#208: Nubank to test stablecoin payments with credit cards

Plus: Stellar Meridian 2025 takes Rio by storm; Onigiri Capital to invest US$50 million in Brazil

Olá pessoal!

Welcome back to Brazil Crypto Report for the week of September 15-19, 2025.

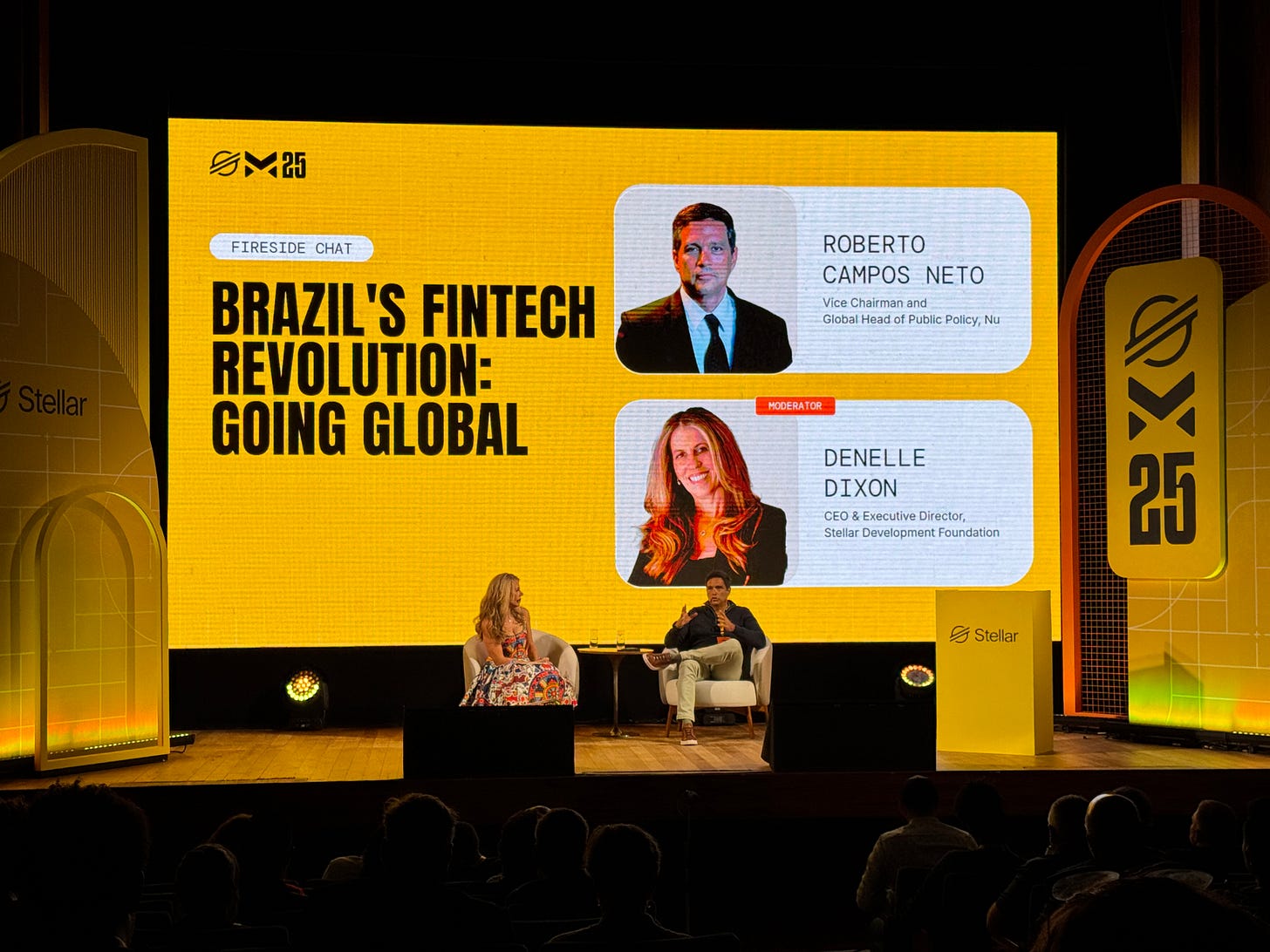

It was great seeing many of you at the Stellar Meridian conference in Rio de Janeiro last week. Big congrats to the Stellar team for putting together what I’m pretty sure was the first ever protocol ecosystem conference hosted in Brazil.

It was a very special moment for me personally as my wife and I celebrated our 15th wedding anniversary at the event.

So what’s next on the itinerary? I’ll be at the Mercado Bitcoin Digital Assets Conference in Sao Paulo this coming week. I’d love to connect onsite if you’ll be around

👊 Jump into the BCR English language Telegram group if you’d like to continue the conversation

📰 Top Stories this Week

Araujo: Drex could still use blockchain

Onigiri Capital to invest US$50 million in Brazil

AmFi to bring tokenized Brazilian assets to the world

Crypto exchanges should be held to same standards as banks, industry says

Nubank to allow stablecoins via credit card, says Campos Neto

Thanks for reading and have a great week!

- AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Avenia is the programmable financial infrastructure for Latin America. Connect to local payment rails like PIX, SPEI and CBU — using stablecoins as settlement — and unlock real-time, cross-border payments without banks, FX desks, or SWIFT.

Whether you're building a wallet, a crypto card, or a global treasury solution, Avenia gives you the APIs and compliance-ready infrastructure to scale in LatAm. Move money between BRL, USD, MXN and more — fast, transparent, and fully on-chain.

P2P.me is the fastest way to buy and sell crypto in Brazil using Pix: direct, secure, and fully onchain.

Backed by Multicoin and Coinbase Ventures, P2P.me offers a compliant on and off ramp with, ZK-KYC, and no hidden fees.

You can easily use P2P.me to pay PIX QR codes in Brazil using your USDc balance. Top-up, scan and pay.

Visit br.p2p.me to get started and earn $50 per operation limit.

🎙️New Podcasts!

This week’s episode is with Thamilla Talarico, head of on-chain finance growth for Brazil at Polygon Labs, and previously with EY where she worked on implementing its Starlight privacy solution for the Brazilian Central Bank’s Drex CBDC project.

Recorded onsite at the Bitso Business Stablecoin Conference in Mexico City, we talk about Polygon’s strategic pivot away from being a general purpose blockchain to focus wholly on stablecoins and RWAs.

Thamilla also talks at length about her experience working on the Drex project, including the ups, downs and challenges, and she gives her assessment of the project’s future without blockchain (for now).

🙌 Also check out BCR on your preferred podcast platform YouTube | Spotify | Apple Podcasts

Onigiri Capital to invest US$50 million in Brazil

Japanese VC Saison Capital has launched Onigiri Capital, a blockchain investment fund focused on Brazil, with US$50 million to back projects in stablecoins, payments, tokenized real-world assets, DeFi and financial infrastructure

Saison Capital is the venture capital arm of Credit Saison, one of the largest non-banking financial companies listed on the Tokyo stock exchange.

Qin En Looi, partner at Saison Capital and managing partner of the new fund, said that the objective is to position Latin America as a source of applied innovation in blockchain. He explained:

“Our vision is to offer Brazilian and Latin American founders the opportunity to scale financial solutions in advanced markets, with direct access to Asia—one of the global hubs of blockchain innovation.”

CoinTelegraph Brasil Livecoins Valor

AmFi to bring tokenized Brazilian assets to the world

Asset tokenization platform AmFi plans to launch a global platform by the end of the year that allows international investors to directly access Brazilian tokens issued on its platform.

These assets have provided an investors with an average return of 21.1%, surpassing that of government bonds and and real estate.

AmFi expects to close 2025 with R$3 billion in tokenized assets. Currently the platform is reporting 60% average monthly growth in digital private credit, CEO Paulo David explained:

"We are democratizing access to high-return investments through tokenization. Our goal is to transform R$10 billion into assets over the next 18 months, maintaining the profitability and security that have made us a benchmark in the sector.”

Crypto exchanges should be held to same standards as banks, industry says

Brazil’s Central Bank will likely require crypto exchanges and service providers to meet the same regulatory standards as banks in its forthcoming regulatory framework. There will be few to no exceptions, according to legal experts speaking at an ABToken event last week.

This treatment would mean a minimum of R$15 million in capital, a dedicated physical headquarters in Brazil, annual independent audits, and robust fraud detection systems. In practice, this puts crypto firms squarely under the same supervisory lens as traditional finance.

The regulator’s objective, explained ABToken chairman Jorge Galvão, is to curb money laundering by combating the infiltration of organized crime into payment institutions, as well as to combat fraud in the Pix system. He said:

"I don't see the Central Bank treating financial institutions differently than it does today. Due to the high volume of fraud occurring not only institutionally but also at the end-customer level, the rules should be the same for all participants in the system."

Nubank to allow stablecoins via credit card, says Campos Neto

The digital bank is working to incorporate dollar-pegged stablecoins into its credit card products, Robert Campos Neto explained at Stellar’s Meridian 2025 conference in Rio de Janeiro.

He said that a test program will allow stablecoin payments directly with the Nubank card, emphasizing that the banking sector’s biggest challenge currently is finding mechanisms to accept tokenized deposits.

The proposal seeks to create a system where digital money coexists seamlessly with traditional credit. He explained:

“The idea is to connect blockchain assets with Nubank’s credit card ecosystem, allowing stablecoins and even tokenized deposits to be used in payments and potentially in issuing credit.”

Campos Neto has served as Nubank’s Vice Chairman and Global Head of Public Policy since July.

CoinTelegraph Brasil Exame CriptoFacil

Araujo: Drex could still use blockchain

The Central Bank’s Drex coordinator Fabio Araujo said that the institution has not completely abandoned blockchain for its Drex project.

It announced last month that the Drex pilot would no longer use the technology. Araujo said:

"The third phase will not use blockchain, but that does not mean the initiative will abandon the technology.”

Speaking at Meridian 2025, he clarified that the bank will continue to explore the most efficient means of implementing asset tokenization - such as blockchain. But he added that there was pressure to deliver a product in the short term - hence the decision to discontinue use of blockchain for the time being:

"In the pilot, we were asked by the Central Bank's board to deliver a product in the short term, and considering this, we concluded that blockchain would not be possible due to privacy and scalability issues.”

Portal do Bitcoin CriptoFacil Exame CoinTelegraph Brasil

🗞Brazil Crypto News Rundown

📈 Markets

Itaú projected that Ethereum could deliver parabolic gains, expecting it to outperform bitcoin during the next bullish phase. In its first dedicated crypto market report it projected price targets implying up to ~87% upside if resistance levels are broken. (CoinTelegraph Brasil) (CriptoFacil)

Brazilian tokenized assets startup DexCap has been selected by Ripple to join the Fenasbac Next acceleration program. (CoinTelegraph Brasil)

Coins.xyz is expanding into Brazil with a focus on stablecoin-based payments, positioning itself as an alternative to speculation-driven exchanges. CEO Wei Zhou says the goal is to complement Pix by enabling Brazilians to seamlessly use stablecoins for cross-border transactions and global financial access. (Exame)

Only one-third of aggressive Brazilian investors include bitcoin or other cryptos in their portfolios. By contrast, participation falls to ~22% among moderate investors and only ~6% among conservative ones, according to a new survey released by the CVM. (CoinTelegraph Brasil) (Portal do Bitcoin)

Denelle Dixon, CEO of Stellar Development Foundation, warned that many blockchain networks won’t survive long-term if they don’t invest in interoperability. Speaking at the Meridian 2025 event in Rio, she said Stellar is exploring stablecoins pegged to local currencies - including potentially the Brazilian real - to reduce reliance on the U.S. dollar. (Exame)

Visa doesn’t see stablecoins as a threat to its core business model, according to Catalina Tobar, Head of Crypto & Blockchain for Latin America & the Caribbean. Rather, the company views them as opportunities for growth, enabling new ways for payments and value flows while it adapts its services. (Exame)

📲 Adoption

Transfero has integrated BRZ, its BRL-pegged stablecoin with the Fireblocks Network for payments and upgraded its role in the Circle Payments Network. These moves now enable BRZ to be used for international settlement among 2,400+ financial institutions. (CoinTelegraph Brasil)

Bitso Business and Brazilian expense management platform Clara are partnering to offer corporate cards and payment solutions backed by stablecoins, enabling companies to use their crypto reserves directly. For example, companies can pay employees or vendors directly using stablecoins without converting them into fiat. (CoinTelegraph Brasil)

Over 33 million Brazilians already have their identity validated on blockchain via the new National Identity Card, which links CPF and civil ID data in an immutable ledger. The government aims to scale this to 150 million identities by 2026. (CoinTelegraph Brasil)

Bitget Wallet now lets Brazilians use stablecoins via any Pix QR code in a self-custodial wallet for payments, while merchants still receive settlement in reals. (CoinTelegraph Brasil)

Brazil’s National Confederation of Industry (CNI) has named “Blockchain Solutions Architect” one of the 16 professions of the future, projecting demand from at least 5% of industrial firms within five years. (CoinTelegraph Brasil)

Vinteum, a group dedicated to training and funding bitcoin developers in Brazil, is celebrating its third anniversary. Founder Lucas Ferreira said:

"It's not just about funding developers. It's about creating a space where people in our region can believe they belong to the Bitcoin ecosystem, can contribute meaningfully, and help shape its future.” (Livecoins)

The Central Bank of Chile is planning a CBDC project similar to Drex. (Livecoins)

The Brazilian Ministry of Agriculture has launched a new digital certificate called VMG that uses blockchain, AI, and geospatial tech to validate grain producers, streamline public credit release, and improve transparency in the Plano Safra program. (Livecoins)

Rio de Janeiro plans to transform itself into a “crypto city,” said Vice-Mayor Eduardo Cavaliere at the Stellar Meridian 2025 event. The municipal government is drawing up a strategy to attract blockchain and crypto firms, encourage widespread adoption among citizens, and expand payment of services like IPTU in crypto. (Exame)

Bruno Oliveira from Brazil has spent two years collecting and selling aluminum cans to gradually buy bitcoin. His story has gone viral as a symbol of financial inclusion and perseverance. (CoinTelegraph Brasil)

🏛 Policy, Regulation and Enforcement

An investor in Brazil recovered R$56,000 after being defrauded by a bitcoin pyramid scheme. (Portal do Bitcoin)

Senator Renan Calheiros accused Chamber of Deputies Speaker Arthur Lira of trying to shield cryptocurrencies and online betting (“bets”) from fair taxation in Brazil’s ongoing income tax reform debate. (Portal do Bitcoin)

The Rio de Janeiro Public Prosecutor’s Office has launched a new cyber crime unit called CyberGAECO tasked with fighting networks that use cryptocurrencies for money laundering and other illicit activities. (Portal do Bitcoin) (Livecoins) (CoinTelegraph Brasil)

Brazilian lawmakers and crypto experts pushed for using stablecoins as a way for BRICS nations to reduce dependency on the U.S. dollar, enhance payment sovereignty, and avoid being “hostages” in international trade. The remarks were made at the Second BRICS Forum on Traditional Values. (Livecoins)

Brazil’s Central Bank is running a technical training on tokenization for its regulatory staff, covering use cases, governance, risks, and audit trails, with sessions led by ABToken’s Caroline Nunes and Batista Luz’s Luciana Horta. (CoinTelegraph Brasil)

Federal Police froze R$130 million and seized ~R$10 million in Operation Inceptio, which cracked down on crime ring in Acre that used shell companies, bank accounts and cryptocurrencies to clean drug-trafficking proceeds. (CriptoFacil) (Livecoins)

A Brazilian hacker was arrested in Operation Eurocyber for leading a transnational scheme targeting victims in Portugal and Spain, with losses exceeding €7 million. The criminal group sold sensitive data and received payments in both cryptocurrency and fiat, and faces charges including money laundering, electronic fraud, and involvement in an organized crime network. (Livecoins)

A Brazilian congressman has proposed limiting cash transactions and phasing out R$100 and R$200 banknotes, arguing that such bills are often used for money laundering, tax evasion, and criminal activities. (Livecoins) (CoinTelegraph Brasil)