🇧🇷BCR #53: Bolsonaro Enters the Metaverse

Also: Highlights from Expert XP; Digital Real trials to commence 2Q 2023; Binance maintains dominance but loses market share in July due to Capitual dispute

Fala pessoal!

Greetings and welcome to 🇧🇷Brazil Crypto Report for the week of August 1-5, 2022.

Lots going on this week as always! I appreciate you reading and hope you enjoy this week’s edition.

-AWS

Binance’s Share of Trading Volume Down in July

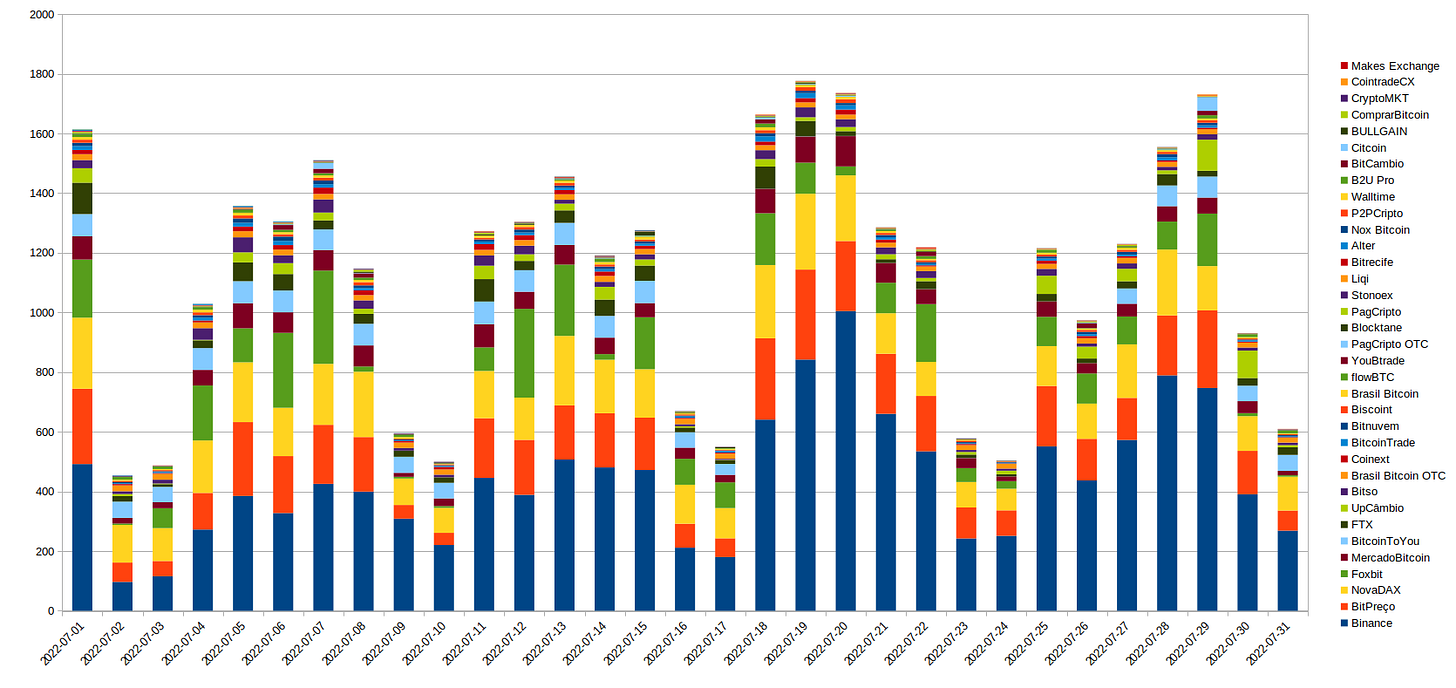

Binance was responsible for 39.33% of bitcoin trading volume in Brazil for the month of July, down from 46.22% in June, according to data from CoinTrader Monitor. The drop in volume is likely due to its dispute with payment processor Capitual, which left customers unable to deposit or withdraw reals for nearly three weeks.

In total, Brazilian exchanges moved 34,728 bitcoins (~R$4bn) during the month of July. That figure is down 13% from the prior month (June 2022), though its a 15% increase from July 2021.

Banco Central: Digital Real to Be a Web3 and DeFi Payment Tool, to Begin Testing in 2023

Fabio Araujo, director of the Digital Real project at the Brazilian Central Bank, said that the CBDC is being designed to be programmable and interoperable with Web3 and decentralized finance protocols. He highlighted these elements as the key differentiators between the Digital Real and Pix, the central bank’s highly successful digital payment system.

He also revealed that testing operations are planned to begin in the second quarter of 2023. The testing will be similar to China’s testing of the Digital Yuan, specifically, with limited values, participants and in select cities. He commented:

"We are an international benchmark in central bank digital currencies, just as we are with Pix... Brazil has brought the issue of CBDC programmability to an international level, and now it is spreading internationally.”

"We are in the first phase of testing where we call financial market participants to explain the idea of building a programmability platform for means of payment using some types of protocols that we have defined, such as decentralized finance protocols, payment-on-delivery protocols, payment versus payment, applications for the internet of things, among others. All these applications have programmability with a common element.”

🎙Be sure to check out the latest episodes of the 🇧🇷Brazil Crypto Report podcast. This week I was joined by Blockchain Rio CMO Tatiana Sampaio to get a sneak preview of next month’s Blockchain Rio festival, which takes place September 1-4.

🤩 We’ll also be launching our invitation-only BCR Institutional platform later this month. This product will focus on providing bitcoin and crypto education to professional investors in Brazil. It will consist of investor-focused content (in Portuguese), exclusive monthly roundtables and discussion groups. Please keep an eye on your inbox for an invitation. If you don’t get an invitation but feel you should (many of you use anonymous email addresses🕵️♀️) feel free to ping me at aaron@brazilcrypto.report.

🗞Brazil Crypto News Rundown

📈 Markets

Crypto asset manager Hashdex is launching an actively managed quantitative crypto fund, dubbed “Top Performers”, which will diversify into high-potential altcoins in an attempt to beat the Nasdaq Crypto index benchmark. The strategy will reproduce the “momentum” strategy used by equity funds in the crypto market, which looks to take advantage of volatility in 30, 60 and 90 day windows. The fund will invest indirectly in cryptos by trading on regulated exchanges overseas. Hashdex CTO Samir Kerbage commented:

“This fund was a demand from customers themselves who see bitcoin as an already consolidated currency that has risen a lot. Everyone wants to know which currency will be the new bitcoin. This background tends to capture that kind of movement.” (Valor)

Hashdex’s Kerbage also argued on a panel during the Expert XP conference that maintaining 1-5% of a portfolio in crypto will make a significant difference in long term performance, and that now is an ideal moment for investors to gain exposure to the asset class.

“Having zero cryptocurrencies is very expensive at this historic moment…When the potential is reflected in prices, there will be an upside that will make a big difference. Bitcoin’s opportunity is disbelief, and the thesis that, 10 years from now, it will be as boring as gold, which will be part of people’s daily lives.” (Valor) (InfoMoney)

QR Asset, the digital asset manager of the QR Capital group, announced a new actively managed crypto fund called QR Crypto Factors available for retail investors, with a minimum purchase of R$1. The portfolio will be balanced by a combination of algorithmic models and in-house experts. It also announced the QR Crypto neutral fund, which is aimed at accredited investors and will allocate 100% of its assets abroad and will be able to take both long and short positions. QR Asset investment director Alexandre Ludolf stated:

“We bring you two options that seek to generate alpha in times of decline and that serve both qualified investors and retail investors.” (InfoMoney)

Fernando Ulrich, the veteran bitcoin commenter and head of education at Liberta Investimentos, was also a featured speaker at Expert XP. He argued that he still sees bitcoin becoming “digital gold” despite the market downturn and critiqued central bank digital currencies as “the worst form of money possible.” He also criticized new “exciting but experimental” developments in the decentralized finance space and issued a warning about the upcoming Ethereum Merge, tentatively scheduled for September 19. He argued that Ethereum developers are putting ESG and sustainability concerns over security, and that this will ultimately be bad for the protocol. He commented:

“The change from Proof of Work to Proof of Stake is being pushed by an inadequate argument. The concern is with sustainability and safety takes a back seat.” (Valor) (InfoMoney)

Hong Kong-based Amber Group will bring its WhaleFin platform to Brazil. It is a a retail-focused crypto platform that offers buying and selling along with other financial products like loans and fixed income. Amber Group is valued at US$3bn and features Sequoia, Paradigm and Coinbase Ventures among its investors. CEO Michael Wu told InfoMoney:

“Latin America is one of the regions with the highest adoption of cryptocurrencies. It has great potential for the adoption of new technologies and for breaking with the current traditional banking scenario. We are excited to fully explore the potential of crypto technology in the region as we expand our presence here.”

Expert XP also featured a panel looking at decentralized finance (entitled DeFi: The New Frontier) including Luis Ayala, director of Latam at crypto custodian Bitgo, and Marcos Viriato, CEO and co-founder of Parfin. Ayala commented on the panel":

“We were born into a centralized system, where we need to trust authorities, like banks, and follow rules. We had no choice. The arrival of DeFi opens up a world of applications and opportunities, but we have to decide if we want to be part of this system, in which we have to trust technology…The possibilities are limitless." (InfoMoney)

Chinese exchange Gate.io announced its arrival in Brazil and hired Andre Sprone, formerly of Easy Crypto, as its country director. The company is currently searching for a payment partner to allow bank deposits and withdrawals in BRL. Sprone told CoinTelegraph Brasil:

“We are going to take advantage of the bear market to prepare the ground for growth. The idea is to form a Brazilian team and show that we are paying attention to the market.”

Crypto exchange BlueBenx announced a partnership with Fireblocks with the aim of improving the security processes on its platform. (CoinTelegraph Brasil)

📱Adoption

Portugal-based crypto exchange CriptoLoja had its bank accounts closed by Banco Santander and Banco Commercial Português, Portugal’s largest bank, over fear of potential criminal activity. Mercado Bitcoin has an ownership stake in CriptoLoja. (CoinDesk)

InfoMoney has a good article highlighting Brazil’s burgeoning tokenization industry.

Brazil’s Superior Electoral Court (TSE) will continue to study the use of blockchain technology for elections and voting and is examining potential solutions built by GoLedger, Waves Enterprise, OriginalMy, IBM and Cryptonomia. (CoinTelegraph Brasil)

🎮 NFTs, Gaming and Metaverse

NFT marketplace DaX Digital Assets aims to tokenize carbon credits and renewable energy certificates. (Valor)

The CVM, Brazil’s securities regulator, will host a metaverse event on August 15 and give a free NFT to all participants. (CoinTelegraph Brasil)

Banco do Brasil will create a metaverse for customers on the Roblox platform, with the official launch coming at the Brasil Game Show in October. (CoinTelegraph Brasil)

Genial Investimentos acquired a plot of land in Decentraland that will reproduce the company’s São Paulo headquarters. Luciano Faustino, CMO at Genial, commented:

"the action in Decentraland is also part of the company's communication strategy to democratize access to the world of investments and connect with new audiences through experiences." (CoinTelegraph Brasil)

🏛 Public Policy, Regulation and Enforcement

The Marco Cripto bill in Congress made it onto the agenda of the Chamber of Deputies last week but didn’t receive a vote. It likely won’t be considered again until after the elections in October. (Portal do Bitcoin)

Mirelis Yoseline Diaz Zerpa, spouse of GAS Consultoria founder and “Pharaoh of Bitcoins” Glaidson Acacio dos Santos, said she has no money available to reimburse investors who lost funds in the pyramid scheme, per her attorney. This statement comes amid new revelations that she withdrew R$1bn worth of cryptocurrencies the day after Glaidson was arrested last summer. (Portal do Bitcoin)

Binance hosted an anti-money laundering training with authorities from Paraguay. It will host a similar workshop for the Rio de Janeiro Public Ministry later this month. (Portal do Bitcoin)

Several attorneys and stakeholders are questioning the need for a bill introduced in Congress last month by Cleber Verde that would criminalize the use of virtual assets for embezzlement. (Valor)

The Receita Federal, Brazil’s tax authority, will offer a course to its auditors on identifying cryptocurrency-related tax evasion and crimes. The course instructor will be Thiago Augusto Bueno, who is author of the book “Bitcoin and Money Laundering”. (Portal do Bitcoin)

A federal judge ordered the release of Marcio Macedo Sobrinho, a suspect involved in an illegal gold mining operation in the Amazon that used cryptocurrencies to launder money. (Portal do Bitcoin)