🇧🇷Brazil Crypto Report #32: The Establishment Fights Back 🥊

Bom dia pessoal 👋 and welcome to 🇧🇷 Brazil Crypto Report for the week of Feb 14-Feb 18, 2022.

I’m just getting back from ETHDenver where I had the chance to partake in my first hacker conference in a couple of years. My overall takeaway is that while this space just keeps getting weirder and weirder, you just can’t bet against the relentless innovation that’s happening on all fronts here.

On the Brazil front, we had some fun controversy this week when former Banco Central president Gustavo Loyola took some strong but poorly aimed shots at crypto in a Valor Econômico op-ed (paywalled). In a Paul Krugman-esque tirade, he launched a volley of largely outdated and easily debunkable criticisms.

Loyola, who served as president of the BC under presidents Itamar Franco and Henrique Cardoso, pointed out that crypto assets have lost “a few hundred billion” in value since the end of 2021 and argued that cryptos will be the “villains” behind the next financial crisis because of their surging popularity and opaque and complex nature of the product offerings.

“Among the candidates for the role of villain are the so-called 'cryptoassets,' whose market accounts for a few hundred billion accumulated losses since the end of last year…And any resemblance to the 2008/2009 financial crisis. It will not be a mere coincidence.”

Loyola also criticized the narratives surrounding bitcoin’s marketing - namely, that the cryptocurrency could replace fiat currencies and ultimately decouple money from the state. Such notions, he argued, constitute a “naive libertarian vision” and go against centuries of precedent.

"To believe that private currencies, such as crypto-assets, can, under normal conditions, replace currencies issued and guaranteed by sovereign national states is to despise not only economic theory but also the monetary history of recent centuries. libertarian, as if states could with impunity renounce their inherent monopoly of issuing money."

He also asserts that proper regulation and central bank digital currencies will ultimately crowd out any space for privately-issued cryptocurrencies to operate:

“There will be no vacuum for private digital currencies to take advantage of.”

Unsurprisingly, Loyola’s remarks were not taken seriously by Brazilian crypto Twitter personalities. Fernando Ulrich perhaps put it best, writing:

“Dear Gustavo, if there exists a risk of a financial crisis, the cause is our central banks and the abuse of power to print paper and electronic money. Don’t blame cryptocurrencies for a problem that is essentially bad monetary management and regulation by the state.”

So what does this all mean? Fairly straightforward really - the relentless pace of innovation that we’re seeing from the Ethereum and related communities continues to clash head-on with the “old guard” of traditional finance and power structures. It’s going to be a knife fight, but we all know who will win out ultimately. There’s simply no turning around at this stage of the game.

- Aaron

If you’re new here, the meta-thesis for this publication is that Brazil - with a population of 214 million and a US$1.8tn economy - is the most overlooked crypto market in the world. The objective is to highlight the important news and provide useful context for the English-speaking audience.

👩💻Brazil Crypto Hiring Spotlight

Job Openings

Coinbase now has 11 Brazil-specific job openings, including a Brazil Country Director and a Regional Managing Director for Latin America.

Transitions

The Brazilian Association of Cryptoeconomics (ABCripto) announced three new members to its executive board. Renata Mancini Lopes, head of compliance at NovaDax, comes in as the new president of the trade group. Mercado Bitcoin CEO Reinaldo Rabelo becomes the new vice-president, while Bernardo Srur - head of risk and compliance at 2TM - is the new director. Rodrigo Monteiro, Executive Director of ABCripto, said in a statement:

“What we expect for 2022 is an even greater growth of the market, the sector and the initiatives. We want the subject more and more in the present, in people's daily lives and with the evolution of the regulatory framework, the entry of new companies, new players, clarified doubts and investments in crypto becoming more and more part of everyone's lives”

Portal do Bitcoin is running a series spotlighting Brazilian cryptocurrency professionals living abroad. The first installment focuses on Rodrigo Souza who moved to the US in 2008 and in 2013 founded BlinkTrade, a technology provider crypto exchanges in Latam. However, he has since pivoted to developing a product allowing P2P operators to better connect with their customers and facilitate trading in a compliant way. Some interesting opinions expressed by Souza in the interview include:

The Brazilian crypto industry is today where the US was five years ago, he claims, particularly on issues like regulation and taxation

The local industry lacks the structure to encourage companies to stay, particularly the low amounts of venture capital being invested in crypto projects compared to other regions

The Brazil crypto scene has been tarnished due to the high prevalence of scams, pyramid schemes and “golpes”.

“[In the US], those who make mistakes are prosecuted. In Brazil, you have to do a lot of shit for the authorities to look at you. Atlas Quantum-style schemes are very difficult to create in the US. In the end, this ends up making the population have a very negative view of bitcoin.”

🗞Brazil Crypto News Rundown 🗞

📈 Markets

Venture capital investments in Latam cryptocurrency companies were R$3.3bn (US$647m) in 2021, up 10x from the prior year, per a study by the Association for Private Capital Investment in Latin America. 2TM Group, the parent company of Mercado Bitcoin, was the largest single recipient at R$1.5bn (US$294m).

Avenue Securities, a US-based brokerage founded by Brazilians, will soon offer trading of more than 30 digital assets on its platform to Brazil-based customers. Roberto Lee, CEO and co-founder, said in a statement:

“Avenue has been connecting Brazilians to world markets in recent years, and this is another remarkable step in our history, now allowing Brazilians access to more and more truly global financial products and services.” (CoinTelegraph Brasil) (Valor Investe)

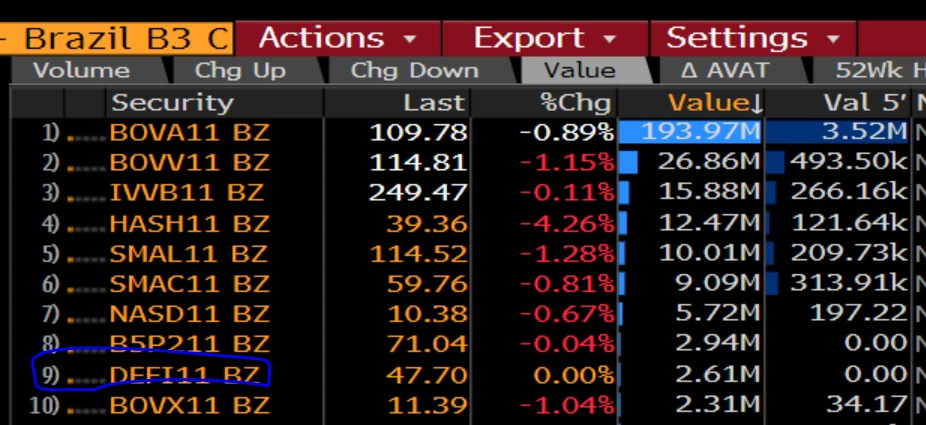

Hashdex raised US$10.5m (R$53.5m) from 2,200 confirmed investors for its DeFi ETF, just over around 10% of the original R$500m projection. QR Capital’s DeFi ETF, which also launched earlier this month, currently holds US$7.5m (R$38m) in net assets. Hashdex’s DEFI11 commenced as one of the top 10 most traded ETFs on the B3 exchange. (The Block) (InfoMoney) (CoinTelegraph Brasil) (Portal do Bitcoin ) (Valor Investe)

Nubank is preparing to include cryptocurrencies in NuInvest, its investment platform, according to O Globo columnist Lauro Jardim. NuInvest currently offers exposure to cryptocurrencies through ETFs but not through spot market trading. (CoinTelegraph Brasil)

Brazilian exchange Biscount has a new feature called Bix that allows customers to purchase bitcoin directly via Pix without need for an intermediary broker. (Portal do Bitcoin) (CoinTelegraph Brasil)

Warren Buffet’s Berkshire Hathaway purchased US$1bn worth of Nubank shares in the fourth quarter of 2021, per filings with the US Securities and Exchange Commission. (CoinDesk)

Passfolio listed three new tokens for trading on its platform, including Rally (RLY), Lido DAO (LDO) and Tokemak (TOKE). (CoinTelegraph Brasil)

Crypto investment manager and platform Uniera announced a new R$10m (US$2m) venture fund aimed at early stage startups in gaming, DeFi, NFTs, metaverse and Web3. (CoinTelegraph Brasil)

NovaDAX has listed 11 new cryptocurrencies to date in February, including PAX GOLD, (PAXG), UST, Band Protocol (BAND), Convex Finance (CVX), TrueUSD (TUSD), USDP Stablecoin (USDP), Livepeer (LPT), Radicle (RAD), Alchemix (ALCX), Bluzelle (BLZ) and cREAL. (CoinTelegraph Brasil)

Banco Inter, one of the largest digital banks in Brazil, argued that decentralized finance has great potential to reshape traditional financial services in a new report. It highlighted popular DeFi protocols such as Compound, Aave, Uniswap and Curve. (CoinTelegraph Brasil)

Adoption

Ronaldinho, the Brazilian football legend, has become a global ambassador for Graph Blockchain, a Canadian firm that offers exposure to altcoins, DeFi and NFTs (not affiliated with The Graph, the decentralized indexing protocol). His involvement with the firm will focus on promoting its subsidiary New World, which is preparing an augmented reality NFT platform.

Ronaldinho has had a number of prior, sometimes controversial, interactions with crypto. He helped promote a brokerage, LBlV, that is accused of offering investments without authorization that resulted in losses to investors. He was also involved in multiple alleged pyramid schemes - the first being 18k Ronaldinho that promised 2% daily returns via crypto arbitrage trading. After a RR300m lawsuit was brought against the entity, he was arrested trying to enter Paraguay with a forged passport. Airbit Club was another scheme assisted by Ronaldinho that shut down after its founder was arrested in the US.

Regarding the Graph Blockchain deal, Ronaldinho commented:

“I understand the influence I have on my fans and engagement with my fans has always been important to me, which is why I decided to become the global ambassador for New World. The global growth of the NFT market has been truly incredible, and this platform allows fans to interact with their favorite celebrities in a way never before done.” (Portal do Bitcoin) (CoinTelegraph Brasil)

Nubank has denied blocking Pix and credit card purchases of cryptocurrencies on Binance after allegations by users that the company was restricting access to the platform. Nubank stated that any specific blockages or restrictions, when they happen, are made automatically by the company’s anti-fraud mechanisms and not related to any internal policy against Binance or cryptocurrencies more generally. The company said in a statement:

“Nubank informs that there is no policy of blocking transactions via Pix for the aforementioned establishment [Binance] and operations continue to function normally. Out of respect for customer privacy and bank secrecy, we do not comment on specific cases. In the event of any additional questions, in addition to those already clarified by our service team, we advise the customer to contact the establishment.” (Portal do Bitcoin)

Elo, one of Brazil’s largest payment processors, released its first NFT that memorializes the company’s first-ever transaction processed. (CoinTelegraph Brasil)

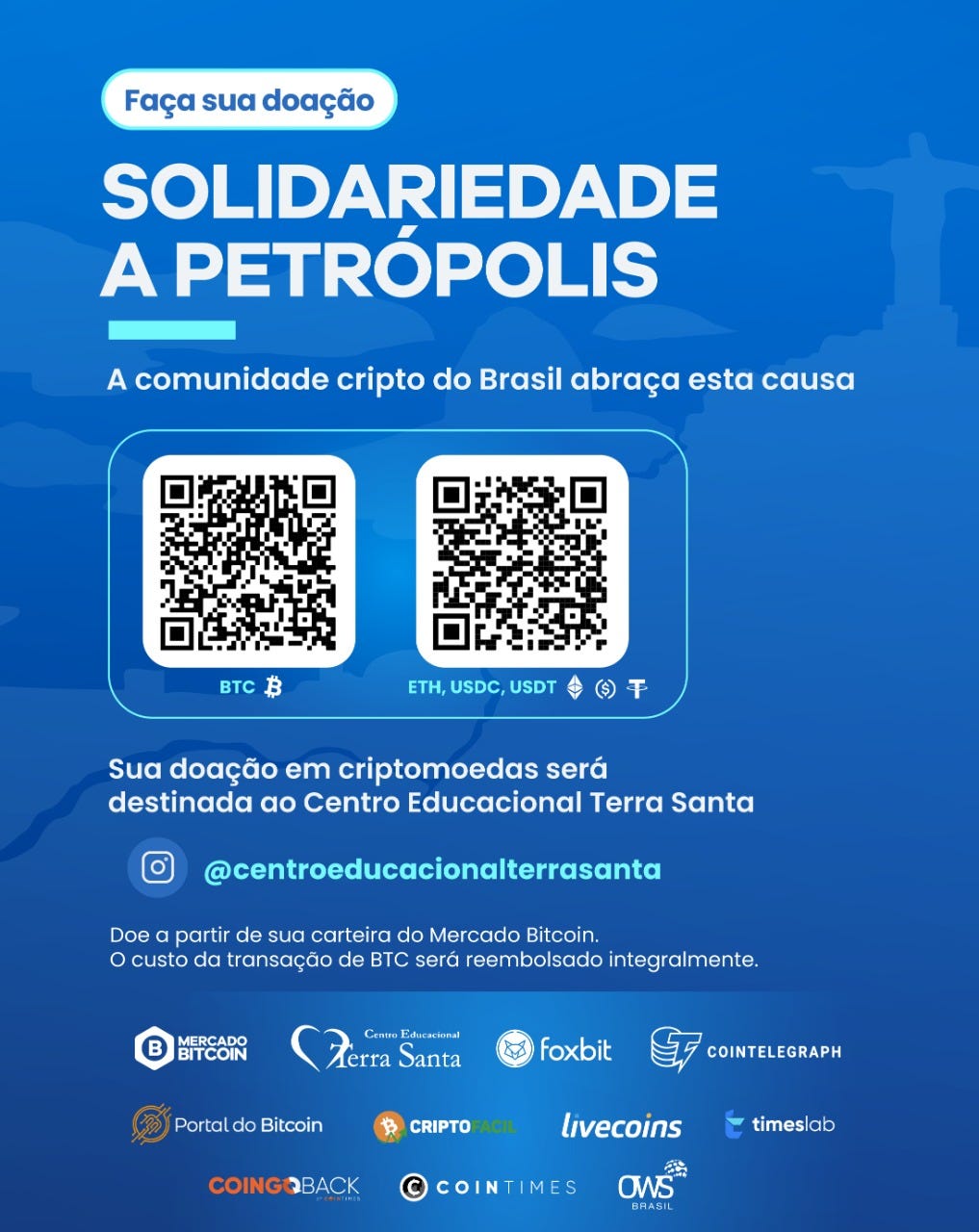

The Brazilian crypto community banded together to raise funds to support those impacted by flooding in Petrópolis, which has resulted in the deaths of at least 117 people. Two public wallets were made available on Mercado Bitcoin where individuals could send BTC, ETH, USDC or USDT. Funds will be converted into reals and sent to Centro Educacional Terra Santa in Petrópolis. (CoinTelegraph Brasil) (Folha de S. Paulo)

The Paulistão is launching its own NFT collection consisting of historic moments from the tournament’s history, with the first edition being a famous goal by Evair of Palmeiras from 1993. Other moments for Corinthians, Red Bull Bragantino, Santos and São Paulo FC are forthcoming in the series, which will be available on the Binance NFT marketplace. Bernando Itri, executive vice president of marketing and communication for the Paulistão tournament, said:

"Entering the NFTs market is another step that we are taking in order to make Paulistão Sicredi the most innovative competition in the country. Together, we will offer fans unique items, which will generate even more unforgettable experiences regarding the competition." (Exame) (CoinTelegraph Brasil)

Mercado Bitcoin and bitcoin-friendly accountant Ana Paula Rabello will release a free e-book to help Brazilians navigate crypto when paying their income taxes. (CoinTelegraph Brasil) (Portal do Bitcoin)

The Lula Institute is introducing a free online course on bitcoin, cryptocurrencies and NFTs. The class, called “Economy & Digital Society” will be taught by Edemilson Paraná, a professor at the Federal University of Ceará. The Lula Institute is linked to former (and potentially future) president Luiz Inácio Lula da Silva. (Portal do Bitcoin) (CoinTelegraph Brasil)

The Itamaraty, Brazil’s ministry of foreign affairs, is listing an understanding of cryptocurrencies and blockchain as a job requirement for 34 entry-level diplomacy roles. (Portal do Bitcoin)

Brazil and 10 other Latam countries signed an agreement to create a blockchain network to guarantee the authenticity of diplomas, digital identity and digital certifications. (CoinTelegraph Brasil)

Coffee Coin, a token linked to the price of coffee and developed by entrepreneurs in Minas Gerais, has appreciated more than 90% in eight months as the price of coffee in the region has increased. (CoinTelegraph Brasil)

Thiago Reis, a popular YouTube and Instagram influencer focusing on investments, caused a stir on social media by suggesting that Satoshi Nakamoto is selling bitcoin. (Portal do Bitcoin)

Primo Rico, another Brazilian finance YouTuber, published a video in which he sold off shares of stock to purchase 58.9 ETH, nearly R$1m (US$200k). Primo Rico, or Thiago Nigro in IRL, has 5.55m subscribers on YouTube and 5.9 followers on Instagram. (Portal do Bitcoin) (CoinTelegraph Brasil)

🎮 NFTs, Gaming and Metaverse

The Sandbox is partnering with Brazilian game studio Hermit Crab to build a Rio de Janeiro-themed city in the metaverse called “Sports Land". Users will be able to practice and compete across various sports in the game, along with the opportunity to complete special missions and collect NFTs linked to real-life football clubs, athletes and leagues. (Portal do Bitcoin)

Allex Ferreira, an early Brazilian bitcoin adopter known as the “Baron of Bitcoin” is launching a collection of NFTs on OpenSea. One of the NFTs commemorates when Ferreira and a group of colleagues took the flag of bitcoin to the peak of Mount Everest in 2015. (CoinTelegraph Brasil)

Brazilian real estate developer Lumy became the first such firm to hold an NFT on its balance sheet after acquiring a work produced by BMW in a charity auction. (CoinTelegraph Brasil)

Folha de S. Paulo ran a feature story looking at the growing popularity of play to earn NFT games.

🏛 Public Policy and Enforcement

The Senate Committee on Economic Affairs will meet Tuesday, February 22 to debate three cryptocurrency bills, with Senator Irajá serving as the rapporteur for the proposals. The bills seek to modify definitions of virtual assets and virtual asset service providers, and to grant power to the Executive Branch to determine which bodies should be responsible for regulating and supervising crypto businesses.

Notably, the bills would define virtual assets as digital representations of value that can be traded or transferred by electronic means - either for payments or investment purposes - and that they are not to be confused with instruments like loyalty and rewards programs.

PL 2303/15, which was authored by Aureo Ribeiro and passed in the Chamber of Deputies in December, has not yet been forwarded to the Senate, per reporting by CoinTelegraph Brasil.

Currently in Brazil, crypto exchanges are not expressly subject to regulation either from the Banco Central or CVM (Brazil’s securities regulator), rendering it more difficult for the government to identify suspicious transactions. Jose Luis Rodrigues of JL Rodrigues & Associated Consultants, explained:

“When we talk about regulation, we are dealing with the regulation of service providers for the sale of virtual assets, that is, the roles and responsibilities of the agents involved in this type of activity. As soon as the bills are approved, regulators, mainly the Central Bank and CVM, enter the field to regulate the law that will bring security to operations with crypto-assets, in the defense of consumers.” (Portal do Bitcoin)

Meanwhile, the Banco Central is moving ahead and developing its own rules to regulate and supervise the Brazilian cryptocurrency market, while defining penalties for scams and frauds. The initiative has been communicated by BC president Roberto Campos Neto to the heads of Brazil’s largest banks, Folha de S. Paulo reports (based on anonymous sourcing).

The proposal will be forwarded to President Jair Bolsonaro and the National Congress sometime in the first quarter and, if all goes according to plan, come into force by the end of 2022. CoinTelegraph Brasil comments that by using this maneuver, the BC is effectively ignoring the range of debate that has been taking place in both the Chamber of Deputies and Federal Senate over the last several months.

The goal here, according to the anonymous banker sources, is to box in cryptoassets as “investment vehicles” from a regulatory perspective - likely meaning that crypto exchanges would need to be headquartered in Brazil, follow all relevant regulations from the CVM, maintain customer registries and document transactions. These initiatives come on the heels of a growing number of scams and pyramid schemes in recent years.

The motivations here appear to stem, at least in part, from Binance - the largest exchange by volume currently operating in Brazil. Binance is headquartered in Malta and has been the subject of several complaints in the Brazilian market. Santander, a bank, took Binance to court last year accusing the exchange of blocking an investigation into a suspicious R$30m transaction initiated by a malicious employee of one of the bank’s clients. Binance initially claimed that it did not have the “technical capacity” to identify the individuals responsible for the wallet in question, but then produced the information shortly after the issuance of a court order.

Binance is registered with the Receita Federal, Brazil’s tax authority, as B.Fintech and was discovered last year to have used a false email and phone number in its documentation.

Journalist Thiago Asmar of Jovem Pan, known as Pilhado, was robbed in São Paulo and had R$200k stolen from his financial accounts, along with cryptocurrencies which were transferred out of his Binance account. The bandits forced Asmar to unlock his cellphone before making off with it and emptying his accounts. (CoinTelegraph Brasil)

Civil Police in São José dos Campos seized two luxury vehicles from Gabriel Rodrigues, aka the “Sheik of Bitcoin”, including a McLaren valued at R$3m (US$585k). The seizure stems from his involvement in a pyramid scheme called DD Corporation, which went defaulted in 2019 after promising 250% annual returns to some 300,000 customers. Rodrigues, however was not arrested as there was no search warrant issued. (Portal do Bitcoin) (CoinTelegraph Brasil)

Rental Coins has received a large uptick of consumer complaints on the website Reclame Aqui after the platform apparently ceased payouts to customers. (Portal do Bitcoin)

Civil police across all Brazilian states will be trained in cryptocurrencies by the end of 2022, according to Vytautas Zumas, Civil Police chief of Goiás - who is heading education for units across the country. (Livecoins)

Pablo Henrique Borges, a 28-year old crypto operator and one of the suspects in the murder of Anselmo Becheli Fausta - aka "Magrelo”, was arrested by Rio de Janeiro Civil Police at a mansion in Angra dos Reis. Magrelo was a high ranking trafficker with PCC - Brazil’s largest criminal organization, who reportedly sought out Borges and his business partner for assistance in laundering US$100m via cryptocurrencies. After a dispute over returning the funds, Magrelo was murdered by gunshot in São Paulo on December 27 while driving in his car. (Portal do Bitcoin) (CoinTelegraph Brasil)

Civil Police have opened an embezzlement investigation into MSK Invest, a company that promised fixed income but stopped paying customers last December. The request was made by a lawyer representing a victim who contributed R$100k (US$20k) and didn’t receive payments. (Portal do Bitcoin) (Valor Investe)

Glaidson Acácio dos Santos, aka the “Pharaoh of Bitcoins” was reportedly considering a political career in the Rio de Janeiro legislative assembly before being arrested last August. (CoinTelegraph Brasil)

What a crazy week, hah!

On Loyola, you should check out the answer Hashdex's portfolio manager (João Marco Braga Cunha) wrote at Exame. https://exame.com/colunistas/joao-marco-braga-cunha/joao-marco-braga-da-cunha-criptomoedas-a-hora-da-pancada/