🇧🇷BCR #65: Binance Eyes Rio's Porto Maravilha for Brazil HQ

Plus: Bitcoin Sheik arrested; Cloudwalk obtains payments license from BC

Ola pessoal!

Welcome to Brazil Crypto Report for the week of October 30- November 4, 2022.

It was great meeting some BCR readers in person in Lisbon last week, and big thanks to everyone who stopped by the Filecoin Station stand at Web Summit. We got a lot of compliments from folks saying we had the best activation of any company at the event. I can’t say that I disagree 😃

I also had the chance to go on CoinDesk TV with Isaiah Jackson to talk about what the results of Brazil’s presidential election mean for bitcoin and cryptocurrencies more generally. I did get rugged a bit by conference internet during the hit so it didn’t come out as cleanly as I would have hoped but it was a great opportunity. More importantly, it demonstrates the growing interest in the Brazil market from crypto folks around the world.

I’ve provided election color in previous editions and don’t have much more to add here, but I’m linking to some pieces this week from Portal do Bitcoin and others that offer additional color on what the presidential elections mean for crypto in Brazil.

The most notable themes here are that local investors appear to be preparing themselves for a possible devaluation of the real against bitcoin, and that Lula’s connections with former Central Bank president and current Binance advisor Henrique Meirelles will open doors for investors to enter the space.

Fintech Unicorn Cloudwalk receives payments license from BC

Brazilian fintech Cloudwalk, owner of the InfinitePay machine and issuer of the Brazilian Digital Real (BRLC) stablecoin, became the first cryptocurrency company in Brazil to receive authorization from the Banco Central to act as a payment institution.

With the license, Cloudwalk can issue and acquire electronic money and post-paid instruments. The license will allow for expanded financial services offering beyond the BRLC stablecoin, which is backed by the real and allows retailers to receive sales in seconds with no fee. The license also means Cloudwalk is the first crypto company in Brazil to obtain a direction to the Banco Central for use by Pix.

Cloudwalk has more than 1.7 million wallets in creation and already lent more than R$25m (US$4.85m) in crypto to small businesses using smart contracts that calculate amounts and interest, according to InfoMoney. Last November, it raised US$150m in a Series C at a US$2.15bn valuation.

Pablo de Mello, Cloudwalk partner & CCO, commented:

“We are very satisfied with the new license approved by the Central Bank. This is a milestone of success and recognition of CloudWalk's journey, which works tirelessly to revolutionize the Brazilian and global financial system.”

Binance eyes Rio’s Porto Maravilha for its Brazil headquarters

Binance is negotiating with the city of Rio de Janeiro to open its Brazil headquarters in Porto Maravilha, in the old port region of the city. Rio’s secretary of economic development Chico Bulhões said during Web Summit last week

“Binance is looking to enter Porto [Maravilha]. We are finalizing the negotiation. CZ [Changpeng Zhao, CEO and founder of Binance] received the key to the city from Mayor Eduardo Paes and wants to expand its presence in Brazil.”

“However, their idea, if all goes well, is to have a headquarters inside Porto Maravalley. They want to be connected within this hub, to have their team there.”

Binance CEO Changpeng “CZ” Zhao also reaffirmed his interest in the Brazil market during a press conference at Web Summit, telling reporters:

“Brazil is a very large, very important and relatively profitable market. We made a local acquisition of Sim;paul, and we have two offices in Brazil, in Rio de Janeiro and in São Paulo. I visited Brazil a few months ago, it's a fantastic place….I met with some regulators, with the mayor of Rio, with the governor of São Paulo, they're all great people and pro-crypto, so we're pretty confident in the investment we have there.”

Regarding the ongoing CZ versus SBF turf war that blew up over the weekend, I recommend taking a look at this thread to better understand what’s happening here. The relevant point is that SBF realizes his only way to upend CZ and Binance is by winning over regulators (same strategy as that taken by the exchanges in the Brazilian market). Realizing that SBF significantly damaged his standing within the crypto community with his “regulated DeFi” policy proposal last month, CZ has gone on the offensive. We’ll be watching closely to see how this unfolds.

Bitcoin Sheik arrested in Curitiba

“Bitcoin Sheik” Francisley Valdevino da Silva was arrested last week by Federal Police in Curitiba. The Sheik was allegedly the operator of several cryptocurrency pyramid scheme companies such as Rental Coins. A court ruling last month prohibited him from continuing to operate; however, subsequent investigations revealed that he violated the court order by continuing to meet with his employees at his home - leading to the preventative detention ruling.

Portal do Bitcoin ran a helpful background profile on the Sheik for those interested in learning more.

Receita Federal reports 3x growth in unique crypto users for September 2022

The number of unique individuals in Brazil that declared cryptocurrency trades in September totaled 1.5m, per the Receita Federal. The figure is up 14% from August 2022 and more than triple the amount recorded in September 2021. The number of companies (unique CNPJs) that reported crypto operations during the month was 14,255, up 81% year-over-year.

However, the total volume of reported cryptos traded for the month was R$11.3bn (US$2.2bn), down 11.8% year-over-year. The most purchased crypto for the month was Tether (USDT) with $26bn (US$5bn), followed by bitcoin at R$4.5bn (US$872m).

CVM looks to create a new division focused on crypto

New CVM president João Pedro Nascimento said that he hopes to create a new division within his agency focused on crypto assets and that he hopes to start a dialogue with the economic team of incoming president Lula on the crypto market and tokenization, among other topics.

The remarks came within a broader speech in which the executive criticized the lack of personnel in the agency. He has repeated this point continuously since taking over last summer, arguing that the CVM needs more personnel to be able to meet the regulatory demands of a fast moving industry.

Upcoming Events

I also wanted to highlight several relevant crypto events in Brazil this year. I unfortunately won’t be attending any of these but wanted to flag in case of interest.

Satsconf, a bitcoin only conference similar to Bitcoin Miami and Adopting Bitcoin, will take place November 8 in São Paulo.

Bit in Rio in takes place November 26 in Rio de Janeiro.

The Crypto House of Commons event on November 18-19, organized by NürnbergMesse Brasil. The event will cover crypto investing trends, NFTs and the metaverse.

ABCripto’s Criptorama event is in São Paulo November 8-9

Have a great week everyone,

-AWS

P.S. If you enjoy this content please consider subscribing and sharing with others who might find it informative!

🎙Catch the latest episodes of the 🇧🇷Brazil Crypto Report podcast.

1️⃣ Isac Costa joined to discuss the Brazilian SEC’s new guidance on crypto tokens and how this fits into the scope of crypto regs in Brazil more broadly. Definitely worth a listen if you’re on the regulatory beat.

2️⃣ Marcello Mari of SingularityDAO discusses how his AI-driven asset management platform became one of the most popular crypto projects in Brazil

3️⃣ Garrett Kinsman, co-founder of Nodle, joined to discuss his smartphone-powered Internet of Things network and how he hopes to onboard one million users in Brazil by this time next year.

🗞Brazil Crypto News Rundown

📈 Markets

Crypto exchange Coinext will launch a service in Brazil that brings passive income products like ethereum staking and crypto lending to users. (Portal do Bitcoin) (Valor)

Crypto infrastructure platform Zero Hash has launched its services in Brazil. The platform offers white label liquidity, custody and regulatory infrastructure services. The company also announced Fernando Velicka as head of Latin America. Edward Woodford, CEO of Zero Hash, stated:

“We are pleased to enable our partners in Brazil to offer crypto products using our industry-leading custody, execution, reconciliation and liquidity solutions.” (CriptoFacil) (CoinDesk)

Bitso launched eight new BRL trading pairs on its platform, including ADA, SOL, USDT, XRP and MATIC. (CoinTelegraph Brasil)

Brazilian Defi protocol Picnic allows users to create their own index funds consisting of different DeFi tokens and products. (CoinTelegraph Brasil)

Nubank will launch its nucoin token in Q1 of 2023, according to anonymous sources heard by CoinTelegraph Brasil:

"The tests have already started and they have been very positive. Nubank will launch Nucoin in the first quarter of 2023. It is being developed by a third party in the crypto-as-a-service model, this provider will also take care of the entire management, including custody."

The price of Flamengo’s $MENGO fan token fell in October despite the club winning the Copa Libertadores and Copa do Brasil. (Livecoins)

Easy Crypto, a New Zealand-based crypto exchange, has indefinitely stopped operations in Brazil after launching in September 2021. (CriptoFacil) (Portal do Bitcoin)

The investment fund arm of Itaú plans to launch an ETF-type fund that will track the price of bitcoin. The product is currently in the pre-operational phase and was created on October 18, per CVM filings. (Portal do Bitcoin)

A disgruntled Brazilian crypto trader made $30,000 betting on a Bolsonaro loss in the election, using the open BOLSONSARO2022 contract launched by FTX back in May. (Portal do Bitcoin)

Investment funds with exposure to crypto assets will have to disclose specific material risks in their prospectuses, such as the possibility of cyber-attacks and key management, according to a self-regulation proposal put forward by Anbima, a capital markets trade group. (Portal do Bitcoin) (Crypto Times) (InfoMoney)

📱Adoption

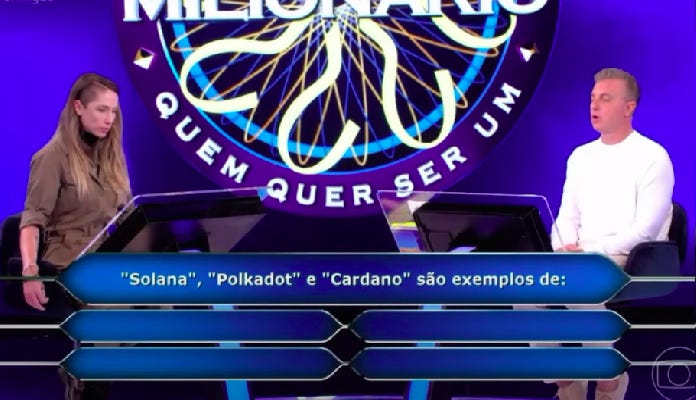

A participant on the Brazilian version of the game show Who Wants to Be a Millionaire won R$10,000 by correctly answering a question about cryptocurrencies. (Portal do Bitcoin)

Cardano founder Charles Hoskinson congratulated Lula for his presidential victory via Twitter. (Portal do Bitcoin)

The city of Recife will promote an event that introduces blockchain tech and cryptocurrencies to the public on November 16-17. (Livecoins)

FMI Minecraft Management, which specializes in bitcoin mining and was founded this year by Brazilian John Blount, raised R$10m in a funding round. (CoinTelegraph Brasil)

The Brazilian Central Bank put out a Twitter thread articulating its vision for the Digital Real

Exame ran a helpful analysis of the Banco Central and President Roberto Campos Neto’s approach toward crypto and the Digital Real, and why global investors should be paying attention to these developments.

The Digital Real will be necessary in a tokenized financial system, the BC’s inspection director Paulo Souza said this week, adding that there will be a flurry of announcements related to the Digital Real, such as final choices of underlying technology, will come in 2023.

“There will come a time when we will have the development of tokenization of financial assets. And for you to buy a digitized token, you will necessarily have to have a currency that is also digital.” (InfoMoney) (Valor)

A new Accenture report on CBDCs notes that the Digital Real will have negative revenue impacts for banks and fintechs, as the Banco Central will begin offering many of the services provided by these institutions for free. However, this will be offset by an expansion of the credit market for financial institutions. According to the report, the Digital Real is not optimizing for greater efficiency in payments but rather on increasing the visibility of exchanges in the financial system and encouraging new products and business models, and bringing more businesses into the formal economy. Edlayne Burr, payments strategy leader at Accenture in Latin America, told Valor:

“Revenues from transaction fees and account maintenance must be replaced by new sources over the years, as CBDCs must provide these functionality at zero or minimal cost.”

“Financial institutions can benefit from CBDCs as an extra channel of contact and distribution, entering into smart [credit] contracts.”

The Banco Central held a meeting with representatives from WhatsApp and Meta (aka Facebook) in what looks like an effort to strengthen relationships with Brazilian regulators. (Portal do Bitcoin)

More than 10 establishments in Jericoacoara, aka “Bitcoin Beach Brasil”, are now accepting bitcoin payments. (Crypto Times)

BetaBlocks announced the launch of white label Web3, NFT and tokenization solutions for companies looking to quickly enter the crypto space. (CoinTelegraph Brasil)

Popular cashback application Méliuz announced a new feature where users can earn between 1-2% bitcoin cashback on purchases. (CoinTelegraph Brasil)

São Paulo has been hit hard by the latest rounds of crypto industry layoffs. According to CoinGecko data, the city had the 7th most layoffs of any in the world. (CoinTelegraph Brasil)

🎮 NFTs, Gaming and Metaverse

Palmeiras player Enrick Felipe will auction off an NFT, via a partnership with Rough Diamonds, that entitles the holder to an authentic professional jersey worn by Felipe. (Crypto Times)

Brazilian gamer Jhoniker Braulio is looking to raise R$20m to develop a first person shooter blockchain game called RIO - Raised in Oblivion. The game will make use of NFTs as in-game items to be collected in various scenarios. (Valor)

🏛 Public Policy, Regulation and Enforcement

Senator Soraya Thronicke introduced a new crypto bill in the Senate that would regulate the issuance, intermediation, custody and settlement of crypto in Brazil. (Livecoins)

Blockchain analytics firm Chainalysis joined ABCripto, a trade group representing Brazilian crypto exchanges and businesses, as an associate member. The entity now has 15 total members. (CoinTelegraph Brasil)

Francisley da Silva Valdevino, aka the Sheik of Bitcoins, was arrested.

The Sheik also claimed that he was crushed into default by the drop in the price of bitcoin and that he has no funds remaining to pay creditors.

Federal Police reported that the gold bars seized at the Sheik’s residence in October were discovered to be brass upon examination by experts. The fake gold and other assets were used as props on social media. (CoinTelegraph Brasil)

The Banco Central notified that it is monitoring the volatility of the crypto assets and DeFi markets to see if there will be ripple effects across the macroeconomic landscape. The institution said in a recent report:

“The BC also continues to monitor the volatility of crypto asset markets on the international scene, their correlation with traditional financial markets and potential impacts arising from the implementation of new decentralized finance (DeFi) tools.” (Portal do Bitcoin) (Exame)