🇧🇷BCR #49: Binance Resumes BRL Deposits and Withdrawals; Crypto Legislation at an Impasse

Binance BRL on and off-ramp functioning as dispute with Capitual drags on; key provisions stripped from crypto regulation bill text

Fala pessoal!

Welcome to 🇧🇷Brazil Crypto Report for the week of July 4-8. For US readers I hope you had an enjoyable July 4 holiday. I had a nice vacation in Florida on the Gulf Coast with some family and friends.

🤩 Before we dive in, friendly reminder that BCR Institutional, our first premium service, will launch later this month July. This product will focus on providing bitcoin and cryptocurrency education to large investors in the Brazil market. It will consist of investor-focused content (in Portuguese), monthly roundtables and networking/chat functions. Stay tuned for more details.

🔥Binance Re-Enables BRL Deposits and Withdrawals

4 million Binance users in Brazil are able to deposit and withdraw via Pix and Ted once again after a 20 day service disruption. The exchange suspended its BRL on- and off-ramp service on June 16 amid a legal dispute with Capitual, with whom it severed ties and has since replaced with Latam Gateway, another payment provider.

The BRL deposits and withdrawals were initially only available via the Binance website, but app functionality was enabled shortly thereafter. Binance’s withdrawal fee has reportedly increased from R$2.60 to R$3.50 under the new system.

Also, A São Paulo court ordered the blocking of R$452m (US$86m) worth of customer funds held on Capitual as part of the ongoing legal dispute between the two parties. The ruling ensures that the funds will be available to Binance customers once the legal process is resolved. Portal do Bitcoin has a good synopsis of where this situation currently stands if you’re interested in diving in more (also a good one in English here).

While Binance’s payment woes appear to be resolved, the incident appears to have put a chink in its armor as its market share of bitcoin trading in the country dropped notably. According to CoinTraderMonitor, Binance processed 54% of bitcoin volumes from June 1-15, but between June 16-30 it made up just 37% of total volume - a 31% decline. We’ll have a better idea once July trading volumes are published in early August.

Despite the disruption, Binance still processed 46% of the ~40,000 bitcoins traded in Brazil during the month, with bitPreço checking in at 17% in second place. Also, Binance announced on July 8 as part of its five-year anniversary that it would waive trading fees on 13 different trading pairs - including BTC/BRL.

🏛Crypto Legislation at an Impasse

Deputy Expedito Netto formally introduced his updated crypto regulation bill to the Chamber of Deputies last week. As expected, the updated text created an uproar because it several key provisions added by the Senate were removed. The most notable is a requirement that foreign crypto brokers immediately create and register a local entity (CNPJ) and begin communicating with tax and AML authorities upon the law being signed. Netto also struck down the Senate bill’s requirement that brokerage firms segregate company and client assets.

The CNPJ question was a point of confusion in last week’s newsletter, as I had heard differing takes on specifically when this provision would take effect. Upon further research, I can confirm that the Senate text gives the standard 180 day window for the law to be implemented, with the exception of the CNPJ and AML provisions - crypto brokers would have needed to immediately comply with these. With that language struck down by Netto, foreign firms will now have 180 days to formalize their operations in Brazil, same as domestic exchanges that are already registered and have an active CNPJ.

While supported by the likes of Binance, the removal of these provisions was predictably not well received by local exchanges and Febraban, which represents Brazil’s banks. ABCripto, a trade group representing the largest domestic brokers, said in a note:

“ABCripto is surprised and disagrees with the suppression of these protections in the newly presented report. We ask for the resumption of the text and the approval of such important measures for the security of the Brazilian cryptoeconomy and its timely, opportune and adequate evolution.”

In pushing back against the asset segregation clause, Binance head of Brazil operations Daniel Mangabeira told Broadcast Estadão:

“the PL mixes in the same basket the segregation of assets of financial resources and digital assets. There is a legislative purism there that can cause some confusion if it goes that way”.

Lastly, the import tax exemption on bitcoin mining hardware was also removed. I strongly recommend having a listen to my podcast interview with Ray Nasser (link below) to better understand how this provision would have boosted the Brazil bitcoin mining industry.

Valor published a pretty balanced piece that weighs the pros and cons of removing these provisions, particularly the asset segregation question

💣 Upshot: While the bill was added to the Chamber of Deputies’ agenda, it was not brought to the floor for a vote and it is unclear if Chamber President Arthur Lira plans to advance it next week. With time running out due to an upcoming recess and then election season, the Banco Central still wielding its influence in the process and a full on lobbying war between Binance and 2TM over the CNPJ and asset segregation provisions, it’s looking less and less likely that this will pass anytime soon.

This has created a sense of urgency among proponents who have labored for years to get the bill to its current stage and are now trying to reverse course and get the removed provisions added back in. Julien Dutra, head of government relations at 2TM, told Portal do Bitcoin:

“If we don't approve this now and only wait for next year or November, we could increasingly cause something reckless for the market in terms of systemic risk in competition.”

🎙Be sure to check out the latest episodes of the 🇧🇷Brazil Crypto Report podcast. I sat down with Arthur Mining CEO Ray Nasser to discuss his thesis of Brazil as a dark horse play for bitcoin miners.

I also chatted with Fuse Capital co-founder João Zecchin about his firm’s forthcoming crypto fund, which would be the first dedicated crypto fund in Brazil.

🙏 Thanks to our partners at HBAR Foundation for supporting 🇧🇷 Brazil Crypto Report! If you're a Latam entrepreneur or developer with an up-and-coming project or idea and need some support, take a look at the HBAR grant program. They're seeding projects focused on DeFi, fintech, NFTs, sustainability and so much more. They also offer a plethora of other resources to help builders bootstrap. Do yourself a favor and check them out! 👊

🗞Brazil Crypto News Rundown

📈 Markets

Brazilian crypto asset manager Hashdex saw inflows of US$117.9m (R$620m) into its crypto ETFs and index products in the first half of 2022, per Bloomberg data. The figure ranks the firm first in the world ahead of 21Shares, Seba Bank, Van Eck and Wisdom Tree. Hashdex CTO Samir Kerbage commented:

“We are pleased with the trust placed in our products. This result reveals the effort of our work to offer Brazilian investors, as well as those from other countries, the best investment strategies for the crypto-assets market in safe and regulated vehicles. regulated for different segments of the crypto market.” (Forbes Brasil) (CoinTelegraph Brasil)

Tokenized crowdfunding platform SMU Investimentos is aiming to be a secondary market for digital assets issued via a primary offering. Through an agreement with the CVM, the Brazilian securities regulator, SMU is able to launch 10 companies raising up to $15m each. The launch window was supposed to commence in July, but SMU has asked to postpone until September. (InfoMoney)

Brazil is a standard bearer for global crypto markets, with its diversity of exchange-traded products, brokerages and investors making it one of the most sophisticated in the world, per Guilherme Rebane, head of Latin Amerca at OSL, a Hong Kong-based liquidity provider and market infrastructure provider. In an interview with E-Investidor, he argued that the critical play is expanding the basket of crypto products

“We don't talk about price anymore. The interest already exists. The big issue is the big players in the market to offer the products (of crypto assets) to the customers”

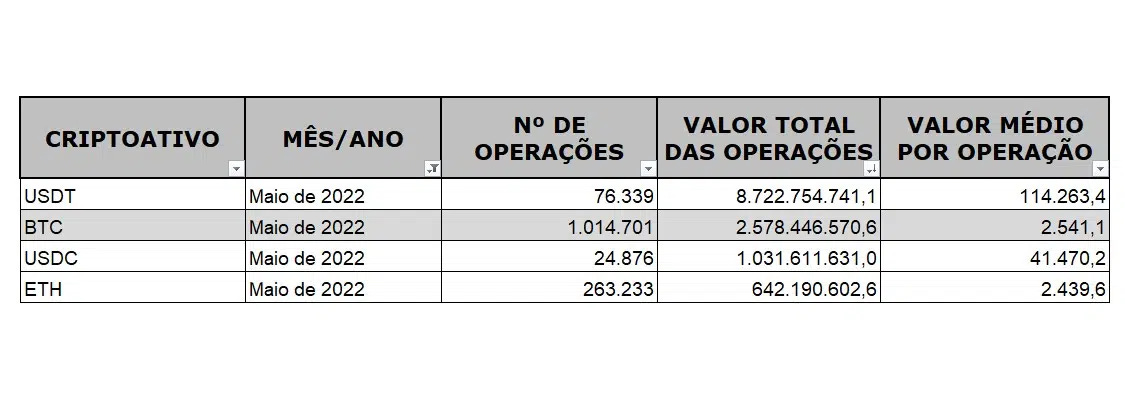

Brazilian traders declared R$8.7bn (US$1.7bn) worth of Tether trades in May, according to Receita Federal data. While bitcoin and ethereum saw more individual trades executed, the majority of the volume was in USDT. (Livecoins)

NovaDAX listed 18 new tokens on its platform, bringing its grand total in Brazil to 150. (CoinTelegraph Brasil)

Itaú Unibanco, Brazil’s largest private bank, will launch a new business unit to transform assets into tokens. More information will be presented on July 14. (Forbes Brasil)

MB Tokens opened trading on a new set of consortium quota tokens called CSCONS04 that have an expected return of 18% per year. (Portal do Bitcoin)

📱Adoption

Binance is the most searched investment site in Brazil, according to a new survey by Comscore. (Livecoins)

Araribóia, the city of Niterói’s social currency used for temporary income, could soon be tokenized, according to mayor Axel Grael. The project currently allocates between R$460 and R$540 monthly to 30,000 low income families. The remarks came at the NFT.Rio summit. (BeinCrypto) (Livecoins)

Crypto exchanges like Mercado Bitcoin and Bitso are unwavering in their sponsorship commitments to Brazilian football clubs despite the crypto winter. (O Globo)

Embrapa, the Brazilian Agricultural Research Corporation, is tracing brown sugar from the Usina Granelli - a facility in Sao Paulo state - to store shelves via a new blockchain product called Sibraar. (CoinTelegraph Brasil)

The Crazy Startup, a launchpad and accelerator, is launching a crypto and Web3 themed reality show tour that will commence in Rio de Janeiro. (BeinCrypto)

Banco de Brasília put out a public tender looking for a candidates with knowledge of cryptocurrencies. (Livecoins)

The Lula Institute resumed its cryptocurrency education initiatives with a new video published on its YouTube Channel. (Portal do Bitcoin)

🎮 NFTs, Gaming and Metaverse

Wine, the Brazilian wine subscription club, announced a partnership with Satoshi Nation, a Brazilian NFT collection. Customers who hold the NFTs will receive discounts and access to special wine labels from around the world. (InfoMoney)

Spanish bank Santander invited startups from Brazil and 10 other countries to a Web3 solutions event hosted in Decentraland. (Livecoins)

🏛 Public Policy, Regulation and Enforcement

Merilis Diaz, fugitive and wife of “Pharaoh of Bitcoins” Glaidson Acácio dos Santos, spoke publicly for the first time since her husband was arrested last August in a pair of YouTube videos. According to the videos, she cried upon realizing that Binance had blocked her account 20 days after Glaidson was arrested, and she insisted that she and her husband are being wrongfully persecuted. Diaz affirmed that “it’s time to open Pandora’s box” and indicated that she considering writing a book about her experiences. (CoinTelegraph Brasil) (Livecoins) (Portal do Bitcoin)

Tunay Pereira Lima and Michael de Souza Magno, two leaders of GAS Consultoria, were released from prison this month following a Habeas Corpus request granted by the Brazilian Supreme Court. (Portal do Bitcoin)

The CVM intends to promote cryptocurrency investment courses for investors, with a particular focus is on retail investors, low income people, children and elderly. (Livecoins)

A three month strike by Banco Central employees ended on July 5. The strike interrupted and delayed numerous agency projects and functions, including Digital Real development - which is now expected to commence testing in 2023, rather than second half of 2022. (Livecoins)

Rodrigo Borges of Carvalho Borges Araújo Advogados argues in a CoinTelegraph Brasil op-ed that Brazil is at the vanguard of crypto regulation globally.

The current crypto crisis is similar to Brazil’s banking crash of 1891, says Unviersity of São Paulo researcher Matheus Cangussu. (Livecoins)

Federal Police carried out raids against a criminal syndicate that allegedly used cryptocurrencies to launder funds generated from illegal gold mining. The operations, including five preventative arrests and 60 search and seizure warrants, were carried out across the states of Rondônia, Acre, Pará, Goiás, Mato Grosso and Rio de Janeiro. (Reuters) (Portal do Bitcoin)

“Bitcoin Sheik” Francis da Silva, mastermind of the alleged Rental Coins pyramid scheme, is attempting to sell his two thousand square meter mansion in Santa Catarina for R$64.5m (US$12.2m). According to his lawyer, da Silva will use the funds to settle debts with investors. The home, however, has five judicial blocks on it preventing it from being sold. (Exame)

TV Globo’s Jornal Nacional television program highlighted MSK Invest, an alleged cryptocurrency pyramid scheme that promised 5% fixed returns on some R$200m in investor deposits. MSK began delaying and suspending withdrawals in late 2021. (Portal do Bitcoin) (Livecoins)

Public Ministry prosecutor Thaigo Bueno said that the “immateriality” of crypto assets helps to explain why they’ve been used so prominently in pyramid schemes and other scams in Brazil.

“The advantage of those who commit these crimes using crypto-assets is that, unlike cattle or other [physical] products, they do not have a physical existence, they are immaterial, electronic. There is nothing tangible to show. And the victim is deceived by the promise of an easy income.” (InfoMoney)

A cryptocurrency scammer was arrested by Minas Gerais police in the Zona da Mata region, where a 46 year-old man had a store where he sold crypto investing offers. (Livecoins)

Crypto exchange BitBlue has been ordered to pay for the financial damages caused by Airbit Clube, a supposed pyramid scheme that caused R$110m in damages. (Portal do Bitcoin)

Renato Silveira, president of the São Paulo Lawyers Institute, argued in a Consultor Juridico article that an international regulatory framework is needed to thoroughly combat crypto being used for crime and tax evasion. (h/t CoinTelegraph Brasil)