🇧🇷BCR #46: Binance Drops Brazilian Fiat Onramp Amid KYC Policy Changes

Also - XP to launch BTC and ETH trading in July; Brazilians ❤️ NFTs

Fala pessoal!

Welcome to 🇧🇷Brazil Crypto Report for the week of June 13-17. It’s getting pretty ugly out there in the markets. I hope everyone’s staying safe and liquid given all the chaos right now.

🏛 We didn’t see any movement on crypto legislation in the Chamber of Deputies last week. However, the bill is on the Chamber’s agenda and could be voted on as early as today. A passing vote would seal the deal and send the bill to President Jair Bolsonaro’s desk to be signed into law. We’ll be watching closely 👀

💰Binance abruptly announced that it is dropping Capitual, its payment servicer and fiat onramp, in exchange for a local provider “to be announced soon”. The surprise announcement came amid reports from customers that Binance had suspended BRL withdrawals via Pix and Ted on its platform, citing updates to the Banco Central’s KYC policies. Other foreign exchanges including Kucoin experienced similar service disruptions due to the change.

The news was first reported by Portal do Bitcoin citing reports from customers, who received the following message from the exchange’s help desk.

“Our BRL deposit and withdrawal channel via PIX and TED is experiencing instability due to the update of Policies introduced by BACEN – Central Bank of Brazil. Deposits and withdrawals through this means are blocked, but don't worry, you can still use other methods to withdraw and deposit.”

In a press release, Binance stated that users could still transact via Binance’s peer-to-peer system and that withdrawals could be processed through a “sell to card” option for Visa. Binance also stated that it will be taking legal action against Capitual, though it’s unclear what the nature of the dispute is.

"[Binance] will promote a smooth transition in the coming weeks and that it is taking all necessary measures, including legal related to Capitual, to ensure that users are not adversely affected by the change".

KuCoin and Huobi, foreign exchanges that also use Capitual, continue to use the vendor. Capitual said in a statement that the two exchanges

“adjust their systems to the changes that have occurred and the services provided to their users in transactions with reais happen regularly…In the case of Binance, Capitual awaits information on this suitability."

Amid the confusion, KuCoin put out an announcement it is now the first major exchange to accept deposits and withdrawals in reais following the enactment of. the new KYC rules. KuCoin CEO Johnny Lyu said in a statement:

“We are proud to be the first exchange to comply with the new PIX regulations and support our Brazilian users to deposit and withdraw BRL normally.” (Livecoins)

I’ll give another update on this story in next week’s edition

Before I dive into this week’s news review I wanted to share a quick team photo from the Ethereum Brasil breakfast last week in Austin at Consensus. It was a great opportunity to meet a bunch of new people from the Brazil scene. Thanks to Conor and Sabrina from the ETH Brasil team for organizing!

Another follow up to Consensus, Paulo Alves of InfoMoney had an excellent write up and produced a really great video with highlights and interviews from the event. Definitely worth a watch. He interviewed several stakeholders from the Latam region and he even managed to find a gringo who speaks Portuguese quite well 👏👏👏

🎙 Be sure to check out the most recent BCR podcast with Daniel Vogel, CEO of Bitso, which we recorded onsite at Consensus 2022. You can listen to the episodes in your browser and on Spotify.

🙏 Thanks to our partners at HBAR Foundation for supporting 🇧🇷 Brazil Crypto Report! If you're a Latam entrepreneur or developer with an up-and-coming project or idea and need some support, take a look at the HBAR grant program. They're seeding projects focused on DeFi, fintech, NFTs, sustainability and so much more. They also offer a plethora of other resources to help builders bootstrap. Do yourself a favor and check them out! 👊

🗞Brazil Crypto News Rundown

📈 Markets

XP will enable bitcoin and Ethereum purchases for customers starting in July. The decision was made after internal surveys showed that half of the company’s clients had some form of exposure to cryptocurrencies. Lucas Rabechini Amaral, director of financial products at XP, commented:

"Of this total of 50% who already had investments in cryptocurrencies, 88% wanted to do so through XP, as it is an environment they already know and trust." (CoinTelegraph Brasil)

InfoMoney/CoinDesk Brasil examined the trend of Latin American crypto exchanges offering some of the highest yield rates in the world on crypto investments. Some exchanges like Bitso offer as much as 15% on stablecoins - much higher than is found in more developed markets. Lemon offers 13% on Dai and 12% on USDC to its Argentine customers, and it previously offered 18% to users who staked UST via Anchor, raising concerns about where exactly these yields are coming from.

The B3 exchange announced that is developing a futures contract with exposure to bitcoin, to be launched later this year. The product will trade at 10% of the price of bitcoin. (CoinTelegraph Brasil)

Lemon Cash, an Argentine exchange, will launch in Brazil in late July and offer users a direct integration with Pix that allows users to load their personal account via Pix and convert to their preferred crypto via a swap tool, and vice versa. (CoinTelegraph Brasil)

Mercado Bitcoin listed eight new cryptos, including Civic, Biconomy, Braintrust and Decentral Games. (CoinTelegraph Brasil)

Brasil Bitcoin announced the listing of two new assets - Band Protocol and Quant, while BlueBenx listed 14 new assets led by Ethereum Classic, Monero, Filecoin and Aave. (CoinTelegraph Brasil)

MB Tokens, an asset tokenization firm in the Mercado Bitcoin ecosystem, partnered with Bolt Energy to launch a token backed by an electricity trading contract with an estimated yield of 15.2% per year. (Portal do Bitcoin)

📱Adoption

Brazilians invest more in cryptocurrencies than in real estate funds, commodities and foreign currencies, per a new report by the São Paulo School of Business Administration of the Getulio Vargas Foundation. Other findings from the study include:

Brazilians are more exposed to crypto than English or French investors

Brazilians take into account a manager’s opinion moreso than the risk itself when making investment decisions

Brazilians invest with much more of a short to mid-term mindset vis-a-vis French and British, placing a premium on liquidity and the ability to redeem invested money quickly. (Valor Investe)

Denelle Dixon, CEO of Stellar Development Foundation, praised the Digital Real plan put forth by the Banco Central and Roberto Campos Neto, saying that it’s the best medium for preserving the role of banks in the financial system while guaranteeing the digitization of money using blockchain. SDF last month joined Mercado Bitcoin’s LIFT Digital Real Challenge consortium, which is developing a proof of concept for the CBDC. (InfoMoney)

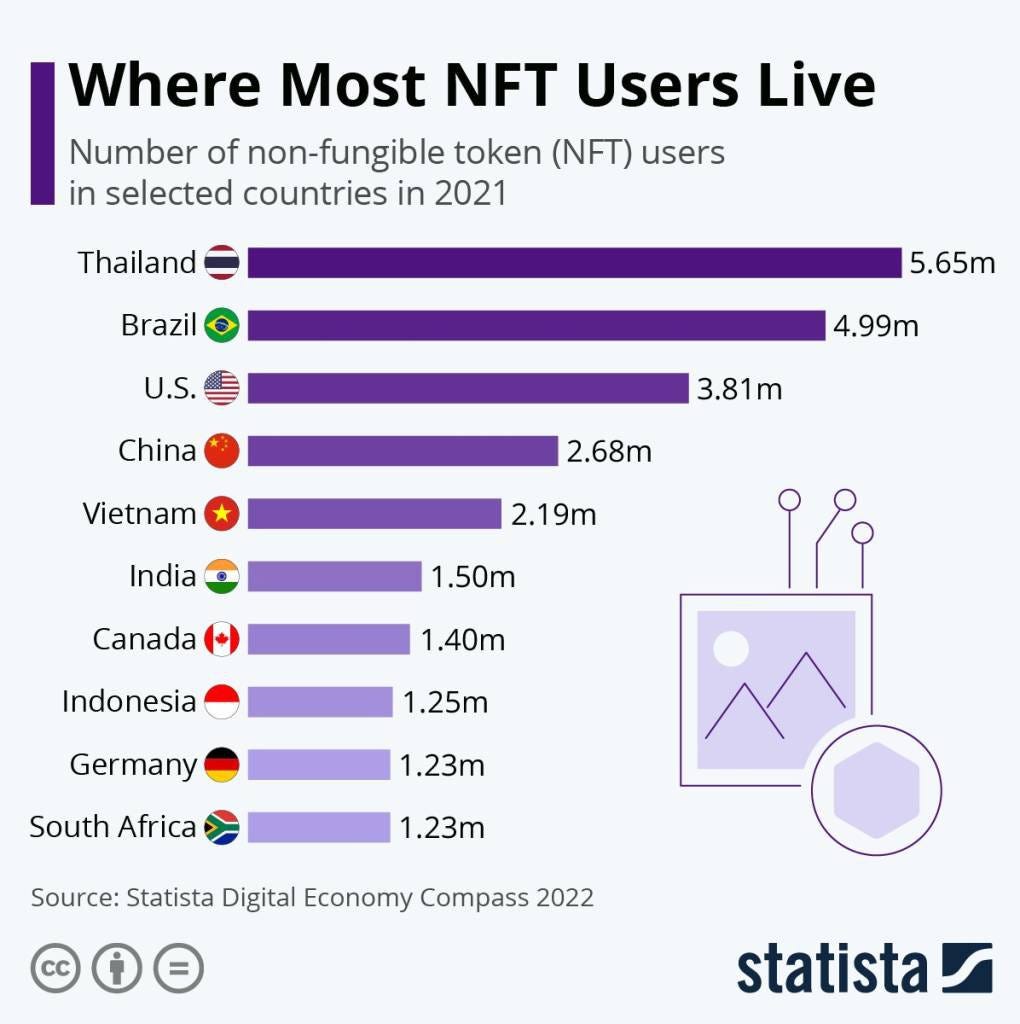

Brazil has the second-most NFT investors of any country, according to a survey by Statista. (Exame)

Despite announcing plans to lay off 1,100 employees (roughly 18% of its workforce), Coinbase will not cut any of its 40 engineers working in Brazil. Fabio Plein, Coinbase’s new country director, also told BlockNews that it will formally launch its Brazil operation in 2023. He said in a statement:

“We see Brazil as a key market for Coinbase’s entry into Latin America and we are excited to continue investing and building here.”

Foxbit announced a partnership with Monte Carlo, Brazil’s second-largest jewelry store to accept bitcoin and other cryptos as a form of payment via Foxbit Pay. (CoinTelegraph Brasil)

For job seekers out there, Ripple is hiring for five positions out of its São Paulo office, but no assholes are allowed to apply, per CEO Brad Garlinghouse. The open roles include sales, legal, business development and customer success.

Bitfy announced a philanthropic partnership with Santa Casa BH, a healthcare provider in Minas Gerais, to facilitate crypto donations to the hospital. (CoinTelegraph Brasil)

Metablock, a tokenized marketplace company based in Ceará, is partnering with Metabank - a Brazilian fintech designed to help individuals with financial planning. (CoinTelegraph Brasil)

The National Education and Research Network (RNP), an arm of the Ministry of Science, Technology and Innovation, is seeking blockchain researchers to help build the “Internet of the Future”. (Livecoins)

Visa is launching crypto cashback cards with several fintechs and startup partners in Brazil and Argentina that will allow users to earn crypto rewards on transactions. The initial batch of companies issuing their own cards include Lemon Cash, Alterbank and Zro Bank. (Finextra)

The president of Funai (Fundação Nacional do Índio), Marcelo Xavier, revived the concept of an indigenous cryptocurrency in response to criticism he has been receiving regarding search efforts for Dom Phillips, a British journalist who disappeared in the Amazon earlier this month. The Índio cryptocurrency, which never launched, was first floated by previous president Michel Temer’s administration as part of an economic development plan. Xavier wrote:

“What there was was the misuse of resources, which were never properly applied, see the case of the creation of an indigenous cryptocurrency, whose contract was canceled during our management and which, if it went ahead, would cause a loss of R$ 45 million to the public coffers.” (Portal do Bitcoin)

🎮 NFTs, Gaming and Metaverse

The two Bored Ape NFTs purchased by footballer Neymar in January have declined 87% in value, from R$6.2m to R$800k. (Portal do Bitcoin)

The Rio de Janeiro City Marathon will give away NFT prizes to top finishers that will provide exclusive experiences and free access to the 2023 race. (CoinTelegraph Brasil)

Vasco da Gama, the Rio-based football club, will sell tickets in the form of NFTs that will also offer exclusive experiences to fans, such as a guided tour of the club’s headquarters and an interactive environment built in the former São Januário Trophy Room. (CoinTelegraph Brasil)

Blockchain game community BAYZ is partnering with game developer Animus and Lakea to build out onramps into Web3 in Brazil. The three entities have combined to invest more than US$5.3m in game development, partnerships and hiring over the last year. (CriptoFacil) (CoinTelegraph Brasil)

ZCore, a Brazilian crypto network, launched a new NFT Farm Horses collection that gives buyers access to the ZCore Club, with benefits such as a DeFi credit card with cashback, DeFi farming opportunities, participation in events, etc. (CoinTelegraph Brasil)

João Doria Neto, the son of former São Paulo governor João Doria has lost R$570k (US$110k) on his purchase of a CryptoPunk NFT in April. However, he remains an evangelist for the technology. (CoinTelegraph Brasil)

Maneva, a Brazilian reggae band, launched its own NFT platform of 320 NFTs divided into three combinations, which give fans the right to the digital art for each song and other swag. (BeinCripto) (Portal do Bitcoin)

DUX, the Web3 gaming startup, is partnering with Dubdogz, a pair of Brazilian DJs, to launch a parallel virtual career in the The Sandbox metaverse. Luiz Octávio Gonçalves Neto, founder and CEO of DUX, commented:

"With the launch of Dubdogz in the metaverse, we expanded our fronts of action and offered new solutions for artists who want to be part of the technological revolution and the global trend of big brands to also be present in the gamer universe". (CoinTelegraph Brasil)

Brazilian football legend Ronaldinho is purchased a Troll Town NFT and promoted it to his Twitter following

🏛 Public Policy, Regulation and Enforcement

Flamengo player Gabriel Barbosa, aka Gabigol, invested in the GAS Consultoria pyramid scheme, which was shut down last year. The exact amount of his investment, or who specifically induced him to make the move, is unknown. (Livecoins)

The R$400m worth of assets seized by police from Glaidson Acacio dos Santos, aka “Pharaoh of Bitcoins” and operator of GAS Consultoria, cannot be auctioned off to reimburse creditors, a judge Rosália Moneiro Figueira ordered. (O Globo)

A new Livecoins report shows that Glaidson’s bank, Banco Bonsucesso SA in Belo Horizonte, closed his account in 2020 after he would not prove the origin of the funds in his account.

Two military police officers were acquitted of attempted murder charges against Enéas de Lima Tomaz, who as a partner at Arbcrypto - a pyramid scheme that used cryptocurrencies to attract new investors. (Portal do Bitcoin)

Federal Deputy Paulo Eduardo Martins introduced a new legislation that would prohibit the Judiciary from accessing the private keys of crypto owners or requiring wallet owners to hand over their passwords. (CriptoFacil)