing everyone at Blockchain Rio this past week. I was privileged to host the Bridge Stage which featured predominantly English language content. Below is a pic of one (of many) stablecoin panel I moderated featuring Solana Foundation, Truther, RedotPay and Aeon

I really feel like this event helped put Latin America at the center of the crypto world in the second half of 2025. Big congratulations to Francisco Carvalho and the organizing team!

Central Bank President Gabriel Galipolo kicked off the event discussing the importance of blockchain in the bank’s innovation agenda was huge.

The conference concluded with the bank announcing that it is no longer using blockchain as part of the Drex project - which we’ll explore in depth below.

👊 Jump into the BCR English language Telegram group if you’d like to continue the conversation

📰 Top Stories this Week

Drex Ditches Blockchain (for now)

Galipolo Refines Vision for Drex in Blockchain Rio Keynote

Brazil’s Congress to hold hearing on Bitcoin Strategic Reserve bill

CVM to use DLT for central securities depository

Thanks for reading and have a great week!

- AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Avenia is the programmable financial infrastructure for Latin America. Connect to local payment rails like PIX, SPEI and CBU — using stablecoins as settlement — and unlock real-time, cross-border payments without banks, FX desks, or SWIFT.

Whether you're building a wallet, a crypto card, or a global treasury solution, Avenia gives you the APIs and compliance-ready infrastructure to scale in LatAm. Move money between BRL, USD, MXN and more — fast, transparent, and fully on-chain.

P2P.me is the fastest way to buy and sell crypto in Brazil using Pix: direct, secure, and fully onchain.

Backed by Multicoin and Coinbase Ventures, P2P.me offers a compliant on and off ramp with, ZK-KYC, and no hidden fees.

You can easily use P2P.me to pay PIX QR codes in Brazil using your USDc balance. Topup, scan and pay.

Visit br.p2p.me to get started and earn $50 per operation limit.

🎙️New Podcasts!

This week I’m joined by Botanix co-founder and COO Alisia Painter. We talk about how Alisia’s three years spent living in Brazil in the mid-2010s exposed her to bitcoin as both a hedge against currency devaluation and also a simple way to remit funds back home.

Alisia is laser focused on making bitcoin usable for emerging market countries like Brazil, and that is what she’s built with Botanix — a Layer 2 blockchain on bitcoin that enables financial products on bitcoin via EVM compatibility and smart contract programmability.

Drex Ditches Blockchain (for now)

The shocker of the week was the news that Drex will discontinue its use of blockchain/distributed ledger technology (DLT) for the third phase of its pilot. The goal is now to deliver the solution in 2026 in a reduced, non-tokenized version.

Fabio Araujo, Drex coordinator at the Central Bank, told Valor that the project will now be divided into two timeframes. The first stage is to launch the project without using a decentralized network with a focus on freeing up collateral by means of reconciling of liens for credit guarantees.

"I have an asset; it belongs to me, but I used it as collateral for a transaction. This is difficult to do today, because I usually have an asset registered with an exchange, and now I'm going to take out a loan from a bank.”

Araujo noted that this is one of the original ideas expected to be built out via Drex, but it was abandoned due to technical and timing challenges. The well-documented privacy challenges also remain a major roadblock. Araujo explained:

"We found good privacy solutions, but apparently they're not enough. We need to put this to the test.”

The second timeframe of Drex will be to continue exploring decentralized technologies as they develop and potentially integrating them for more complex use cases.

In his opening keynote at Blockchain Rio, Central Bank president Gabriel Galipolo reinforced the point that the bank had stopped defining Drex as a distributed ledger technology (DLT) infrastructure:

"Why am I not talking about DLT? Because we are increasingly gaining clarity and moving toward the idea that technology has to be agnostic. We want to solve a problem. What is the problem we need to solve? And what is the available and most suitable technology to solve this problem?"

Before going on stage but with a hot mic, he was even overheard joking with his advisors that he “couldn’t talk about DLT anymore”.

Industry response is mixed

The response from the industry was tempered, as many had been quietly expecting some sort of change to be announced — such as a potential move away from Hyperledger Besu. While the move to dump blockchain wasn’t a massive surprise, it does feel a bit like a rug pull given the extensive investments companies had to make to participate in the pilot.

Regina Pedrosa, executive director of ABToken, told BlockNews:

"I view the news with concern and surprise, as it is now unclear exactly what the infrastructure investments of the pilot companies will be like. I hope it can be reconsidered soon, and perhaps a new network will serve as a foundation, already considering the pillars of privacy, interoperability, and standardization.”

Andre Carneiro, CEO of BBChain, also told BlockNews that it doesn’t mean much practical change at all for him, and that the bank’s decision:

"only impacts the settlement leg. The organization market continues as normal and goes far beyond settlement. Market participants will be able to issue, transact, and integrate their tokens across platforms. And they will settle in the format determined by the Central Bank."

Marcos Sarres, CEO of GoLedger, told Exame that the Hyperledger Besu platform did not meet the privacy requirements for the Drex project, and that alternatives like Hyperledger Fabric — which processes 200,000+ transactions per second and has built-in privacy would perhaps fare better.

"The issue isn't Hyperledger; it's a client that was chosen, called Besu. I believe DLT should return, especially because those of us who work with blockchain know, and this is my opinion as an expert in the field, that Besu technology isn't ideal for what was being sought. There are technologies that are already built into the core; you don't need to develop, customize, or provide privacy or scalability.”

Andre Portilho, head of digital assets at BTG Pactual, argued that the decision to drop blockchain was “correct” and “strategic” given the circumstances:

"The first thing that's important to understand is that, given the Central Bank's requirements for Drex and the chosen technology, it wasn't possible to arrive at a solution that simultaneously delivered privacy, scalability, and programmability with some level of decentralization.”

Foxbit CEO João Canhada noted that tokenization will continue in the Brazil market with or without Drex:

“The current tokenization market isn't anchored in what Drex will be able to deliver in the future. It will adapt when Drex is willing. But it's advancing despite Drex. It's completely the opposite. Nothing changes. We're here, we're going to work, we're going to make it happen.”

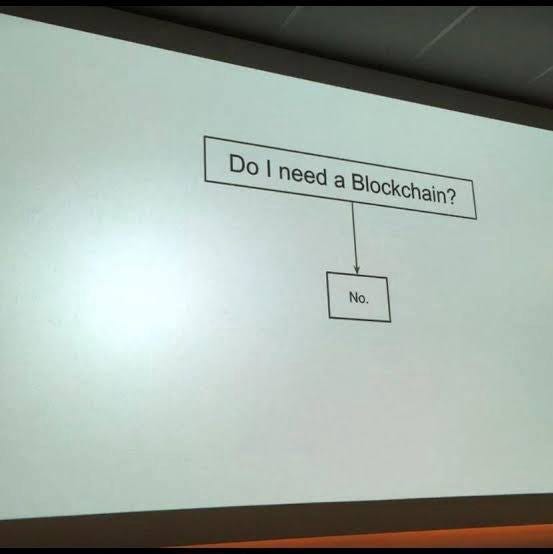

With this development, it’s a good time to brush off one of my favorite memes from 2017

Valor Exame BlockNews Valor CoinTelegraph Brasil

Galipolo Refines Vision for Drex in Blockchain Rio Keynote

New Central Bank president Gabriel Galipolo gave the opening presentation at Blockchain Rio, where he re-emphasized that Drex is a financial infrastructure project and not a central bank digital currency in the general understanding of the term:

"When we talk about Drex, we're not exactly talking about what a classic CBDC is in the literature. With a CBDC, you ultimately break with a logic that's present in economic theory and will begin to transform these deposits that people hold in CBDCs into liabilities.”

He looped in the philosophical question of whether money should be ultimately by the central monetary authority or commercial banks. Modern consensus is that commercial banks are ultimately responsible for deciding how much money to inject into the economy via the fractional reserve banking system, while the monetary authority’s role is to either stimulate or inhibit that activity by controlling interest rates.

The concept of a CBDC represents a directional turn from that consensus, he noted:

“CBDC messes with this a bit, because it's the idea of a currency truly issued by the central bank. You kind of shorten the path between the money arriving, which until now is handled by banks, and the central bank. In the case of Drex, it doesn't exactly configure this; it comes much closer.”

Further, he noted that Drex didn’t need to take on the characteristics of a more textbook CBDC because innovations like Pix already exist: “Solutions like Pix solve many of the problems faced by various CBDCs.”

Rather, Drex - he emphasized - should be thought of as part of a broader system focused on asset tokenization and not a replacement for cash or Pix. Instead, the goal of Drex is to enable the transformation of assets into tokens to better facilitate the flow of credit — which remains quite costly and inefficient in the country.

"Drex is increasingly a solution, regardless of the technology used, that aims to facilitate asset collateralization for credit and transactions with less friction through the tokenization of smart contract assets.”

Galipolo also emphasized that he now sees stablecoin usage advancing primarily as a means of payment rather than a money market play, due to the fact that the Genius Act prohibits paying interest directly on these assets.

Brazil’s Congress to hold hearing on Bitcoin Strategic Reserve bill

The hearing will discuss proposed legislation to create a national strategic reserve of the cryptocurrency, including potential rules for custody, purchase and sale.

The proposal is contained in bill 4.501/2024 and intends to use bitcoin as a means of diversifying up to 5% of the country’s assets. Author Deputy Eros Biondini argues that bitcoin is a viable alternative to high inflation, currency devaluation and distrust in traditional financial assets.

The hearing will be held by the Economic Development Committee in the Chamber of Deputies at 4:00pm. It will be both open to the public and live-streamed.

Diego Kolling, head of bitcoin strategy at Meliuz, Febraban chief economist Rubens Sardenberg, and Pedro Henrique Giocondo Guerra of the Ministry of Development have confirmed their attendance as participants.

BlockNews Portal do Bitcoin Valor CoinTelegraph Brasil

CVM to use DLT for central securities depository

Brazil’s securities regulator revealed that it intends to decentralize the central securities depository via the use of distributed ledger technology.

This would allow the B3 exchange, for example, to choose whether to maintain its current system or migrate entirely to the blockchain. Raphael Acácio, the CVM’s Standards and Developments Manager, said at Blockchain Rio:

“They will be able to choose the system under which they wish to operate. The central depository continues to exist because it is provided for by law, but now they will have two possible operating models. Thus, those currently operating as depositaries under the traditional model will be able to migrate to the blockchain, within this new structure.”

🗞Brazil Crypto News Rundown

📈 Markets

Brazil is one of the markets with the greatest opportunity for crypto self-custody, Ledger executive Michael Lado argued at Blockchain Rio. The company also announced that is now possible to buy crypto via Pix using Ledger Live. (Valor) (CoinTelegraph Brasil)

“Every fintech will become a crypto company” because of stablecoin integration with traditional finance, BTG Pactual’s head of digital assets Andre Portilho argued during a panel at Blockchain Rio. (Exame)

BB Asset, the asset manager of Banco do Brasil, launched a new fund called BB Multimercado Bitcoin that invests in bitcoin via ETFs. The estimated fundraising is R$50 million for the first year, it said in a statement. Fabricio Reis, commercial and product director for the fund, said:

"The new fund provides an efficient and regulated way to access the cryptoasset market, expanding the allocation options for the world's leading digital asset.” (Valor)

Fireblocks CEO Michael Shaulov identified three major opportunities in the Brazil crypto market. Speaking at the Blockchain Rio opening event, he said they are 1) mass adoption by retail, 2) being the first player to obtain a regulatory license, and 3) Brazil’s position as an infrastructure hub for cross-border payments with stablecoins. (CoinTelegraph Brasil)

Circulation of Brazilian real-pegged stablecoins reached R$70 million in June, according to a new survey by Iporanga Ventures. This figure is 70% higher than the same period in 2024, with much of the growth coming in the form of B2B payment infrastructure. In total, real-pegged stables moved a total of R$5 billion in 2024. According to partner Renato Valente:

"It's for remittances more than a store of value. In the creator economy, there are many creators who do things in Brazil, but their customers are abroad. Thus, the money leaves Pix and enters a stablecoin to reach the other side, which smooths the transaction.” (Valor) (CoinTelegraph Brasil)

BitPanda CEO Lukas Enzersdorfer-Konrad spoke with BeinCrypto about the exchange’s international expansion plans and a potential public offering.

Brazilian stablecoin payments startup and YCombinator participant BlindPay has raised US$3.3 million in a funding round, with YouTube co-founder Jawed Karim among the participants. (Globo)

📲 Adoption

Ethereum, Base and Polygon are the most used smart contract platforms in the Latin America region, while networks like Avalanche, Arbitrum and Optimism have lost ground, according the the Sherlock Communications Blockchain Latam Report 2025. (Exame)

Kast, the stablecoin banking and payment product, announced an integration with Pix for its Brazilian users. (Livecoins)

Flow Podcast (the Brazilian equivalent of Joe Rogan) interviewed bitcoin specialist Fernando Ulrich

Bitget announced a new Mastercard-branded crypto card in Brazil that allows for settlement of purchases in dollars without fees. (CoinTelegraph Brasil)

Ripple acquired Toronto-based payments platform Rail for US$200 million. It will allow Ripple to offer comprehensive stablecoin payment services and virtual accounts. Silvio Pegado, Ripple’s director for Latin America, said that the acquisition will help Brazil companies do business in the US:

"Rail has virtual accounts. The goal is to serve a Brazilian company that needs a collection point—not a traditional bank account—in the United States. With Rail's system, we can create a custodian to leave a collection point in the United States for this company.” (Portal do Bitcoin) (CoinTelegraph Brasil)

Rodrigo Tolotti of Portal do Bitcoin explores the downfall of Moss, a once highly-touted tokenized carbon credit project that forged partnerships with Flamengo, Gol and C6 Bank. Guilherme Rossetto, current CEO of the project, blamed the collapse on a contraction in the voluntary carbon market globally.

“The decline in MCO2's value reflects the global contraction in this market, with reduced demand from companies, questions about certification methodologies, and regulatory uncertainty.”

Curitiba-based Vetrii has created a blockchain-based digital vehicle passport that records information such as inspections, maintenance, part replacements and battery history in electric cars. (CoinTelegraph Brasil)

The city of Rolante in Rio Grande do Sul was officially declared the state’s “Bitcoin Capital” by Governor Eduardo Leite. (Portal do Bitcoin)

🏛 Policy, Regulation and Enforcement

Brazil’s crypto industry appears to be united in opposition against the tax increase imposed on the industry by the government’s Provisional Measure in June, according to experts interviewed by Portal do Bitcoin. Maria Isabel Carvalho Sica Longhi, director of public policy at Ripple, explained:

"Everyone has to pay taxes; that's not an issue. But the timing and manner in which it was implemented are the main issues. There's no Central Bank regulation yet; you're taxing a nascent sector without a clear definition of what that sector actually consists of.”

Senator Carlos Portinho defended the use of blockchain in elections and other areas of Brazilian public service, arguing that these conversations cannot be “taboo”.

"The vote belongs to the citizen and must be inviolable. But the system needs to be as well. Why not use blockchain to guarantee this…We cannot turn innovation into a taboo. Just as we talk about blockchain in elections, we have to talk about Drex with the same openness?” (CoinTelegraph Brasil) (Valor)

ANPD, Brazil’s data protection regulatory agency, denied an appeal from Tools for Humanity - the parent company of World - to reverse its suspension on the company’s use of cryptocurrency financial incentives to new users registering on the platform. The ANPD said that the refusal was due to "insufficient evidence indicating that the risks identified by the preventive measure were mitigated or even eliminated." (Exame)

Juan Carlos Reyes, president of El Salvador’s National Commission for Digital Assets, said during a Blockchain Rio presentation that the country is about to sign a bitcoin monitoring agreement with Brazilian Federal Police. (CoinTelegraph Brasil)

Primeiro Comando da Capital and Comando Vermelho, Brazil’s largest criminal factions, have moved R$28.2 billion in the last six years through fintechs with the help of cryptocurrencies, according to a new survey by Jornal O Globo. (CoinTelegraph Brasil)

The CVM fined Bluebenx’s operators R$35 million for fraud and illegal offering of securities. The company ran a crypto pyramid scheme dating back to 2019. (Portal do Bitcoin) (CoinTelegraph Brasil)

The National Council of Justice launched its CriptoJud system that creates a centralized hub of communication between judicial organs and crypto exchanges. It will allow judicial authorities to check the existence of crypto assets linked to debtors. Previously, verifying ownership of these assets required sending individual letters to each crypto exchange. (InfoMoney) (Portal do Bitcoin)

Sao Paulo Civil Police dismantled an illegal cryptocurrency mining scheme in Sorocaba, a city in the state’s interior. 59 ASIC devices, two notebook computers, a CPU and a cell phone. Irregular electricity usage patterns were identified by the police, indicating energy theft. (Portal do Bitcoin) (CoinTelegraph Brasil)

Military police in Rio de Janeiro arrested a municipal civil guard from Campos dos Goytacazes suspected of stealing electricity to mine cryptocurrencies in the Santa Rosa neighborhood. (Portal do Bitcoin)