#210: Brazil crypto volumes at $319 billion from 2024-25, says Chainalysis

Plus: Mercado Bitcoin looks to be a 'super app' for Brazilian users; Binance relaunches card product in Brazil

Olá pessoal!

Welcome back to Brazil Crypto Report for the week of September 29-October 3, 2025. I hope everyone is having a great weekend.

This week we got a nice info dump from our friends at Chainalysis about crypto flows in Latin America and Brazil’s surprising dominance in the region.

Brazil checked in at #5 in the global rankings, and has emerged as a far larger market than competitors in the region like Argentina and Mexico that tend to get more attention from the crypto industry more broadly. We dive into the data below.

Also, I have an opening for another podcast/newsletter sponsor for the remainder of the year. If you’re interested in partnering with BCR to get your brand in front of 8,000 readers interested in the Brazil and Latam markets, please respond to this email or hit me @AaronStanley on Telegram.

👊 Jump into the BCR English language Telegram group if you’d like to continue the conversation

📰 Top Stories this Week

Brazil moves US$319 billion in crypto volumes: Chainalysis

Finance Minister Haddad says Drex is not for surveillance

Binance re-launches Binance Card in Brazil

Mercado Bitcoin looks to become a financial “super app” for Brazil

Thanks for reading and have a great week!

- AWS

🙌 🇧🇷Brazil Crypto Report is a free publication; if you wish to support my work you can do so by hitting the button below👇

Brazil Crypto Report is presented by

Avenia is the programmable financial infrastructure for Latin America. Connect to local payment rails like PIX, SPEI and CBU — using stablecoins as settlement — and unlock real-time, cross-border payments without banks, FX desks, or SWIFT.

Whether you’re building a wallet, a crypto card, or a global treasury solution, Avenia gives you the APIs and compliance-ready infrastructure to scale in LatAm. Move money between BRL, USD, MXN and more — fast, transparent, and fully on-chain.

🎙️New Podcasts!

This week we published two new episodes. The first is with Raagulan Pathy, founder and CEO of KAST. KAST has quickly become one of the hottest consumer-focused stablecoin products in all of crypto, and Latin America now accounts for 30% of the company’s total business.

The second is a fascinating panel that I hosted at Stellar Meridian 2025 in Rio de Janeiro that explored some fascinating use cases of stablecoin adoption in emerging markets. This session included

Our very own Camila Rioja of Plexus Institute, which is working with community banks and currencies in the northeast of Brazil

Sebastian Siseles of Vesseo wallet, which is building crypto <-> fiat USDC rails on Stellar for end users

Ibrahim Abdulhussein of Digibank, which is using stablecoin rails to deliver remittance payments in war ravaged parts of the Middle East

Justin Norman of The Flip, who has spent significant boots on the ground time in emerging markets recently making a documentary film about stablecoins

🙌 Also check out BCR on your preferred podcast platform YouTube | Spotify | Apple Podcasts

Brazil moves US$319 billion in crypto volumes: Chainalysis

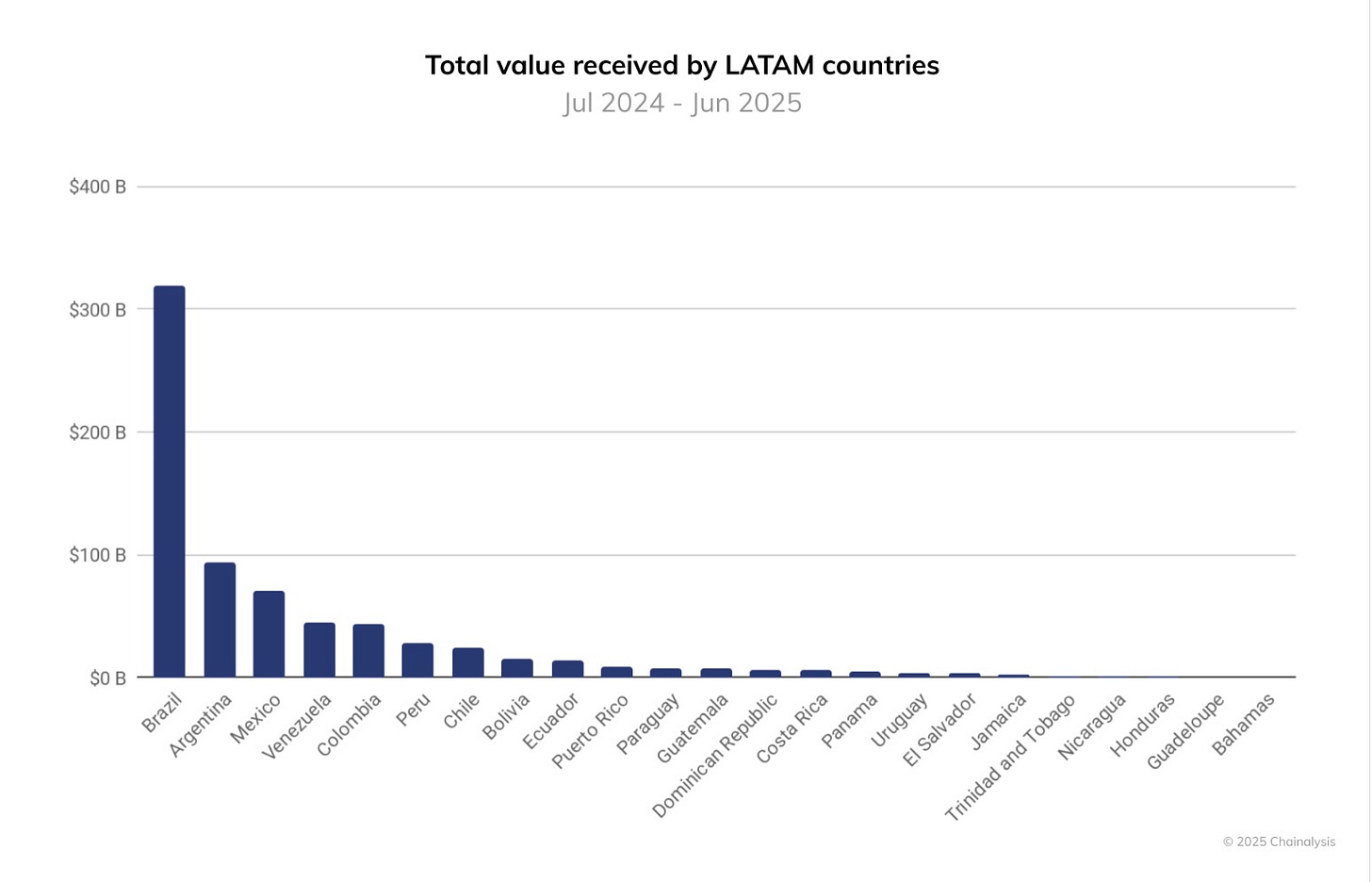

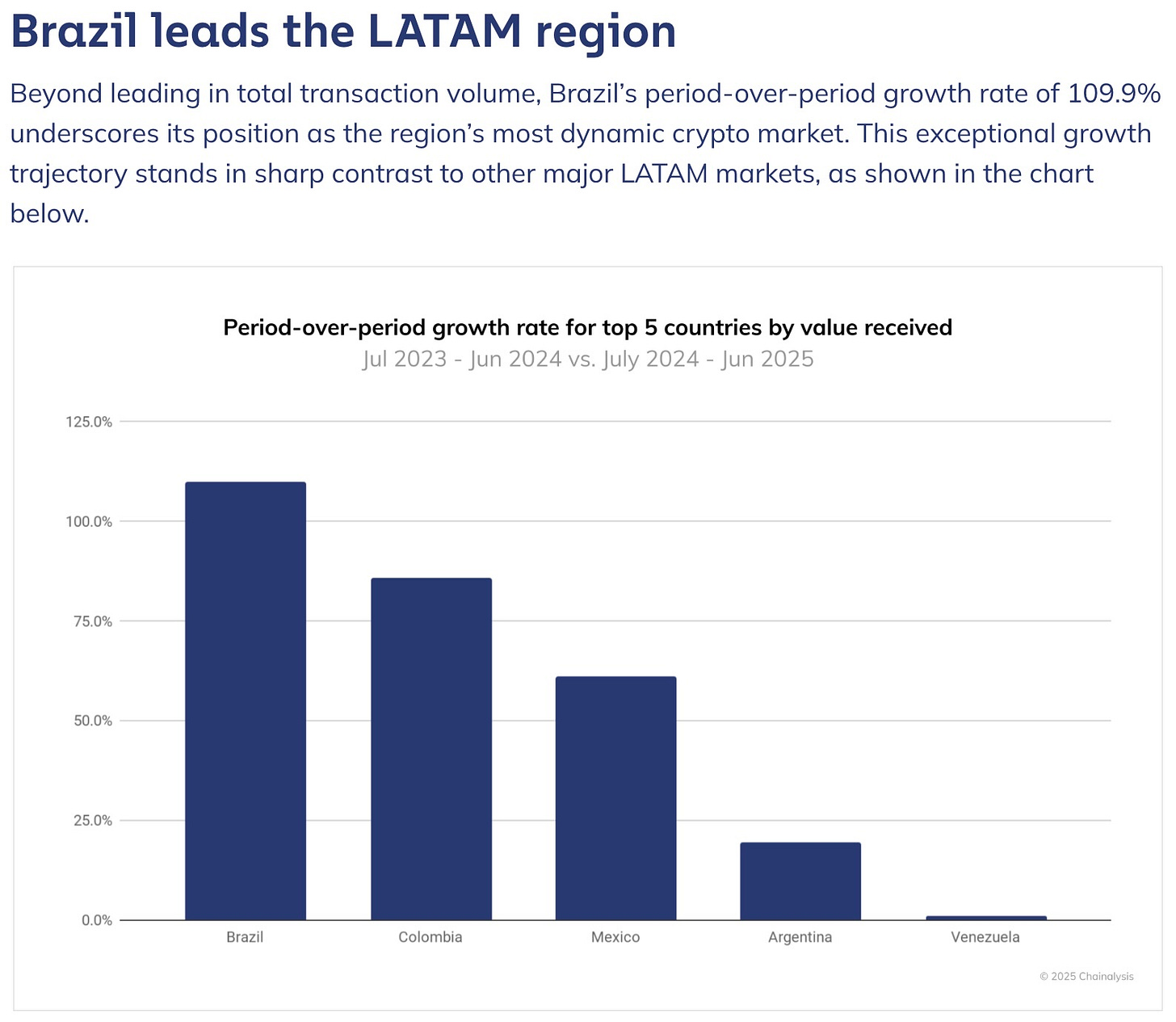

Brazil moved R$1.7 trillion (US$319 billion) worth of crypto between July 2024 and June 2025, according to Chainalysis’ Geography of Cryptocurrency Report.

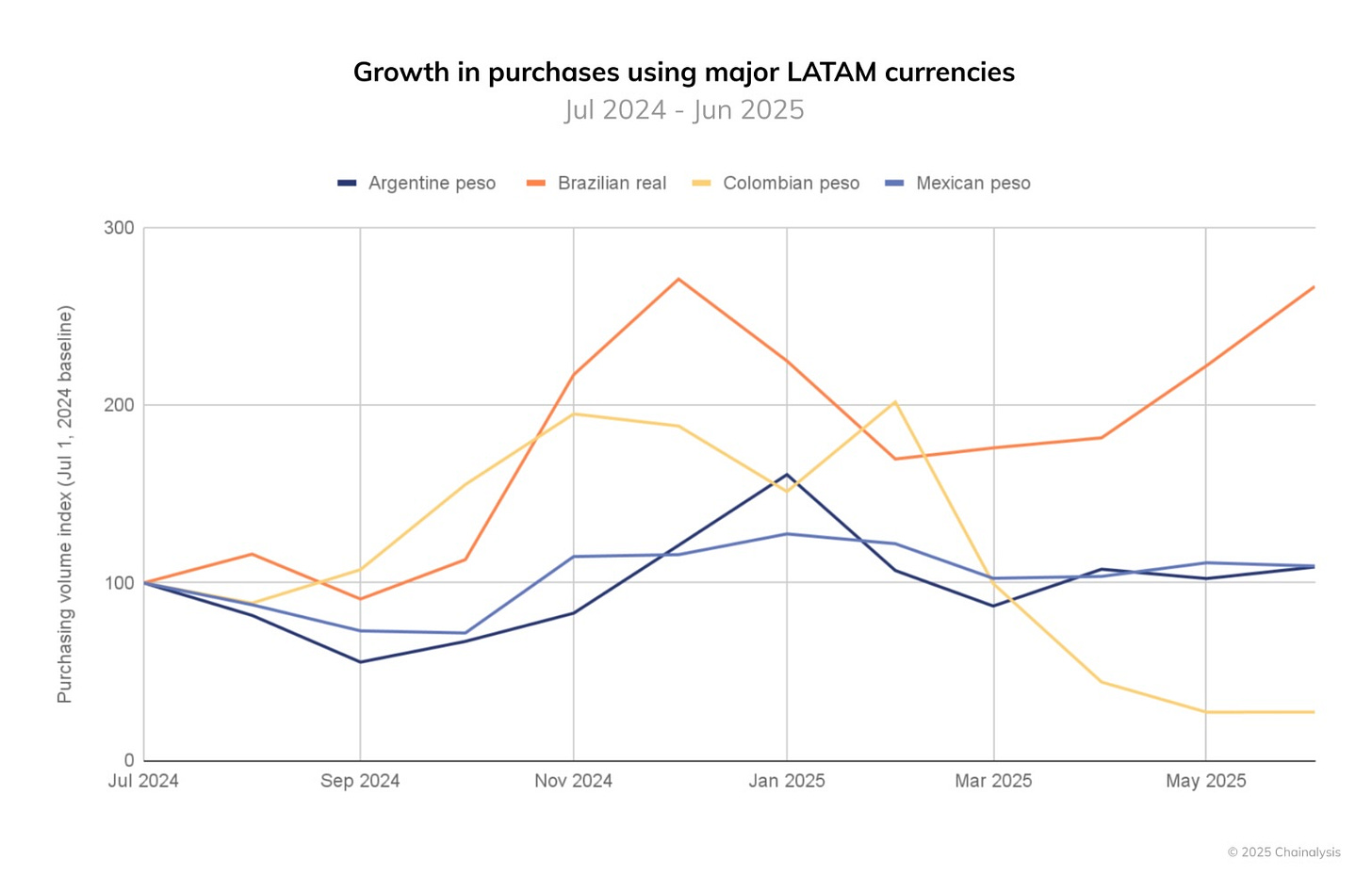

90% of that volume came in the form of stablecoins, “reflecting their role in international payments and remittances.”

Furthermore, the report notes that crypto action in the country is advancing across all segments:

“Brazil’s progress is broad and consistent: in addition to strong institutional performance, all transfer value ranges have grown, retail maturity has deteriorated, and everyday use has expanded.”

The blockchain analytics firm attributed this growth to regulatory decisions by the Central Bank that have helped to create a dynamic ecosystem, along with advances by major banks like Itau, Mercado Pago, Nubank, etc.

The report forecasts that Brazil will remain among the top crypto countries globally amid both retail and institutional support.

Brazil’s volumes during the period were 3x that of neighboring Argentina (US$94 billion) and well above the Latam’s other large markets like Mexico (US$71.2 billion) and Colombia (US$44 billion).

The region has been turning to crypto in recent years due to the combination of inflation, exchange rate volatility and capital controls, the report notes.

Valor Investe Exame Portal do Bitcoin Valor CoinTelegraph Brasil

Haddad says Drex is not for surveillance

Finance Minister Fernando Haddad said that the Central Bank’s Drex project is not intended to be a political tool or a means to police people’s transactions, but rather as an infrastructure project that prioritizes efficiency and visibility in the financial system

Speaking on the 3 Irmaos podcast, he acknowledged that the technology hypothetically allows for such control but stressed that this is not the reason it is being built. He pointed out that making public data transparent doesn’t necessarily equate to granting control:

“There is transparency, not control. You speak of transparency in Brazil and everyone assumes control”

As an example, he pointed to how tokenized infrastructure could shed light on tax exemptions and fiscal waivers.

Exame Valor Portal do Bitcoin CoinTelegraph Brasil

Binance re-launches Binance Card in Brazil

Binance re-launched its Mastercard card product in Brazil that enables purchases and ATM withdrawals with crypto while providing 2% cashback on transactions.

Because the card is issued in Brazil, however, it is subject to IOF transaction taxes - unlike the setup of similar products being launched by other global players.

The card is integrated with the user’s Binance wallet and converts held cryptocurrencies into fiat in real-time at the point of sale.

Binance originally launched the product in 2023 but suspended it the following year after the rollout of Binance Pay.

Binance’s VP of Latam Guilherme Nazar said in a statement:

“Brazil is a strategic market for the company, and the card adds to the complete portfolio of crypto payment solutions already available to Brazilian users.”

BlockNews Portal do Bitcoin CoinTelegraph Brasil

Mercado Bitcoin looks to become a financial “super app” for Brazil

The crypto exchange is moving beyond just trading to be a full solution for Brazilian users’ financial lives - spending, saving, and investing.

This transition will be anchored by MB’s push into digital fixed income products. Daniel Cunha, head of corporate development, argued that, at the end of the day, delivering these products to consumers is more important than talking about blockchain. He told CoinDesk:

“The revolution happens when the protocol disappears. The customer doesn’t want to hear about blockchains and tokens. They want to know the rate, the risk, and the maturity date.”

Part of this transition means using less industry jargon. While everybody in crypto is talking about tokenization, MB has removed the term from its marketing materials. Cunha explained:

“We tried a ton of variations…When we stopped saying ‘token’ and started saying ‘digital fixed income,’ things took off.”

This comes as crypto trading’s position in MB’s revenue mix becomes less important. It’s down from 95% at its peak to 60% today, and it’s expected to fall below 30% in the future.

🗞Brazil Crypto News Rundown

📈 Markets

Renowned asset manager Luis Stuhlberger of Verde Asset warned of a looming “anti-dollar run.” He forecasted a strong depreciation of the U.S. dollar driven by Federal Reserve rate cuts and global capital flows into real assets like bitcoin and gold. (InfoMoney) (Valor) (CoinTelegraph Brasil)

OranjeBTC is set to begin trading on Brazil’s B3 stock exchange on October 7 via a reverse merger with education company Integraus. (Portal do Bitcoin) (CriptoFacil)

30% of Mercado Bitcoin’s revenue now comes from asset tokenization, and about 40% of staff are dedicated to that division, according to CFO André Gouvinhas. (InfoMoney)

Small and mid-sized Brazilian companies now account for 10–15% of the investments in crypto on Mercado Bitcoin, deploying bitcoin and stablecoins as conservative treasury tools aimed at hedging inflation and currency devaluation, according to Daniel Cunha - MB’s head of corporate development. (CoinTelegraph Brasil)

Bitcoin miners like Tether, Bitmain, and Enegix are negotiating with energy providers to launch mining operations and convert wasted clean power into digital infrastructure. Renova Energia has already committed US$200 million to a 100-MW wind-powered mining project in Bahia. (Reuters) (CoinTelegraph Brasil)

Bradesco and Itaú are a part of a global 30-institution SWIFT pilot to create a shared digital ledger to settle tokenized assets 24/7 and test real-time international payments. (CoinTelegraph Brasil)

Nubank plans to expand to the United States with a focus on crypto and dollar-denominated products, according to Finance Minister Roberto Campos Neto, who said the move reflects how Brazilian fintech innovation is now exporting its model abroad. (CoinTelegraph Brasil)

Brazil’s central bank has cut its U.S. dollar reserves to a record low while boosting holdings of gold and Chinese yuan, reflecting a broader global de-dollarization trend that is reshaping reserve management across emerging markets. (CoinTelegraph Brasil)

Hurst Capital is launching a new set of RWA tokens related to the traffic accident compensation market in Texas. The initiative offers Brazilian investors a projected return of 25% annually. (CoinTelegraph Brasil)

📲 Adoption

OKX announced that Brazil will be the first country to receive its new products: OKX Pay and OKX Card. The OKX Pay account acts as a digital wallet denominated in dollar or stablecoin balances, while the OKX Card enables payments directly from that wallet, enabling benefits like access to stablecoins, 5% annual yield, and no IOF or exchange spread. Announcing the product at Token2049 in Singapore, OKX marketing director Haider Rafique said:

“We’ve seen how Pix has transformed the country’s financial ecosystem. However, there’s still a lack of efficient solutions for spending, investing, and sending funds abroad…OKX Pay and OKX Card aim to meet this need, enabling international transactions without IOF or exchange rate spreads, in addition to offering democratic access to stablecoins through an experience similar to local fintech digital accounts.” (BlockNews) (CoinTelegraph Brasil)

Not to be outdone, Bybit will test out its new Bybit Pay solution at the Tomorrowland Brasil festival, where attendees will be able to use a Bybit crypto card to top up their event wristbands and earn 20-30% cashback on merchandise and food and beverage purchases. (Exame)

Brazilian fintech LiberPay is launching globally with a platform that connects Pix and crypto payments, letting users pay or receive in stablecoins while merchants settle instantly in local currency. (CoinTelegraph Brasil)

Brazilian exchange Foxbit has entered the real-world asset market through a new partnership that will tokenize condominium receivables, a segment worth an estimated R$ 1.8 trillion. (CoinTelegraph Brasil)

Valor and Exame highlighted El Dorado, a startup founded by Venezuelan entrepreneurs that enables peer-to-peer stablecoin remittances in the country and its diaspora population. The platform has integrated Pix and is expanding its operations in Brazil. (CoinTelegraph Brasil)

Phase 2 tests of the Drex Pilot successfully executed tokenized credit use cases using public bonds and bank credit bills, automating loan issuance and collateral management via smart contracts. The results appear to validate blockchain-based credit flows even as Drex’s next phase shifts away from DLT infrastructure. (CoinTelegraph Brasil)

Belo Horizonte’s City Council a bill declaring the city the “Bitcoin Capital” of Brazil. It aims to transform BH into a crypto and blockchain innovation hub through incentives, education, and promotion of bitcoin adoption. (Portal do Bitcoin) (CriptoFacil)

Brazil’s Ministry of Defense has incorporated TS4, a blockchain-based solution developed by Tarpon Tech, into its Program for Electronic Documents. (BlockNews)

The Central Bank has launched a “contest button” in Pix apps so users can dispute fraudulent transactions digitally. Upon activation, the system will signal the payment recipient’s bank to block the funds, with a return to the victim in up to 11 days. (Portal do Bitcoin)

Brazil now ranks as the country with the most businesses accepting Bitcoin payments in the world, with more than 1,200 merchants now taking BTC for goods and services, according to data from BTC Map. (Livecoins)

🏛 Policy, Regulation and Enforcement

Brazil’s judiciary has begun testing CriptoJud, a new system that lets courts block and seize cryptocurrencies directly on exchanges. (CoinTelegraph Brasil) (Livecoins)

The powerful rural caucus (bancada do agro) in Congress blocked the first vote on MP 1303, a provisional measure that would have eliminated the tax exemption on crypto gains earned abroad. (CoinTelegraph Brasil)

A man under investigation for a major INSS (Brazil’s social security sysetm) fraud attempted to convert R$59 million into cryptocurrencies, according to authorities. (Portal do Bitcoin)

The Brazilian Central Bank’s proposed Consultation 124/2025 seeks to treat stablecoin transactions used in international transfers as foreign exchange operations, requiring they comply with traditional FX rules - a shift that aims to close regulatory gaps and bring crypto platforms under the same supervision as banks and authorized FX providers. (CoinTelegraph Brasil)

The CVM’s forthcoming regulation for tokenized assets aims to enable a quasi-secondary market by relaxing current restrictions under CVM Rule 88, allowing issuer control of secondary trading within closed environments under certain conditions. (Portal do Bitcoin)

The CVM has issued a public warning against a crypto-forex platform offering leverage of up to 200x to Brazilian users. (Livecoins)

A judge has ordered that Glaidson Acácio dos Santos, aka “Pharaoh of Bitcoins”, be removed from the Rio prison system and transferred back to the federal system for three years in maximum security, citing ongoing risks to public safety and continued criminal influence. (Portal do Bitcoin)

Federal Police arrested an influencer accused of orchestrating a R$146 million fraud scheme, using PIX payments as a front. (Portal do Bitcoin)

A kidnapping-for-crypto case in Goiânia ended violently this week, with two suspects killed and one arrested after a police chase. (Livecoins)