🇧🇷BCR #35: Rio to Accept Crypto Taxes; Hashdex Plots European Expansion

👋 Bom dia and welcome to 🇧🇷Brazil Crypto Report for March 21-25th, 2022.

We’re in exciting times now that Coinbase is reportedly in advanced talks to acquire 2TM Group and Mercado Bitcoin. If you haven’t seen, take a look at the analysis I published on Sunday. We haven’t learned any additional details since but I’ll be keeping a close eye on this story moving ahead.

🤯 One of the important themes from last week that I didn’t have a chance to write about was a decision by the Supremo Tribunal Federal - Brazil’s Supreme Court - to issue an order blocking messaging app Telegram from operating in the country unless Telegram shut down the profiles of certain accounts of President Jair Bolsonaro supporters who were spreading “misinformation” and met a list of other conditions.

Telegram has long prided itself on its “censorship resistant” value proposition. So it was surprising to see founder Pavel Durov capitulate and agree to the STF’s demands. Telegram removed the channels and profiles of identified “misinformation” spreaders and agreed to manually monitor each day the 100 most popular channels in Brazil - tagging flagged posts as “inaccurate”.

Irrespective of politics, this is a development that many in the crypto world will find disturbing (it hasn’t been publicized much outside of Brazil) as Telegram has obviously been the go-to messaging app for crypto investors and communities. It’s enjoyed this status precisely because of its refusal to bend the knee to governments and take these types of censorship actions. Will there be a slow migration away from Telegram to more secure platforms like Signal? We’ll see

Updates on the CZ/Binance Brazil Roadshow

CZ told newspaper O Globo that Binance will comply with all relevant Brazilian crypto legislation and regulation as soon as it opens an official office in the country. This would include Normative Instruction 1888, under which the exchange must inform authorities of user activities. CZ told O Globo:

“Brazil is very important to us and we are at a turning point in Brazil, from an unregulated to a regulated market. And I want to make our intentions for Brazil very clear…We want to act in full compliance with the regulation, to make the market grow in a healthy way."

Questions of regulatory dodging and facilitation of illicit activity have plagued Binance in Brazil recently. CZ sought to drive a stake through the heart of those narratives in the interview, continuing:

"I believe that regulation is important. We are not evolved enough to live in a society without rules, so you have to have some rules. Current regulation in this sector around the world is still very incipient. Most regulations only consider brokers , but there are also EFIs, NFTs, GameFi, SoFi, fan tokens, metaverse." (CoinTelegraph Brasil)

Binance also intends to launch a crypto debit card product in Brazil and is looking for partners to assist. The nice thing about crypto debit cards that convert crypto into fiat upon the point of sale is that they increase crypto payment adoption without necessarily requiring merchants to accept crypto. (CoinTelegraph Brasil)

CZ also announced via Twitter that Binance will soon open an office in Rio de Janeiro, though the location of the much sought-after Binance Brazil headquarters remains unrevealed

Rio de Janeiro to Accept Crypto Payments for Taxes in 2023

Rio formally announced that residents would be able to pay their IPTU tax in cryptocurrencies starting next year. The city also announced the creation of the Municipal Committee for Cryptoinvestments, which will establish rules and guidelines that govern how the city invests resources into the crypto economy.

The plan aims to “stimulate the circulation of cryptocurrencies” while using them as a means to stimulate culture and tourism. Secretary of Economic Development Chicão Bulhões said in a statement:

“In addition to already having a strong ecosystem in the area of crypto-assets, the city has great potential to grow even more, due to the large number of universities and research centers installed here. The cryptocurrency universe is yet another important segment with great potential to further develop Rio’s economy in this area of innovation and technology.”

(Valor Investe) (O Globo)

💣 Trending Cryptos in Brazil

The most popular cryptos in Brazil as of March 29 are Bomber Coin, Smooth Love Potion and Baby Doge Coin, per data provider CoinGecko.

👩💻 Brazil Crypto Jobs Spotlight

Job Openings

Fan token platform Socios.com is hiring for a Head of Marketing in Brazil. Socios, which is powered by the Chiliz platform, has already partnered with Palmeiras, São Paulo FC, Clube Atlético Mineiro, and Flamengo in Brazil and now looks to onboard 200+ more football clubs onto its platform

Transitions

Crypto asset manager Hashdex has appointed Laurent Kssis to lead the company’s European expansion efforts. Kssis spent two years as managing director at Swiss crypto asset manager 21shares. (CoinDesk) (The Block)

🎉 Upcoming Events

Crypto events in Brazil are a thing again. Here’s are some upcoming ones to keep on your radar

Portal do Bitcoin Summit - March 30 (online)

BITCONF by CoinPayments is happening May 20-22 in São Paulo.

Blockchain Rio - September 1-4 in Rio de Janeiro

🗞Brazil Crypto News Rundown

📈 Markets

Tokenization platform Liqi is launching a new crypto exchange in Brazil.

Liqi was founded by BitcoinTrade founder Daniel Coquieri

The firm recently raised a R$27.5m investment round from the likes of Kinea Investimentos, Itaú Unibanco and others.

The platform’s official launch will come on April 4

“Since we created Liqi, the purpose has been to connect blockchain, tokens and cryptocurrencies to the traditional financial market. Little by little, we gained people's trust and showed what we are capable of. We value security and access democracy, this is our essence. Our next step will be to bring NFT and DeFi.” (CoinTelegraph Brasil) (Portal do Bitcoin)

Fuse Capital is launching a stablecoin investment fund that seeks to yield 20%+ yield annually.

The Fuse Capital Wasabi DeFi Yield fund seeks to circumvent the general volatility of cryptocurrencies.

The minimum required investment into the fund is US$100k

The fund will be administered by Atlas Fund Services, with custody handled by Transfero Group

To manage the fund, Fuse brought on Marcel Weiskopf, who previously spent 18 years managing currency and fixed income portfolios for Fox Investimentos, a hedge fund. Weiskopf commented:

"Wasabi's operation is very similar to fixed income or high yield funds. Its great differential is our experience. Because of it, we were able to use DeFi solutions and methodologies that we created at Fuse to operate in high yield in crypto. This is something that is still beyond the reach of most institutions." (CoinTelegraph Brasil)

Mercado Bitcoin announced that it will list five new ERC 20 tokens, inlcuding Keep Network (KEEP), Render Token (RNDR), Origin Protocol (OGN), Skale Network (SKL) and Opulos (OPUL). (Portal do Bitcoin)

Passfolio announced the listing of 18 new cryptos, inclduing TerraUSD (UST), Wrapped Centrifuge (WCFG), Ethereum Name Service (ENS), Solana (SOL and more. (CoinTelegraph Brasil)

📱Adoption

25% of Brazilians are expected to buy cryptocurrency this year for the first time, per a new survey commissioned by Sherlock Communications. Currently, 13% of the Brazilians have purchased crypto. The survey was conducted across multiple Latam markets, but found that Brazil is at the most advanced stage of adoption. (CoinTelegraph Brasil) (Exame)

Buddha Spa is partnering with Foxbit to tokenize its business. Brazil’s largest spa network will issue a token on the Ethereum blockchain that gives investors exposure to Buddha Spa’s growth (a token will be distributed every time a massage is performed), affords votes on company strategic decisions and gives token holders discounts on services. The token will be traded on Foxbit. Gustavo Albanesi, Buddha Spa CEO, said in a statement:

“The Buddha Spa Token represents a significant innovation in the wellness market. In addition to discounts on products and services, it gives the user the right to vote in the company's decision-making and also works with an investment". (CoinTelegraph Brasil)

Socialtech Ribon, a Brazilian startup lauded by the Bill and Melinda Gates Foundation, announced that it will change its business model into a DAO later this year. The platform allows users to donate to social causes using tokens in an easily traceable way. (CoinTelegraph Brasil)

Brazilian UFC star Matheus Nicolau will receive payment for his fights in bitcoin via a partnership with payroll service Bitwage. Per the announcement, Nicolau is the first Latin American athlete and second UFC fighter to be paid in bitcoin.

“I make my money the hard way. I bleed for it. MMA is an intense sport where you put everything you've got. While I'm constantly struggling on the one hand, I get the feeling that I'm constantly losing money on the other. Then it occurred to me: Bitcoin is the solution.” (CoinTelegraph Brasil

Brazilian developer Gustavo Toledo launched a mini YouTube course to help developers learn to program in Solidity. (Portal do Bitcoin)

🎮 NFTs, Gaming and Metaverse

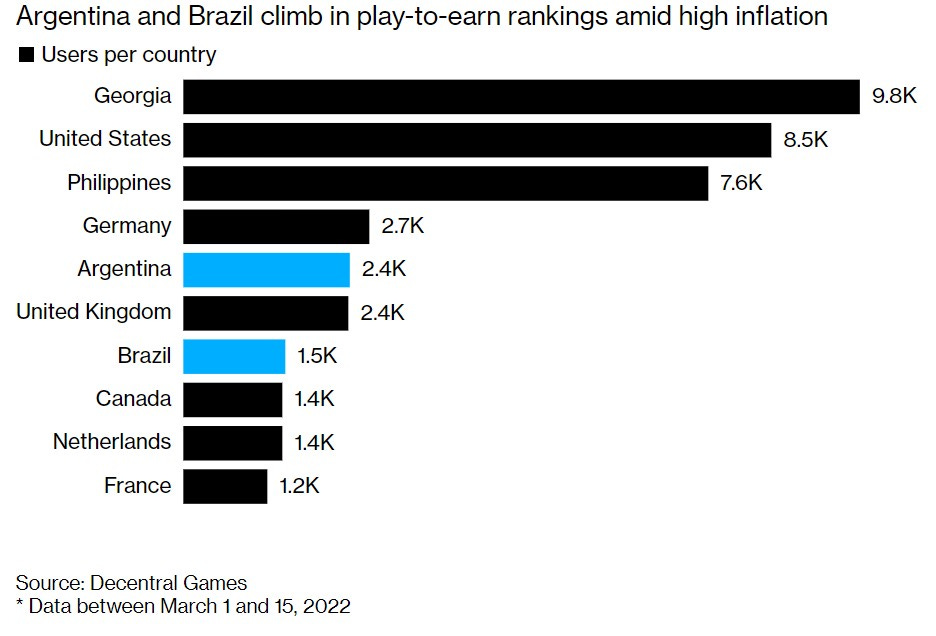

Brazil has the 7th most NFT game users in the word, per a new study by Decentral Games. In Latam, only Argentina had a higher amount.

Gabriel Mellace, head of investor relations at Decentral Games, commented:

“The trends in Argentina and Brazil show that the numbers will continue to rise. Young people are not just looking for profitability. They are also looking for fun.” (Portal do Bitcoin)

Businesswoman and celebrity Carol Paiffer of Shark Tank Brasil will begin investing in NFTs, starting with a project called Timeless by Brazilian artist Luca Benites. With the thesis that digital is “on par” with the real world as far as experiences go, she commented:

“We must always be aware of new market trends, and NFTs will certainly still have great growth among artists, brands and audiences. I've known Luca's work for a long time, and when I found out that he was going to launch this new digital project, I knew it was the right time to step into this universe.” (CoinTelegraph Brasil) (Exame)

Brazilian UFC fighter José Aldo announced a new NFT collection commemorating previous fights and representing open vacancies in a fight gym in The Sandbox metaverse. After launch, the first 500 reservations for the metaverse gym sold out in one hour. (CoinTelegraph Brasil)

Brazil’s first metaverse wedding took place in Decentraland between CNN jouranlist Rita Wu and Andre Mertens. The ceremony was held in a virtual church in partnership with an Outback Steakhouse store and Stonoex. (CoinTelegraph Brasil)

Zebedee, a bitcoin-native gaming startup, launched a new integration with Bipa that facilitates bitcoin network play-to-earn game rewards into reals and Brazilian bank accounts. Bipa is a Brazilian mobile app that allows users to trade bitcoin in reals via the Lightning Network. (CoinTelegraph Brasil)

Neymar earned more than R$1.4m (US$291k) worth of ApeCoin due to his Bored Ape NFT purchases. (CoinTelegraph Brasil)

Lumx Studio, a Brazilian project focused on metaverse, raised R$2m in 24 hours via the sale of 3000 NFTs that give holders the voting power in the future of 55Unity - a post-apocalyptic themed game that takes place in Rio de Janeiro. (Exame)

🏛 Public Policy, Regulation and Enforcement

A Rio de Janeiro court has ordered the seizure of assets from “Pharaoh of Bitcoins” Glaidson Acacio dos Santos, his wife Mirelis Zerpa and GAS Consultoria to reimburse former clients. The lawsuit was brought by a consumer protection group trying to block R$17bn (US$3.56bn) in funds held by the three entities. (CoinTelegraph Brasil)

Federal Police arrested a Paraná couple accused of earning R$6m in 2019 with fake crypto trading robot, in an entitled Bad Bots. The plot deceived more than 3,000 customers by promising exorbitant and automated returns, but then refused to process customer withdrawals. (Portal do Bitcoin)

The Banco Central officially changed its “open banking” nomenclature to “open finance” as it seeks to encompass more than just traditional banking products. (Exame)