🇧🇷BCR #80: Digital Real passes critical milestone

Plus: Authorities appeal to Interpol to track down Braiscompany founders; Ripio launches new Web3 wallet

Olá pessoal!

Huge welcome to 🇧🇷Brazil Crypto Report for the weeks of February 20-24, 2023! I hope everyone had a fun Carnaval week.

Wanted to flag quickly that if you’re going to ETHDenver you should check out the Filecoin Virtual Machine Hackerbase on February 28 and March 1. You can get a sneak peak at how the FVM (set to launch in mid-March) will bring smart contracts and user programmability to the Filecoin blockchain. This will enable a number of new use cases like DataDAOs, decentralized finance on Filecoin, programmable storage deals and, ultimately, compute-over-data functionality that enables Web2 scale use cases to the Web3 world.

Be sure to check out my most recent interviews with João Marco Braga da Cunha of Hashdex about a potential shared currency between Brazil and Argentina, and Karen Duque of Bitso and Julien Dutra of Mercado Bitcoin where we get the inside story of how Brazil’s bitcoin law was signed into law last December.

Enough shilling! Now onto the content! Have a great week everyone!

-AWS

Digital Real Passes Critical Interoperability Test

A major Digital Real test involving transactions processed on a public blockchain was successfully completed. It was an important step towards the goal of creating a CBDC that allows for real-time low-cost settlement, enables interoperability with open networks and provides sufficient traceability, privacy and compliance to meet regulatory requirements.

In the pilot project, developed by Mercado Bitcoin and Stellar within the confines of Banco Central’s LIFT Lab, DvP (delivery versus payment) transactions were simulated on Stellar’s open, public blockchain using a prototype version of the Digital Real.

According to those involved, the project was successful because it demonstrates that a tokenized Brazilian payment system can be linked directly to the world of public blockchains and decentralized finance services.

Fulvio Xavier, responsible for special projects at MB stated:

“Our thesis was to prove that it is possible, viable and safe to carry out transactions with digital assets using a representation of the real on public networks. The Central Bank is always concerned with understanding what happens when [transactions] leave its hands.”

According to Valor, the test involved all steps of the transaction, such as registering and verifying KYC information and using Stellar network tools to issue and manage assets, wallets, keys and settlement.

The test also met another key objective: that it be simple enough for use by a user with no prior experience with digital wallets and cryptocurrency.

Also involved in the test were Cheesecake Labs, who provided design and engineering support; ClearSale for fraud prevention and credit scores; and CPQD foundation, which provided telecommunications research.

More Digital Real coverage in Brazil’s mainstream press

Nathalia Grant of Folha de São Paulo wrote a nice overview of the Central Bank’s Digital Real project, which is expected to be fully rolled out in 2024.

Specifically, the article focuses on the utility of programmable money and how this would ostensibly give citizens more control over their money. It uses the example of a parent transferring funds to a minor that can only be used for pre-ordained items.

Rodrigoh Henriques, head of innovation at Fenasbac and coordinator of the Central Bank’s Lift Challenge - a lab that incubates Digital Real use cases, told Folha:

"Programmability is not just about time, but about function. It can be on a specific date, for a specific person, as long as something has happened before, at a combined rate".

Notably, Henriques states that BC has identified through Lift that certain use cases simply aren’t shovel ready and will take more time to develop. This is true of offline payments, which can be processed even when the payor or payee is not connected to the internet.

Once a main focus of the project, offline payments has been moved to the back-burner. Henriques explained:

"We are clear that this dual offline functionality is important in the digital real, but it is not a priority in the Brazilian CBDC solution now because it would require a level of testing and complementarity with other technologies."

Braiscompany owners still on the run; authorities appeal to Interpol

A federal court in Paraíba ordered the preventive detention of Antonio Neto Ais and Fabrícia Campos, the co-owners of Braiscompany - the R$1.5 billion (US$289 million) cryptocurrency pyramid that stopped making payments to investors late last year.

In addition, the court asked that the executives be included on Interpol’s wanted list. Both Neto and Campos have been on the run since February 16, when Braiscompany’s offices were raided by federal police.

There are speculations that Neto is in Argentina, per location data from an Instagram post. He has apparently since disabled location tracking on his phone.

The court ruled that “the necessary steps be taken to issue the arrest warrants and their inclusion in red dissemination, then forwarding the set of documents to the Superintendence of the Federal Police in Paraíba to request the dissemination to Interpol”.

“No one in charge” at Braiscompany, says lawyer

A letter sent to company employees by a lawyer representing the firm, and obtained by Portal do Bitcoin and other journalists, asserts that Braiscompany is directionless and leaderless with Neto and Campos fleeing authorities.

Orlando Penha, of the firm Orlando Virginio Penha & Associados, who represents the company, told employees:

“The company, by choice, does not have directors able to respond to administrative inquiries, since everything was communicated directly by Messrs. Antônio Neto and Fabrícia Campos, who are now on the run.”

“As has always been reported, the law firm does not have the power to give any guidance regarding the direction of the company, especially since it has not even been asked to file a judicial reorganization or bankruptcy action, nor has it received information about possible funds from the company capable of make the company recover.”

The letter also instructed employees to seek private legal assistance for individual guidance, to stop posting on social media and to cease signing any new contracts on behalf of the company. There are speculations that a mass firing of Braiscompany employees is in the works.

Other Braiscompany updates:

Federal Police blocked R$15 million (US$2.9 million) worth of funds in accounts linked to Braiscompany accounts on Binance. The block impacts the individuals registered to the accounts and not legal entity.

Braiscompany’s 2022 balance sheet (as reported by the company) shows that it had R$774 million (US$149 million) in customer funds at the year’s end. The figures were delivered to Paraíba authorities in response to a civil investigation launched against the company by the Public Ministry.

The Public Ministry stated that it had some “good news for investors” in that it had found some funds that can potentially be recovered and returned to clients.

While Neto and Campos remain on the run, some trollers crafted masks in his likeness deployed them during Carnaval

🗞Brazil Crypto News Rundown

📈 Markets

Ripio unveiled its new multi-chain Web3 wallet, focused on enabling decentralized finance, for users in Brazil, Uruguay, Argentina and Colombia.

The wallet is a Chrome and Firefox extension that allows users to connect with DeFi applications, collect NFTs, explore metaverses, etc.

Customer login info is the same as that already used on the Ripio exchange, meaning the user will be able to regain access to the wallet even if the recovery phrase is lost

The wallet offers compatibility with the Ethereum, Polygon and BNB Chain blockchains

Ripio CEO Sebastian Serrano said in a statement:

“Ripio is the first company to launch this web3 product in Latin America and this shows the market that we are innovative and seek to develop a crypto ecosystem in the region.” (Valor) (InfoMoney) (Portal do Bitcoin)

BTG Pactual announced the successful termination of its ReitBTZ token, the world’s first ever security token issued by a bank. It was first offered to the market in March 2019 and provided an average yield of 137%. The token distributed more than R$4 million (US$770,000) to holders. Andre Portilho, head of digital assets at BTG Pactual, stated:

“The ReitBZ token brought a lot of practical learning about the use of technology and a better understanding of the market dynamics for this type of asset. The project enabled the development of other business fronts, such as the creation of Mynt, BTG's crypto platform, which allows us to create a complete structure for structuring and distributing new tokens in the future.” (CoinTelegraph Brasil) (Exame)

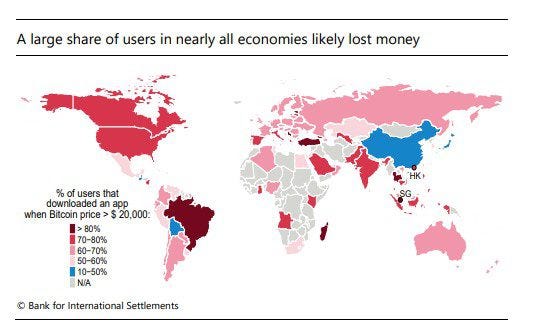

Brazilians are among those who lost the most money during the crypto market decline, claims the Bank for International Settlements in a new report. The report asserts that many Brazilian investors only began to buy bitcoin after the price surpassed US$20,000.

📱Adoption

Brazilian trader Daniel Duarte released a new book about the history of Ethereum and the ETH ecosystem. (Portal do Bitcoin)

Arthur Mining, the American mining firm founded by Brazilians and looking to make an entrance into the Brazilian market, is repositioning itself as an “energytech” firm that re-allocates otherwise wasted energy. Rudá Pellini, co-founder, explained:

“We take the energy that could be wasted and transform it into small batteries of money for customers.”

Holders of the Santos Fan Token will have access to the Binance Fan Club, which gives select fan token holders exclusive experiences. More than 500,000 individuals hold the SANTOS token, according to the exchange. (CoinTelegraph Brasil)

Crypto exchange Foxbit launched a donation matching campaign to raise funds for those impacted by severe flooding in São Paulo state. The exchange said in a statement:

“With the heavy rains of the last few days, the coast of São Paulo is experiencing a huge nightmare due to flooding, landslides and road closures. And to help the region and the affected victims, we, at Foxbit, are launching the emergency campaign ‘Help the North Coast’”. (Crypto Times)

The B3 exchange and QR Asset Management are teaming up to offer a free course on cryptocurrencies for investors. Lecturers will include Fernando Ulrich, Fernando Carvalho, Alexandre Ludolf, Theodoro Fleury and more. (Portal do Bitcoin)

Web3 themed Carnaval floats and festivities were prevalent across Brazil (and even Switzerland) last week

🎮 NFTs, Gaming and Metaverse

Rede Globo launched an NFT collection around the third season of its program “The Masked Singer: Brasil”. (CoinTelegraph Brasil)

Upland partnered with the Mangueira samba school to create a Carnaval experience in the blockchain-based metaverse platform. (Crypto Times)

Upland also launched its metaverse version of São Paulo with 25 thousand properties for sale. Users will be able to conduct business in four neighborhoods: Itaim Bibi, Liberdade, Sé and Cambuci, with new neighborhoods and iconic places to be made available soon. Ney Neto, Upland's Latin America director, stated:

“The opening of São Paulo brings many possibilities for entrepreneurs who want to start their businesses in the metaverse. And for brands that are still figuring out how to activate in this new space. Stores, digital experiences and interactive games are some of these opportunities.” (BlockNews) (CoinTelegraph Brasil)

🏛 Public Policy, Regulation and Enforcement

Crypto exchanges operating in Brazil are still studying the ramifications of new Central Bank rules impacting Pix.

The new rules are focused on institutions that offer “Pix-as-a-Service” and transactional accounts - which are used by crypto exchanges that offer Pix to their users.

These rules will weigh on platforms that outsource their Pix functionality to other parties

Institutions offering Pix have an end of May deadline to abide by the new rules. (CoinTelegraph Brasil)

The CVM, Brazil’s securities regulator, is seeking to create a “favorable environment” for the development of crypto assets.

Pursuant to a formal decree to be issued by the Ministry of Finance, the CVM expects to be responsible for regulating crypto asset issuers when their activities include the issuance of tokens

The agency affirmed to CoinTelegraph Brasil that it intends to encourage development of the tokenization market within its regulatory scope. Antonio Berwanger, market development superintendent at the CVM, stated:

"When appropriate, [the agency] will work on an adequate and non-invasive regulation of the subject, with the objective of guaranteeing greater predictability and security, in order to foster a favorable environment for the development of crypto-assets, with integrity and with adherence to relevant constitutional and legal principles".

The Central Bank of Brasil won the “Most Innovative Central Bank 2023” award, given by Global Financial Market Review. (BlockNews)

The Superior Tribunal de Justiça denied an appeal by Mercado Bitcoin after a client who lost their coins after a hack won a case against the exchange in a lower court. (Livecoins)