🇧🇷BCR #37: Why was Roberto Campos Neto in Miami this week? 🤔

Did the Banco Central president attend BTC Miami? BTC trading volumes up 28% in March; Brazil leads in Latam crypto adoption, per Gemini report

Bom dia amigos -

🎙Before we dive in I’d like to quickly note that the 🇧🇷Brazil Crypto Report podcast is up and in a groove. You can check out the latest episode with Paulo Alves, crypto editor at InfoMoney on Spotify or on my Substack page. We geek out on some of the big Brazil crypto news of the last month.

I hope everyone who made it to Bitcoin 2022 in Miami this week enjoyed themselves and learned something interesting. Looks like there was a big turnout from the Brazil crypto scene, so nice job showing up to represent✊. I wasn’t able to make it this year regrettably. I was on the road too much in March so decided to sit this one out.

Interestingly, Banco Central do Brasil president Roberto Campos Neto was also in Miami this week for a pre-scheduled vacation amid a strike by his employees. Bitcoiners of course read into this as more than just a mere coincidence:

Did Campos Neto actually travel to Miami to hang out with bitcoin bros? The Banco Central declined to comment publicly on his reason for the trip, so we’ll probably never know for sure. Nevertheless it is a fun speculation game - for all we know he may have just been hanging out at the beach, but there are some compelling reasons to suspect that he actually went to the conference in stealth (or at least to take meetings).

While hardly a “bitcoiner”, Campos Neto has been very forward thinking in his embrace and understanding of blockchain technology, smart contracts, etc. - particularly in his approach to the Digital Real development. He clearly understands the value proposition of crypto and sees where this is all going.

We know he has lots of relationships with important figures in the bitcoin/crypto scene. For example, Brian Brooks - the former head of the US Office of the Comptroller of the Currency and (briefly) the CEO of Binance.US; Jeremy Allaire - the CEO of Circle; Valor Capital Group - an outfit that has invested in most of the prominent Brazilian crypto companies like Hashdex.

Seems like awfully bad timing for a “vacation”. BC employees are demanding a 25% pay increase, and are threatening to go on strike and temporarily shut down the Pix payments system (currently the crown jewel of BC financial innovation) if they don’t get their way.

There’s also a clear trend of government authorities and central banks in the Latam region looking at bitcoin more closely. The case of El Salvador adopting bitcoin as legal tender is just the tip of the spear. (CoinTelegraph Brasil reports that Rio de Janeiro Mayor Eduardo Paes was also in attendance).

If he was actually attending Bitcoin Miami, there’s no way the BC would actually say so publicly. We’re still way too early and bitcoin is still a pretty controversial issue in these circles. Publicly admitting that the BC president was attending a bitcoin conference would be a public relations train wreck.

Just to overemphasize, I have no idea what Campos Neto was doing in Miami last week, but I wouldn’t be the least bit surprised if he was indeed there to hit up the conference and/or meet with bitcoin and crypto people. Adoption is picking up speed at a massive clip right now and forward-thinking regulators like Campos Neto recognize that they need to stay on top of these developments or get left behind.

- AWS

🎉 Upcoming Events

Crypto events in Brazil are a thing again. Here’s are some upcoming ones to keep on your radar

Future of Money portal is hosting a virtual Digital Gold Masterclass with Andre Portilho on April 12-14

BITCONF by CoinPayments is happening May 20-22 in São Paulo.

Blockchain Rio - September 1-4 in Rio de Janeiro

🗞Brazil Crypto News Rundown

📈 Markets

Bitcoin trading in Brazil for March was R$4.9bn (US$1.04bn) up 28% from February, ending a four month decline in trading volumes, per data from CoinTrader Monitor. The increase comes against the BRL’s strengthening valuation against both bitcoin and the dollar.

23,181 total bitcoins were exchanged during the month across Brazilian exchanges, with an average daily trading volume of 747 BTC.

Total volume was down 15% from March 2021, when crypto markets were in peak euphoria.

Impressively, Binance accounted for nearly half of total bitcoin trading volume in the country (48.6%). This figure is up by nearly 50% from January, when it had a market share of 32.8%. (CoinTelegraph Brasil)

Mercado Bitcoin listed four new tokens for trading: Singularity DAO (SDAO), MetisDAO (METIS), Badger DAO (BADGER) and Singularity Net (AGIX). (Portal do Bitcoin) (CoinTelegraph Brasil)

The NFTS11 ETF listed for trading this week on the B3, Brazil’s primary stock exchange.

The NFTS11 product tracks the MVIS CryptoCompare Media & Entertainment Leaders Index, managed by MV Index Solutiions.

Investo and VanEck are the firms behind product

The MVIS is comprised of a basket of metaverse tokens including Decentraland (MANA), Axie Infinity Shards (AXS), Gala Games (GALA), Basic Attention Token (BAT), Chiliz (CHZ) and Enjin Coin (ENJ).

NFTS11 carries an administrative fee of 0.75% per year and a purchase price of R$100 (US$21) per share.

Jan Van Eck, CEO of VanEck, commented:

“We are delighted to bring this new fund to the Brazilian market in partnership with Investo, providing attractive solutions for investors looking for ways to grow invested markets and add targeted and differentiated exposures to the digital asset universe.” (CoinTelegraph Brasil)

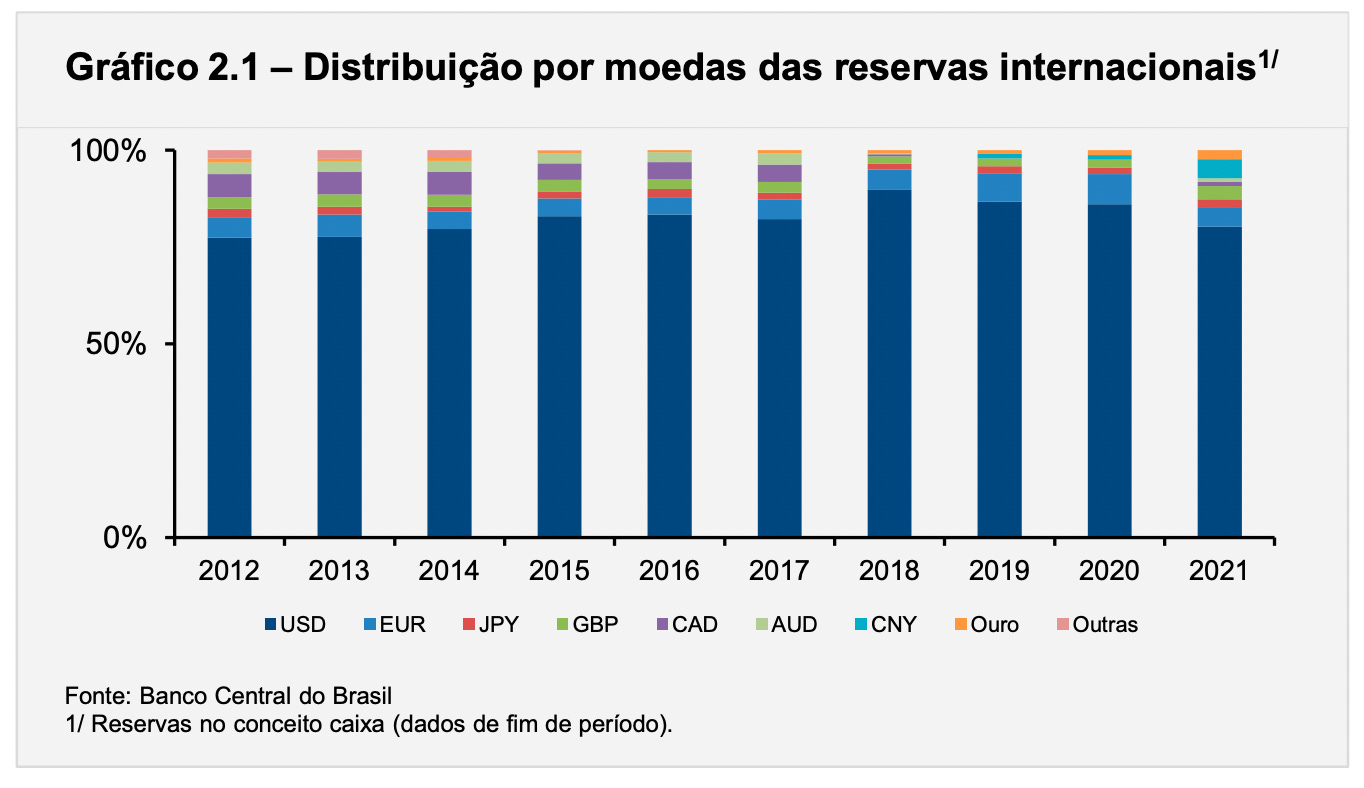

The Banco Central increased the share of yuan and gold in its foreign currency reserves in 2021, while decreasing its exposure to dollars and euros. The dollar continues to be the overwhelming currency in the reserve, though that share decreased from 86% to 80% from 2020. (CoinTelegraph Brasil)

Binance made 12 new cryptocurrencies available for purchase by Brazilian customers with debit cards. (Livecoins)

Inflation in March hit was the highest seen in the month in 28 years, with the IPCA consumer price index rising 1.62% from February, and up 11.30% over the prior 12 months. The Banco Central has raised its baseline Selic interest rate from 2% to 11.75% during that time in an attempt to cool off the economy, and it has signaled another 100 basis point rate hike to come in May. (Reuters)

📱Adoption

Brazil leads the Latam region in crypto adoption, according to Gemini’s 2022 Global State of Crypto report. Some findings from the report, which surveyed 1,700 Brazilian adults:

41% of respondents own crypto

51% of crypto holders acquired their first crypto within the past year

45% of respondents say they plan to purchase crypto for protection against inflation

The gender breakdown of Brazilian crypto holders is 55% male, 45% female

66% of respondents said that cryptocurrency is the future of money

Among non-owners who plan to purchase crypto in the next year, 55% are women (Money Times) (CoinTelegraph Brasil)

Glenn Greenwald, an American journalist who lives in Rio de Janeiro, publicly spoke out against attacks on bitcoin and crypto by Hillary Clinton and other US Democrats. Greenwald also appeared on stage at the Bitcoin Miami conference with former US presidential candidate Andrew Yang.

Football club Vasco da Gama is launching inaugural “club coins” to commemorate the 2022 Brazilian championship. They will be issued as NFTs through a partnership with Block4, which is backed by 2TM. (CoinTelegraph Brasil)

Ex-Brazilian YouTuber Bruno Aiub, known as “Monark”, argued that platforms such as YouTube are in decline and that decentralized networks like bitcoin are the future. Co-host of the Flow Podcast and sometimes referred to as the “Brazilian Joe Rogan”, Monark’s YouTube channel was demonetized in February. (CoinTimes)

Bruno Garcia, a back-end developer at Mercado Bitcoin, was awarded a scholarship to study bitcoin code development by the Brink Foundation. Garcia was a key contributor to bitcoin’s Taproot upgrade, which was implemented last November. He commented on the grant:

“The focus is to continue helping with testing and reviewing pull requests, improving functional tests by covering more features, studying more about mutation tests to implement in Core and some other things more from wallet, network, peer to peer.” (Portal do Bitcoin)

SBT, Brazil’s second-largest television network, auctioned off an NFT collection with InsipireIP and Mercado Bitcoin that feature images and stories of Silvio Santos, the network’s founder. Bruno Milanello of Mercado Bitcoin commented:

“The number of large companies and personalities that have an eye on the cryptoeconomy is growing. The SBT initiative is a pioneer in the country's television by bringing together entertainment and the vanguard of cryptoeconomics around Silvio Santos, a personality dear to all Brazilians”. (BeinCrypto) (CoinTelegraph Brasil) (Exame)

The Shibata supermarket chain in São Paulo is accepting the WiBX cryptocurrency as a form of payment. Shibata is one of the investors and partners in Wiboo, creator of WiBX, which trades on Mercado Bitcoin. Customers are eligible for promotions, invitations and cash back by using the WiBX application. Because the crypto is connected to the supermarket’s payment system, the payments are made directly via a QR code generated by the cashier’s computer screen. (CoinTelegraph Brasil)

São Paulo brewery Cervejaria Dogma will launch a Hazy IPA beer called Halfin in honor of Hal Finney, a cypherpunk and one of the critical figures in bitcoin’s history. In 2021, it released a similar beer named for Satoshi Nakomoto. Dogma will also release a new beer in partnership with Carol Souz and Kaká Furlan of UseCripto. Leonardo Satt, co-founder and partner at Cervejaria Dogma commented:

“The evolution of money and currency has changed the economic system over time, and what happens with bitcoin today is the next level of evolution of the monetary system. In this historical scenario, Hal Finney is one of the most important people after Satoshi Nakamoto, so we decided to honor him”. (CoinTelegraph Brasil) (Livecoins)

CriptoBeer, a collectible Brazilian beer, hits the shelves later this month. Each can of beer will have unique and exclusive labels that will have associated NFTs and metaverse functionality. (Crypto Times)

🎮 NFTs, Gaming and Metaverse

Preta Gil, a popular Brazilian actress, singer and presenter, entered the NFT market with a purchase of one of two CryptoRastas. She currently has 9.2 million followers on Instagram and 5.5 million on Twitter. (CoinTelegraph Brasil)

The Oscar Neimayer Museum in Curitiba is hosting its first ever NFT art exhibit. The work is entitled “Origin”, by Parana artist André Mendes and is a mural that can be accessed through augmented reality via an Instagram filter. (CoinTelegraph Brasil)

The producers of the Brazilian film Blue Building Detectives 3 - an Adventure to the End of the World, are launching a series of NFTs linked to items used by actors during filming that will grant exclusive experiences. The NFTs are being auctioned on the NFTexp marketplace, with proceeds going to charity. (CoinTelegraph Brasil) (Portal do Bitcoin)

Brazilian pharmaceutical manufacturer Cimed is launching a collection of 119 NFTs to raise funds for scientific research in space. (CoinTelegraph Brasil) (Exame)

The CVM, Brazil’s securities authority, held a meeting in the metaverse to promote education around NFTs and metaverse concepts for consumers, investors and policy makers. The event was part of the CVM’s Global Money Week. José Alexandre Vasco, the CVM’s investor guidance superintendent, emphasized that metaverse is an important trend in the post-pandemic world:

“CVMEducacional, CVM's financial education channel, placed its cornerstone in Metaverso. The idea is that, in the short term, there will be periodic events in Metaverso, and, in the medium term, an educational environment will also be developed by CVMEducacional.” (Livecoins) (CoinTelegraph Brasil)

🏛 Public Policy, Regulation and Enforcement

The Senate approved a request by Senator Irajá to consolidate three Senate crypto bills and the bill passed by the Chamber of Deputies in December into a single text, setting up the bill for a vote in the Senate Plenary. Should the legislation be approved, it will be sent to the Chamber of Deputies where the amended legislation would need a full plenary vote. The texts are largely similar, however there are some key differences. The updated text:

Requires the segregation of investors’ assets, whereby in the event of a bankruptcy, client assets would be separated from those of the company and be unable to be used for settling debts

Promotes a tax exemption for crypto mining done with clean energy

Creates a register of politically exposed persons (Portal do Bitcoin)

João Pedro Nascimento, the incoming president of the CVM, Brazil’s securities authority, highlighted cryptocurrency as an issue that “must be addressed” during his confirmation hearing in the Senate. (CoinTelegraph Brasil) (Livecoins) (Portal do Bitcoin). Nascimento stated:

“The intermediary, when it says that it is holding crypto assets for its clients, has to demonstrate that these assets are protected, they cannot be affected by anything other than the fluctuation risk itself. The investor must be subject to the risk he wants”.

Senator Flávio Arns of the Podemos party shared his perspective on crypto legislation in the Senate with Crypto Times. Some highlights from the interview:

The bill has three primary objectives: 1) give security to the digital assets market, which saw R$200m (US$42m) traded in 2021 but lacks a regulatory framework, 2) ensure crypto businesses are in compliance with anti-money laundering and financial crime provisions mandates, and 3) protect Brazilian investors against fraudulent shell companies and pyramid schemes dealing in cryptocurrencies

The legislation will require crypto companies to hold a state-issued license before able to open and operate, and be subject to supervision from the regulating body moving ahead. The bill also would require the Consumer Protection Code to be applied in the relationship between consumers and crypto brokers.

There wouldn’t be much immediate change required for crypto companies that already abide by the provisions in the legislation

The big change will come once the Banco Central (the likely regulatory body to be assigned to oversee the market) defines its procedure for licensing new entrants and supervising current actors

The legislation was drafted with extensive dialogue with the market participants and carries “no risk” of stifling innovation in this sector

Renato Dias Gomes, a candidate for director of the Banco Central, defended the need for crypto regulation during a confirmation hearing in front of the Senate Committee on Economic Affairs.

The CEA approved his candidacy, which now moves toward a full Senate Plenary vote.

Gomes, who is currently an economist at the BC, extolled the need for crypto policy to focus on three fronts: preventing money laundering and terrorism financing, prudential regulation and financial education.

Gomes also opined that most cryptocurrencies “have no fundamentals”, adding that:

“Many Brazilians have been trading crypto assets. And they are dangerous assets, which do not work as insurance for Brazilians' income fluctuations. Consumers need to know what they are doing.” (Livecoins) (Valor Investe)

Andre Brasil, a gold-medalist swimmer for Brazil’s paralympics team, claims in a new lawsuit to have lost R$160,000 that he invested in MSK Invest, a pyramid scheme that is under investigation in Sao Paulo. (Livecoins)

Crypto hardware wallets like Ledger and Trezor will be exempt from import taxes until 2025, per new guidance released by the Bolsonaro administration. It’s unclear, however, how much of an impact this decision will have on the total price of the device. The reduction comes as part of a broader import tax holiday on computer and telecommunications goods; however, crypto wallets were specifically identified in the decision, which was published in the Official Gazette of the Union. It describes hardware wallets as follows:

"Cryptocurrency storage devices, supporting Bitcoin, Ethereum, XRP, Bitcoin Cash, EOS, Stellar, among other digital currencies, secure bitcoin wallet, with the function of connecting any computer via USD and with built-in OLED screen for double checking and confirmation of transactions with a single touch of its buttons." (CoinTelegraph Brasil) (Livecoins)

A São Paulo family is seeking R$3m (US$630k) in reimbursement from MR7 Bank, an investment scheme that promised 12% monthly returns by investing in cryptocurrency. A subsidiary company called Open Sea Securitizadora (not affiliated with Open Sea) was used to apparently used to market the scheme. (Livecoins)

The Federal Public Ministry is hosting an online course on April 25 called Cryptocurrencies and Criminal Asset Persecution to train civil police and state public ministry agents. The lead speaker will be Attorney General Alexandre Senra, who holds a certificate in blockchain from Massachusetts Institute of Technology and in decentralized finance from University of Nicosia. (Livecoins)

The Receita Federal, Brazil’s tax authority, has extended the income tax filing deadline from April 5 to May 31, giving crypto traders more time to figure out

their liabilities ☠️. (CoinTelegraph Brasil) (Portal do Bitcoin)

GAS Consultoria partner Tunay Pereira Lima was returned to prison from house arrest after a habeas corpus petition was denied. (Portal do Bitcoin)

The US Secret Service taught a course on cryptocurrency crime and forensics to Brazilian law enforcement personnel. The training took place at the Ministry of Justice in Brasilia. (Livecoins)

A new bill introduced in the Chamber of Deputies seeks to limit the extent that cryptocurrencies and other investment assets can be seized in lawsuits and bankruptcy proceedings. (Livecoins)

The CVM published a list of 23 countries that “most threaten” the global financial system, including Turkey, Cayman Islands, Malta, Panama, Philippines and United Arab Emirates. (Portal do Bitcoin)

Samsung Brasil’s YouTube account was hacked and used to promote a scam using the image of MicroStrategy CEO Michael Saylor. (Livecoins)