#206: Brazil Jumps to 5th in Chainalysis Global Crypto Index

Plus: Itau launches new crypto asset division; crypto exchange regulations coming this year, says Central Bank

Olá pessoal!

Welcome back to Brazil Crypto Report for the week of September 1-5, 2025, and happy Brazilian Independence Day for those who celebrate.

Chainalysis put out a teaser to its annual global crypto adoption index, and Brazil made a surprise leap to claim the fifth place spot. It had been slowly falling from 7th in 2022 to 10th in 2024, so it’s nice to see a move back up the rankings!

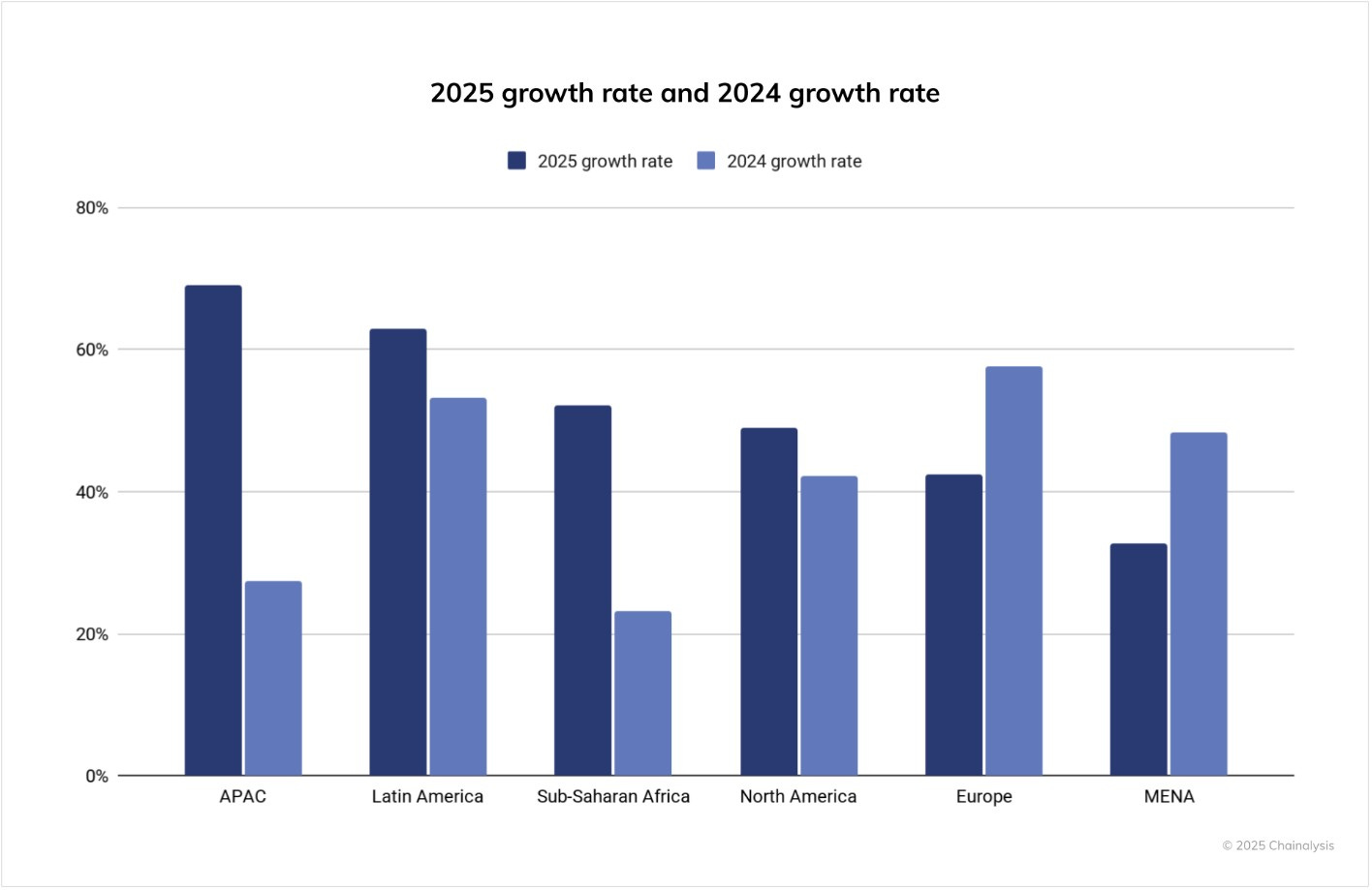

The full report will be released in a few weeks, but the teaser blog post has some interesting color about how adoption in the Latam region has grown compared to other parts of the world. The survey obviously isn’t perfect, but it’s the best information we have available for measuring this type of usage and sentiment globally.

👊 Jump into the BCR English language Telegram group if you’d like to continue the conversation

📰 Top Stories this Week

Brazil Surges to 5th in Chainalysis Global Crypto Adoption Rankings

Itau launches dedicated crypto unit led by former Hashdex executive Joao Marco Braga da Cunha

Crypto Regulations to Come in 2025, says Central Bank president Galipolo

Thanks for reading and have a great week!

- AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Avenia is the programmable financial infrastructure for Latin America. Connect to local payment rails like PIX, SPEI and CBU — using stablecoins as settlement — and unlock real-time, cross-border payments without banks, FX desks, or SWIFT.

Whether you're building a wallet, a crypto card, or a global treasury solution, Avenia gives you the APIs and compliance-ready infrastructure to scale in LatAm. Move money between BRL, USD, MXN and more — fast, transparent, and fully on-chain.

P2P.me is the fastest way to buy and sell crypto in Brazil using Pix: direct, secure, and fully onchain.

Backed by Multicoin and Coinbase Ventures, P2P.me offers a compliant on and off ramp with, ZK-KYC, and no hidden fees.

You can easily use P2P.me to pay PIX QR codes in Brazil using your USDc balance. Topup, scan and pay.

Visit br.p2p.me to get started and earn $50 per operation limit.

🎙️New Podcasts!

This week’s episode is with Matheus Moura, CEO and co-founder of Avenia. We discuss his thesis that every company will eventually become a financial services company - and how Avenia is building the infrastructure to enable this with its "one API" approach in Brazil and, soon, the rest of Latin America.

The Avenia team’s journey is super interesting as well. They started off as a crypto-focused quantitative hedge fund, but pivoted to stablecoins and payments infrastructure in 2023 upon seeing demand for this type of product. Worth a listen!

Brazil Surges to 5th in Chainalysis Crypto Adoption Rankings

Brazil now ranks 5th in global crypto adoption, according to the 2025 edition of the Chainalysis Global Crypto Adoption Index, trailing only India, the US, Pakistan, and Vietnam.

The a position reflecting strong traction across both retail and institutional usage. This prominence aligns with broader regional trends: Latin America led global growth in crypto inflows, achieving 63% year-over-year expansion driven by stablecoin adoption, inflation hedging, and remittance modernization.

Two other Latam countries, Argentina and Venezuela, also made the top 20.

Brazil held 10th place in 2024, 9th place in 2023 and 7th place in 2022.

CoinTelegraph Brasil BlockNews

Itau launches dedicated crypto unit

Itaú Asset has launched a dedicated crypto asset investment division within its Multimesas business, led by former Hashdex portfolio director João Marco Braga da Cunha.

It offers clients diversified exposure to digital assets such as bitcoin ETFs, blockchain equity funds, and crypto-linked retirement products and has already attracted R$ 850 million in AUM. The division will also create new products in the future including fixed-income options and vehicles for focused on crypto volatility.

He told Valor:

"The crypto asset segment has unique characteristics for alpha generation. It's a relatively new market, creating significant opportunities due to its volatility, and with a predominance of retail investors.”

Recall that Itau has existing products, including its ion brokerage application - which offers 10 different cryptocurrencies, and a bitcoin ETF and retirement fund offering exposure to crypto.

(CoinTelegraph Brasil) (CriptoFacil) (Valor Investe) (Livecoins)

Galipolo: Crypto Regulations to Come in 2025

Central Bank president Gabriel Galipolo affirmed that the publication of regulatory rules for crypto exchanges will happen before the end of 2025.

The statement was made during a press conference in Brasilia with the bank’s directors. Referring to the three public consultations on digital assets that still remain open, he said:

"We are in the final stages of finalizing these drafts, and they should be released over the next few months.”

He emphasized that his team expects “next few months” in this context to mean the year 2025 specifically, but acknowledged the possibility of another slight delay.

CoinTelegraph Brasil Livecoins

🗞Brazil Crypto News Rundown

📈 Markets

Mercado Bitcoin became the first Latin American exchange to list the controversial Trump-linked World Liberty Financial (WLFI) token. (BeinCrypto)

Ethereum trading volume rose 4% month-over-month to approximately R$ 2.49 billion during the month of August in Brazil, while Bitcoin volumes dropped to R$ 3.75 billion (an 8% decline), and Tether declined 12%, slipping to R$ 8.03 billion. (CoinTelegraph Brasil)

Citi Latin America’s services head, Steve Donovan, identified Brazil as the ideal testbed for building a “Pix Global” platform powered by stablecoins and tokenization, offering 24/7 programmable payments. (CoinTelegraph Brasil)

Webull Brasil is expanding its crypto product suite to add staking capabilities, tokenization options, and a U.S.-dollar savings account with a 15% interest rate. The idea is to offer Brazilian investors passive income and asset diversification with features like cashback and exposure to tokenized stocks. (CoinTelegraph Brasil)

Sebrae and BTG Pactual Asset Management have launched the FIC FIP Sebrae Germina, an early-stage venture fund with an initial R$ 100 million commitment. It is targeting investments into 8–10 seed and pre-seed startups and expects to scale up to R$ 450 million nationwide by 2026. (Livecoins)

Fintech DUX has advanced R$15 million in tokenized receivables over the past four months to creators - including influencers, artists, and content producers in a play to become the “bank of Brazil’s creative economy.” (Valor Pipeline)

Bitget announced 173% growth in its Brazil customer base and a 404% increase in transactions during the first half of 2025 compared to the prior year period. (CoinTelegraph Brasil)

Méliuz shares suffered a steep 17.6% drop in August - its worst monthly performance since declaring itself Brazil’s first bitcoin treasury company. The drop was attributed to a retreat in the bitcoin price and a waning market narrative around so-called Digital Asset Treasury companies. The company also added 9.01 bitcoins to its treasury, bringing its total to 604.69, the largest among public companies in Latin America. (CoinTelegraph Brasil) (Livecoins) (Exame)

Hashdex CIO Samir Kerbage argued during Ethereum’s underperformance that the asset was a “sleeping giant”. Now he sees the token eventually hitting US$10,000 once stablecoin solutions begin being rolled out in the US. This is due to three factors, he argues: advances in network infrastructure, the global trend toward asset tokenization, and the wealth transition from Boomers to millennials. He wrote in his CIO Notes newsletter:

"As more investors understand the important role Ethereum will play as the technological infrastructure of the global economy, we have no doubt they will recognize that this sleeping giant was never truly asleep."

Mercado Bitcoin launched a real-world asset token backed by a luxury residential property in Bragança Paulista, offering investors a fixed income of IPCA + 13% per year. (CoinTelegraph Brasil)

Triad Markets - a Solana-based prediction market developed by Brazilians -has mobilized over R$ 50 million in just seven months since its beta launch, positioning itself to challenge global leaders like Polymarket and Kalshi by focusing on locally relevant, Brazil-centered prediction events. (CoinTelegraph Brasil)

📲 Adoption

Brazilian investors continue to favor just five cryptocurrencies - bitcoin, Ethereum, Solana, XRP, and AAV - despite access to over 240 options, according to Webull data, underscoring a preference for digital assets with established credibility. (CoinTelegraph Brasil)

Valor Capital, Itau vice chairman Ricardo Villela Marino and Nubank co-founder Edward Wible joined a US$10 million funding round for Pointsville - a digital asset and loyalty program infrastructure firm - looking to expand Central and South America. (Bloomberg)

Tokeniza, a CVM-regulated platform, and Graphite Network have partnered to enable simple, compliant purchases of onchain RWAs directly via Pix, with a R$10 minimum.(CoinTelegraph Brasil)

Television network SBT are launching the “Baú da Fidelidade” Web3 loyalty program within the “Bora” superapp, with the idea of using tokens as reward points. The initiative is developed through a joint venture between Minu and Wibx. (CoinTelegraph Brasil) (Exame)

The state of Paraná state government, in conjuction with Banco BV and Vetrii, intends to issue blockchain-backed digital identity tokens for vehicles. These would record ownership and service histories and aim to prevent fraud in transfers, odometer tampering, and financing. (CoinTelegraph Brasil) (Livecoins) (CriptoFacil)

A string of cyberattacks has prompted Brazil’s Central Bank to focus on fortifying Pix’s security, potentially delaying and drawing resources away from other innovation priorities like Drex. (CoinTelegraph Brasil) (CriptoFacil)

Satsconf 2025, Brazil’s largets bitcoin-focused event is taking place November 7-8 in Sao Paulo.

The Department of Motor Vehicles in Brazil’s Federal District has mandated that all accredited companies implement blockchain-based systems within six months to modernize record integrity and process automation. (Livecoins)

New legislation proposes amendments to formally recognize cryptocurrencies as inheritable assets. (CoinTelegraph Brasil)

Fan tokens for Vasco ($VASCO), Fluminense ($FLU), and Palmeiras ($VERDAO) are now tradable on the Australian Cube Exchange. (Livecoins)

Banco Inter will host the cryptocurrency-themed Inter Invest Summit on September 20 at Atlético Mineiro’s Arena MRV. (Livecoins)

A new two-year public-private research initiative in Minas Gerais called Smart Coffee Flow will deploy blockchain and AI to track the entire coffee supply chain via QR codes. (Livecoins)

ABToken released a “Manual of Best Practices for Tokenization of Financial Assets and Securities”, covering issuance, post-trade processes, governance, investor protection, technical compatibility and compliance aligned with FATF guidelines. (BlockNews)

Brazilian self-custodial wallet Chainless says it has grown its user base by 300% this year and will integrate Uniswap v3 liquidity pools via its mobile app. (CoinTelegraph Brasil)

Deputy Júlia Zanatta and Drex opponent declared that the Central Bank’s withdrawal of blockchain architecture and CBDC labeling from its Drex proposal was a response to public concern and hailed the shift as a partial victory while urging continued vigilance:

“people understood Drex was meant to watch us.” (Livecoins)

🏛 Policy, Regulation and Enforcement

The State of Rio de Janeiro has published regulations for fixed-odds betting that prohibits the use of cryptocurrencies for payments and demanding transactions only via Central Bank-supervised systems like PIX, TED, debit/prepaid cards. (Livecoins)

Tether will brief senior officials from the Receita Federal, Banco Central, and Ministério Público in Brasília on September 4–5, presenting stablecoin fundamentals and risks. (Livecoins)

The Superior Tribunal de Justiça ruled that judges may issue subpoenas to cryptocurrency exchanges to identify and seize digital assets in debt enforcement cases, recognizing that crypto holdings are part of a debtor’s estate. (CriptoFacil)

Deputies from the PT blocked progress on the draft law proposing Brazil hold up to 5% of its international reserves in bitcoin, citing concerns over volatility, fiscal risks, and the need for further technical study. (Livecoins)

Pastor Roberta Monzini - who previously held an official position under Bolsonaro - filed a lawsuit against YouTube after her gospel channel was hacked in July by crypto scammers using the Solana brand. (Livecoins)

Brazilian courts have ordered the auction of three Parana estates formerly owned by the “Rei do Bitcoin”, orchestrator of the Bitcoin Banco pyramid scheme. Properties including high‑standard yet vandalized buildings, access to a river, and legal environmental preservation zones will be auctioned for a starting bid of R$4.5 million. (Livecoins)

In Operação Promessa Ilusória, the Federal Police blocked upwards of R$ 8.3 million in cryptocurrency and arrested a Campinas woman suspected of involvement in a human trafficking operation. (Livecoins)

A Brazilian court has ordered G44 Brasil - a crypto-linked Ponzi scheme - to reimburse an investor R$ 56,000 after deeming the contracts null. (Livecoins)

A São Bernardo do Campos court directed the blocking of Pix keys and the seizure of crypto assets belonging to a company and its four wealthy partners to enforce the collection of a R$ 4.5 million debt. (Livecoins)

Federal Police executed Operação Hawala seeking to dismantle a criminal network that laundered over R$ 1 billion via cryptocurrency by converting proceeds from smuggled electronics through shell companies and exchanges. (Livecoins)

Civil Police dismantled a Chinese-led criminal organization operating a fake crypto exchange called EBDOX that actively recruiting Brazilians via WhatsApp. The scheme allegedly solicited R$1 billion in fraudulent investments and coerced victims into sending additional payments under the guise of “blocked withdrawals.” (CoinTelegraph Brasil)

Federal Police arrested five suspects and executed ten search and seizure warrants in Operation Sibila, targeting a criminal network that laundered ~R$ 50 billion in cryptocurrency between 2020 and 2024 through shell companies and exchanges. (CoinTelegraph Brasil) (Livecoins)

Dante Felipini, aka “Criptoboy”, laundered ~R$ 19.4 billion in cryptocurrencies on behalf of PCC, the organized crime group, to groups like Hezbollah and European mafias. He used OTC entities like Makes Exchange and One World Services to route bypass the banking system. Felipini was arrested while attempting to flee to Dubai. (Portal do Bitcoin)

Civil Police in Mato Grosso do Sul launched Operation Edbox, executing 19 search and seizure warrants across multiple states to dismantle a scheme that moved over R$ 1 billion in 2024. (CriptoFacil)

Rio de Janeiro police arrested a man running a clandestine bitcoin mining farm in Ilha do Governador, accused of stealing electricity to power the 24/7 operation after neighbors reported noise and excessive energy use. (Portal do Bitcoin)